Personal finance automation leverages AI-driven tools to streamline budgeting, expense tracking, and investment management, enhancing individual money management efficiency. Mortgage servicing platforms focus on automating loan payment processing, escrow management, and customer communication to improve lender operations and borrower experience. Discover how these technologies transform financial management by exploring their unique capabilities and benefits.

Why it is important

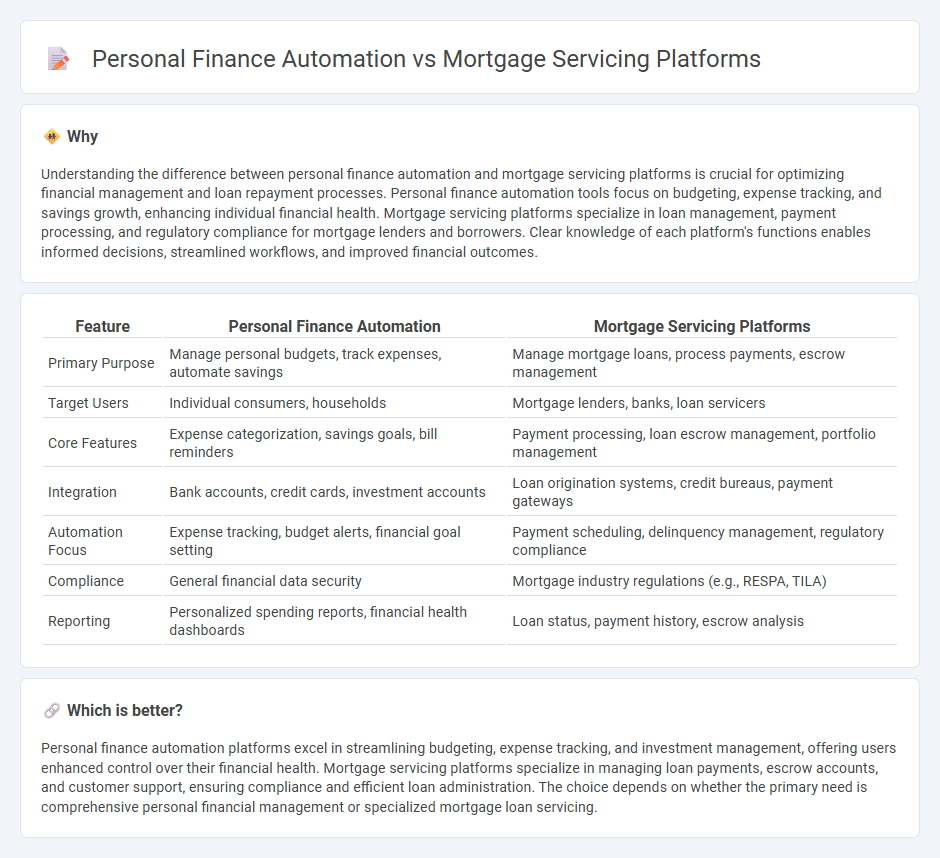

Understanding the difference between personal finance automation and mortgage servicing platforms is crucial for optimizing financial management and loan repayment processes. Personal finance automation tools focus on budgeting, expense tracking, and savings growth, enhancing individual financial health. Mortgage servicing platforms specialize in loan management, payment processing, and regulatory compliance for mortgage lenders and borrowers. Clear knowledge of each platform's functions enables informed decisions, streamlined workflows, and improved financial outcomes.

Comparison Table

| Feature | Personal Finance Automation | Mortgage Servicing Platforms |

|---|---|---|

| Primary Purpose | Manage personal budgets, track expenses, automate savings | Manage mortgage loans, process payments, escrow management |

| Target Users | Individual consumers, households | Mortgage lenders, banks, loan servicers |

| Core Features | Expense categorization, savings goals, bill reminders | Payment processing, loan escrow management, portfolio management |

| Integration | Bank accounts, credit cards, investment accounts | Loan origination systems, credit bureaus, payment gateways |

| Automation Focus | Expense tracking, budget alerts, financial goal setting | Payment scheduling, delinquency management, regulatory compliance |

| Compliance | General financial data security | Mortgage industry regulations (e.g., RESPA, TILA) |

| Reporting | Personalized spending reports, financial health dashboards | Loan status, payment history, escrow analysis |

Which is better?

Personal finance automation platforms excel in streamlining budgeting, expense tracking, and investment management, offering users enhanced control over their financial health. Mortgage servicing platforms specialize in managing loan payments, escrow accounts, and customer support, ensuring compliance and efficient loan administration. The choice depends on whether the primary need is comprehensive personal financial management or specialized mortgage loan servicing.

Connection

Personal finance automation tools streamline budgeting, expense tracking, and loan management, directly influencing mortgage servicing platforms by providing real-time financial data and enhancing customer insights. Mortgage servicing platforms utilize automated personal finance data to improve payment processing accuracy, identify risk factors, and tailor customer communication. Integrating these technologies creates a seamless experience that boosts operational efficiency and supports personalized mortgage servicing solutions.

Key Terms

**Mortgage servicing platforms:**

Mortgage servicing platforms streamline loan management by automating payment processing, escrow management, and compliance tracking, enhancing efficiency for lenders and servicers. These platforms integrate advanced data analytics and customer communication tools to improve borrower engagement and reduce delinquencies. Explore how mortgage servicing platforms transform loan servicing and borrower experience.

Escrow management

Mortgage servicing platforms provide comprehensive escrow management by automating tax and insurance payments and ensuring compliance with regulatory requirements, reducing errors and enhancing borrower transparency. In contrast, personal finance automation tools offer basic escrow tracking but lack the specialized functionality and integration needed for complex mortgage servicing workflows. Explore the differences and benefits in-depth to choose the right solution for your escrow management needs.

Payment processing

Mortgage servicing platforms specialize in secure, compliant payment processing tailored for loan management, automating escrow calculations, and managing payment schedules for millions of borrowers. Personal finance automation tools focus on streamlining individual payment tracking and bill management across diverse accounts, prioritizing user-friendly interfaces and expense categorization. Discover how these distinct payment processing solutions can optimize financial workflows for both institutions and consumers.

Source and External Links

10 Recommended Loan Servicing Platforms - Highlights top platforms like LendingPad and ICE Mortgage Technology for efficient loan management.

The Mortgage Office - Provides powerful loan management software with features like automated fund management and loan servicing.

LoanPro - Offers comprehensive loan processing and management solutions.

MSP Mortgage Servicing System - A leading platform for servicing first mortgages, home equity loans, and lines of credit with advanced features.

Peach - Provides API-first loan management and servicing software for flexibility and compliance.

Black Knight Servicing Solutions - Offers cloud-based loan servicing software with AI-driven analytics.

Fundingo - Lists recommended platforms like ICE Mortgage Technology and Black Knight for optimal portfolio management.

The Mortgage Office - Enables lenders to scale with automated loan servicing and enhanced reporting.

ICE Mortgage Technology - Offers comprehensive solutions including the Ellie Mae Encompass platform for end-to-end loan servicing.

dowidth.com

dowidth.com