Regulatory sandboxes offer fintech companies a controlled environment to test innovative banking solutions under regulatory supervision, minimizing risk while ensuring compliance. A soft launch involves releasing financial products or services to a limited audience to gather user feedback and address potential issues before a full-scale rollout. Explore the distinct advantages of both approaches to optimize your bank's product development strategy.

Why it is important

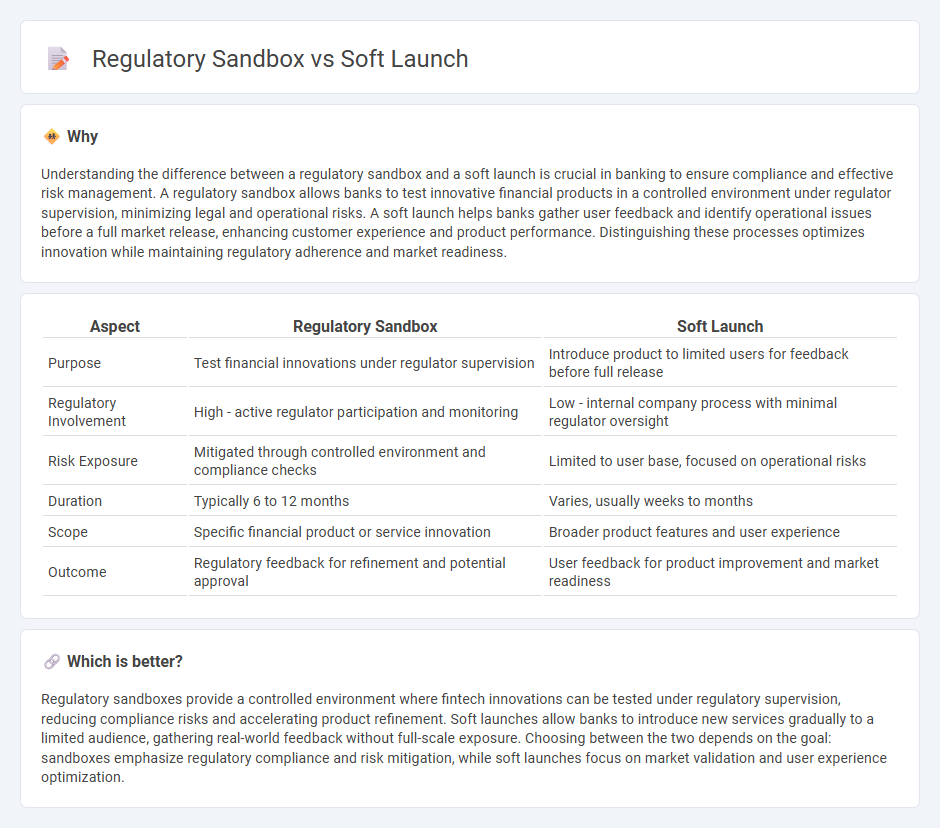

Understanding the difference between a regulatory sandbox and a soft launch is crucial in banking to ensure compliance and effective risk management. A regulatory sandbox allows banks to test innovative financial products in a controlled environment under regulator supervision, minimizing legal and operational risks. A soft launch helps banks gather user feedback and identify operational issues before a full market release, enhancing customer experience and product performance. Distinguishing these processes optimizes innovation while maintaining regulatory adherence and market readiness.

Comparison Table

| Aspect | Regulatory Sandbox | Soft Launch |

|---|---|---|

| Purpose | Test financial innovations under regulator supervision | Introduce product to limited users for feedback before full release |

| Regulatory Involvement | High - active regulator participation and monitoring | Low - internal company process with minimal regulator oversight |

| Risk Exposure | Mitigated through controlled environment and compliance checks | Limited to user base, focused on operational risks |

| Duration | Typically 6 to 12 months | Varies, usually weeks to months |

| Scope | Specific financial product or service innovation | Broader product features and user experience |

| Outcome | Regulatory feedback for refinement and potential approval | User feedback for product improvement and market readiness |

Which is better?

Regulatory sandboxes provide a controlled environment where fintech innovations can be tested under regulatory supervision, reducing compliance risks and accelerating product refinement. Soft launches allow banks to introduce new services gradually to a limited audience, gathering real-world feedback without full-scale exposure. Choosing between the two depends on the goal: sandboxes emphasize regulatory compliance and risk mitigation, while soft launches focus on market validation and user experience optimization.

Connection

A regulatory sandbox allows banks and fintech companies to test innovative financial products and services in a controlled environment under regulator supervision, minimizing risks before full market release. Soft launch complements this by enabling a limited, real-world deployment of these innovations to gather user feedback and monitor performance without widespread impact. Together, they accelerate innovation in banking while ensuring compliance and customer protection.

Key Terms

Pilot Testing

Soft launch involves releasing a product to a limited audience to gather real-world feedback, while a regulatory sandbox allows companies to test innovative financial products under relaxed regulations with regulatory oversight. Pilot testing in both contexts focuses on assessing product functionality, user experience, and compliance risks before full-scale deployment. Explore detailed comparisons and best practices to optimize your pilot testing strategies.

Compliance

Soft launches allow companies to test products in limited markets with minimal regulatory scrutiny, enabling iterative improvements before full-scale compliance verification. Regulatory sandboxes provide a controlled environment where innovators can work closely with regulators to ensure adherence to legal and compliance frameworks while developing financial or fintech solutions. Explore more about how these approaches balance innovation and regulatory compliance.

Risk Mitigation

Soft launches allow companies to release products to a limited audience, managing real-world risks while gathering user feedback to iteratively improve offerings. Regulatory sandboxes provide a controlled environment where financial services innovators can test new technologies under regulatory supervision, reducing compliance risks and enhancing consumer protection. Explore how both methods strategically mitigate risks to optimize innovation in highly regulated industries.

Source and External Links

What is a Soft Launch - A soft launch is the strategy of releasing a product to a limited audience with minimal marketing, serving as a rehearsal to test real-world use and optimize before a full public launch.

Soft launch - A soft launch, or soft opening, is a limited release with few marketing efforts, aimed at gathering feedback and making refinements before a full, high-profile launch.

What Is a Soft Launch in a Relationship? The Dating Trend ... - In relationships, a soft launch means subtly sharing hints about dating someone on social media without fully confirming it, similar to the business concept of low-key product release.

dowidth.com

dowidth.com