Neo-brokerages offer low-cost, technology-driven platforms for self-directed investing, focusing on commission-free trades and real-time market access. Robo-advisors utilize algorithm-based portfolio management to provide automated, personalized investment strategies with minimal human intervention. Discover how these innovative solutions transform wealth management and suit different investor needs.

Why it is important

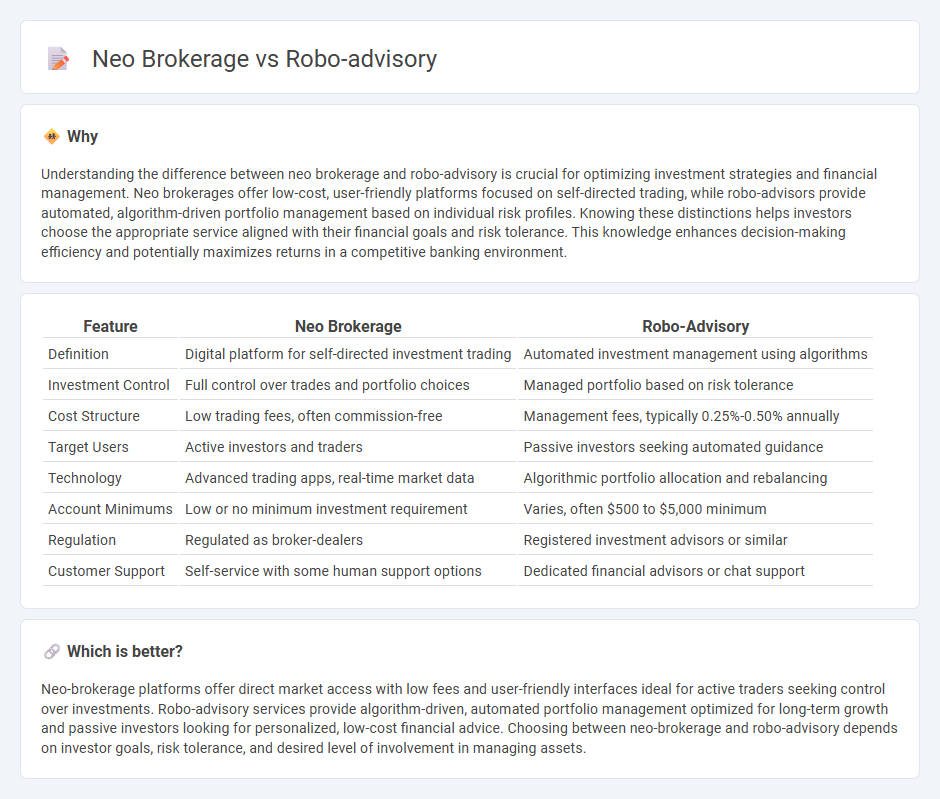

Understanding the difference between neo brokerage and robo-advisory is crucial for optimizing investment strategies and financial management. Neo brokerages offer low-cost, user-friendly platforms focused on self-directed trading, while robo-advisors provide automated, algorithm-driven portfolio management based on individual risk profiles. Knowing these distinctions helps investors choose the appropriate service aligned with their financial goals and risk tolerance. This knowledge enhances decision-making efficiency and potentially maximizes returns in a competitive banking environment.

Comparison Table

| Feature | Neo Brokerage | Robo-Advisory |

|---|---|---|

| Definition | Digital platform for self-directed investment trading | Automated investment management using algorithms |

| Investment Control | Full control over trades and portfolio choices | Managed portfolio based on risk tolerance |

| Cost Structure | Low trading fees, often commission-free | Management fees, typically 0.25%-0.50% annually |

| Target Users | Active investors and traders | Passive investors seeking automated guidance |

| Technology | Advanced trading apps, real-time market data | Algorithmic portfolio allocation and rebalancing |

| Account Minimums | Low or no minimum investment requirement | Varies, often $500 to $5,000 minimum |

| Regulation | Regulated as broker-dealers | Registered investment advisors or similar |

| Customer Support | Self-service with some human support options | Dedicated financial advisors or chat support |

Which is better?

Neo-brokerage platforms offer direct market access with low fees and user-friendly interfaces ideal for active traders seeking control over investments. Robo-advisory services provide algorithm-driven, automated portfolio management optimized for long-term growth and passive investors looking for personalized, low-cost financial advice. Choosing between neo-brokerage and robo-advisory depends on investor goals, risk tolerance, and desired level of involvement in managing assets.

Connection

Neo-brokerage platforms leverage advanced algorithms and AI-driven robo-advisory services to offer automated, low-cost investment management. These technologies integrate real-time market data and personalized financial planning to enhance user experience and portfolio optimization. The synergy between neo-brokerage and robo-advisory democratizes access to sophisticated banking and investment tools, reducing reliance on traditional financial advisors.

Key Terms

Algorithmic Portfolio Management

Algorithmic portfolio management in robo-advisory utilizes AI-driven models to provide automated, personalized investment strategies based on individual risk profiles and market trends. Neo brokerages, while offering user-friendly platforms and lower fees, typically emphasize real-time trading and access to multiple asset classes but may lack the comprehensive algorithmic optimization found in robo-advisors. Explore detailed comparisons to understand which platform aligns best with your investment goals and technological preferences.

Commission-Free Trading

Robo-advisors automate investment management using algorithms, focusing on portfolio diversification and low fees, whereas neo brokerages prioritize commission-free trading, offering users direct market access with minimal costs. Commission-free trading has revolutionized retail investing by removing traditional barriers, enabling frequent trades and real-time decision-making for active investors. Explore the key differences and benefits of robo-advisory and neo brokerages to optimize your investment strategy.

Digital Onboarding

Robo-advisory platforms streamline digital onboarding through automated risk assessments, algorithm-driven portfolio recommendations, and seamless KYC verification, enhancing user experience for investment management. Neo brokerages emphasize ultra-fast account opening, simplified user interfaces, and integration with mobile wallets to attract a younger, tech-savvy clientele. Explore how these innovations in digital onboarding are reshaping the investment landscape.

Source and External Links

Robo-advisor - Wikipedia - Robo-advisors are digital financial services that use algorithms to provide personalized investment management and advice online, typically with minimal human intervention and at a lower cost than traditional advisors.

What is a robo advisor? | Robo advisory services - Fidelity Investments - A robo advisor is an affordable, automated investment platform that creates and manages a portfolio based on your financial situation, goals, and risk tolerance through a simple online questionnaire and ongoing digital oversight.

Best Robo-Advisors: Top Picks for 2025 - NerdWallet - Robo-advisors automate portfolio management--including tasks like rebalancing and tax optimization--using algorithms, offering low fees and hands-off investing, with some services optionally including access to human advisors for an additional cost.

dowidth.com

dowidth.com