Central Bank Digital Currency (CBDC) represents a state-backed digital form of money, offering secure, instant, and cost-efficient transactions directly between users, bypassing traditional banking intermediaries. Interbank transfer systems, such as SWIFT and Fedwire, enable the movement of funds between financial institutions but often involve longer settlement times and higher transaction costs. Explore the key differences and benefits of each system to understand their impact on the future of digital finance.

Why it is important

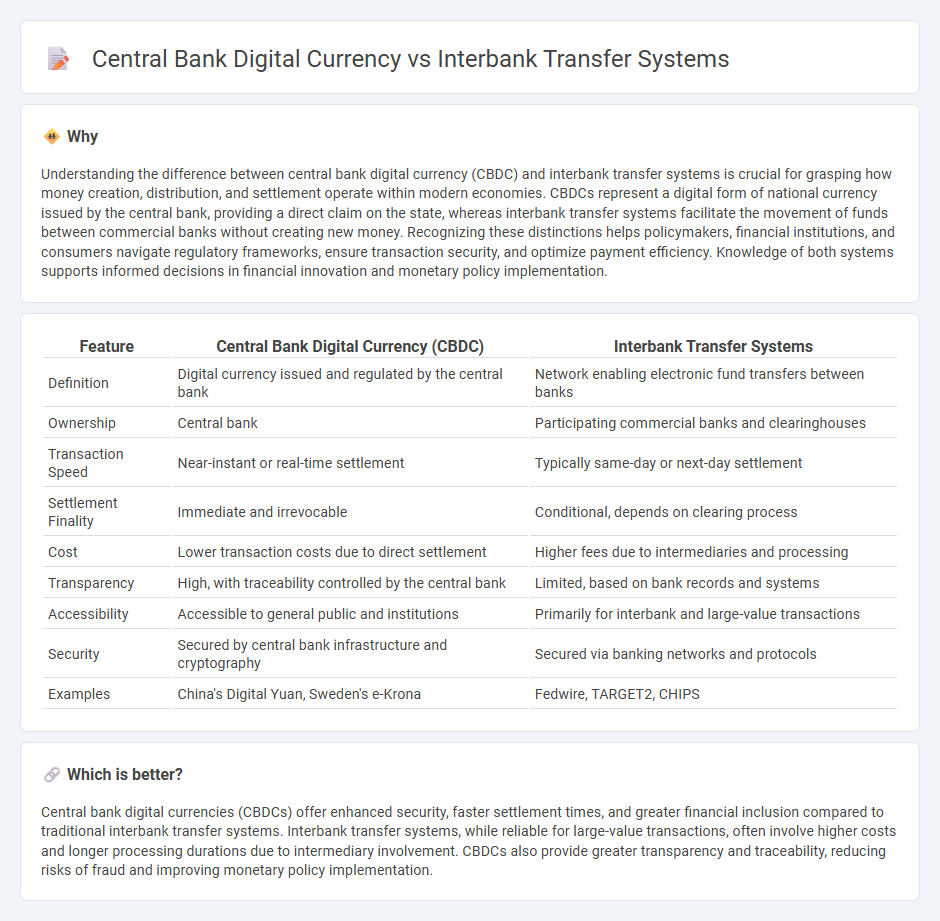

Understanding the difference between central bank digital currency (CBDC) and interbank transfer systems is crucial for grasping how money creation, distribution, and settlement operate within modern economies. CBDCs represent a digital form of national currency issued by the central bank, providing a direct claim on the state, whereas interbank transfer systems facilitate the movement of funds between commercial banks without creating new money. Recognizing these distinctions helps policymakers, financial institutions, and consumers navigate regulatory frameworks, ensure transaction security, and optimize payment efficiency. Knowledge of both systems supports informed decisions in financial innovation and monetary policy implementation.

Comparison Table

| Feature | Central Bank Digital Currency (CBDC) | Interbank Transfer Systems |

|---|---|---|

| Definition | Digital currency issued and regulated by the central bank | Network enabling electronic fund transfers between banks |

| Ownership | Central bank | Participating commercial banks and clearinghouses |

| Transaction Speed | Near-instant or real-time settlement | Typically same-day or next-day settlement |

| Settlement Finality | Immediate and irrevocable | Conditional, depends on clearing process |

| Cost | Lower transaction costs due to direct settlement | Higher fees due to intermediaries and processing |

| Transparency | High, with traceability controlled by the central bank | Limited, based on bank records and systems |

| Accessibility | Accessible to general public and institutions | Primarily for interbank and large-value transactions |

| Security | Secured by central bank infrastructure and cryptography | Secured via banking networks and protocols |

| Examples | China's Digital Yuan, Sweden's e-Krona | Fedwire, TARGET2, CHIPS |

Which is better?

Central bank digital currencies (CBDCs) offer enhanced security, faster settlement times, and greater financial inclusion compared to traditional interbank transfer systems. Interbank transfer systems, while reliable for large-value transactions, often involve higher costs and longer processing durations due to intermediary involvement. CBDCs also provide greater transparency and traceability, reducing risks of fraud and improving monetary policy implementation.

Connection

Central bank digital currency (CBDC) enhances interbank transfer systems by providing a secure, instantaneous settlement layer that reduces reliance on traditional intermediaries. Integrating CBDCs into interbank networks streamlines liquidity management and lowers transaction costs by enabling direct, real-time transfers between financial institutions. This connection fosters increased efficiency and transparency in the overall banking and payment infrastructure.

Key Terms

**Interbank Transfer Systems:**

Interbank transfer systems facilitate the real-time or batch processing of payments between banks, ensuring liquidity and efficient fund settlement across financial institutions globally. Key systems include the Federal Reserve's Fedwire in the United States, the TARGET2 system in the Eurozone, and the CHAPS in the United Kingdom, all of which enable high-value, secure transactions essential for economic stability. Explore how advancements in these systems and their integration with central bank digital currencies are shaping the future of digital payments.

Real-Time Gross Settlement (RTGS)

Interbank transfer systems like Real-Time Gross Settlement (RTGS) facilitate instantaneous high-value fund transfers between banks, ensuring finality and settlement risk reduction. Central Bank Digital Currency (CBDC) integrates with RTGS to enhance liquidity management, transaction speed, and transparency in digital payments. Explore the evolving synergy between RTGS and CBDC to understand the future of efficient interbank settlements.

SWIFT

SWIFT facilitates secure international interbank transfers through a standardized messaging network connecting over 11,000 financial institutions worldwide, enabling efficient cross-border payments but relying on correspondent banking and often incurring delays and fees. Central Bank Digital Currency (CBDC) offers a state-backed digital alternative, potentially streamlining settlement processes, reducing transaction costs, and enhancing payment transparency by leveraging blockchain or distributed ledger technology. Explore the evolving landscape of payment systems to understand how SWIFT and CBDCs shape the future of global finance.

Source and External Links

What is Inter Bank Transfer? - Interbank transfer systems enable electronic funds transfer between accounts in different banks, primarily via RTGS (Real Time Gross Settlement) and NEFT (National Electronic Funds Transfer), both maintained by the Reserve Bank of India, with RTGS providing real-time, individual settlements.

How Do Interbank Settlement Networks Work? - Interbank clearing and settlement networks coordinate between multiple payment systems to enable banks worldwide to send and receive wire transfers rapidly, using systems like Fedwire and CHIPS in the US, and SWIFT for international payments.

Interbank Funds Transfer Systems - Interbank funds transfer systems facilitate the digital transfer of funds between banks, as seen in examples like the Philippines' PESONet and InstaPay, showing global variation but common goals of secure, efficient electronic payments.

dowidth.com

dowidth.com