Pay by Bank enables direct bank-to-merchant transactions, enhancing security and reducing transaction fees by eliminating intermediaries. Buy Now, Pay Later offers consumers flexible, interest-free installment plans, increasing purchasing power and driving higher conversion rates. Explore the benefits and differences of these payment solutions to optimize your financial strategy.

Why it is important

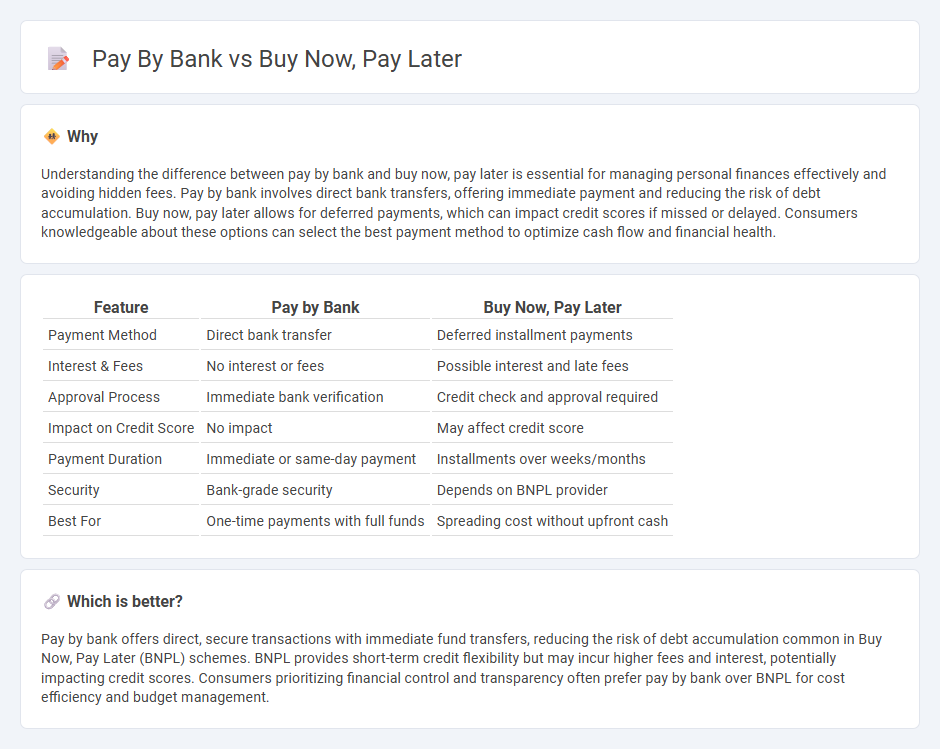

Understanding the difference between pay by bank and buy now, pay later is essential for managing personal finances effectively and avoiding hidden fees. Pay by bank involves direct bank transfers, offering immediate payment and reducing the risk of debt accumulation. Buy now, pay later allows for deferred payments, which can impact credit scores if missed or delayed. Consumers knowledgeable about these options can select the best payment method to optimize cash flow and financial health.

Comparison Table

| Feature | Pay by Bank | Buy Now, Pay Later |

|---|---|---|

| Payment Method | Direct bank transfer | Deferred installment payments |

| Interest & Fees | No interest or fees | Possible interest and late fees |

| Approval Process | Immediate bank verification | Credit check and approval required |

| Impact on Credit Score | No impact | May affect credit score |

| Payment Duration | Immediate or same-day payment | Installments over weeks/months |

| Security | Bank-grade security | Depends on BNPL provider |

| Best For | One-time payments with full funds | Spreading cost without upfront cash |

Which is better?

Pay by bank offers direct, secure transactions with immediate fund transfers, reducing the risk of debt accumulation common in Buy Now, Pay Later (BNPL) schemes. BNPL provides short-term credit flexibility but may incur higher fees and interest, potentially impacting credit scores. Consumers prioritizing financial control and transparency often prefer pay by bank over BNPL for cost efficiency and budget management.

Connection

Pay by bank and buy now, pay later (BNPL) services are connected through seamless bank-based payment integrations that enable instant approval and direct debit from customers' bank accounts. This connection enhances transaction speed and security by leveraging bank verification systems and real-time fund transfers. Financial institutions benefit from increased customer engagement and lower fraud risks while consumers enjoy flexible payment options without traditional credit checks.

Key Terms

Credit Assessment

Credit assessment for Buy Now, Pay Later (BNPL) services often involves minimal or no traditional credit checks, relying instead on alternative data such as transaction history and spending patterns, making approval faster but potentially riskier. Pay by bank methods typically require verification of bank account details and may include real-time balance or transaction screening, providing a more secure but sometimes lengthier evaluation process. Explore the detailed differences in credit assessment between BNPL and pay by bank options to make informed financial decisions.

Settlement Time

Buy Now, Pay Later (BNPL) services typically offer instant approval and deferred payment options, but the actual settlement time to merchants can range from a few hours to several days depending on the provider. Pay by Bank, also known as Open Banking payments, facilitates near-real-time settlements directly from the buyer's bank account, often completing transactions within minutes. Explore detailed comparisons and benefits of each method to choose the optimal payment solution for your business needs.

Transaction Fees

Buy now, pay later (BNPL) services often charge higher transaction fees compared to pay by bank methods, which typically have lower or no fees due to direct bank transfers. BNPL fees include interest and service charges that merchants may pass on to consumers, while pay by bank leverages secure, real-time bank payments minimizing extra costs. Discover more about how transaction fees impact your payment choice and overall cost efficiency.

Source and External Links

The 'Buy Now Pay Later' Trap, Explained - YouTube - Buy Now Pay Later (BNPL) programs let you split purchases into interest-free installments but can resemble modern layaway plans, with the risk of deferred payments adding up over time.

Buy Now Pay Later | Pay in 4 - Sezzle offers a BNPL option allowing you to pay in 4 interest-free installments over 6 weeks, with instant approval and no impact on credit score, usable online and in-store at major retailers like Amazon and Walmart.

Buy Now Pay Later | Pay in 4 | Pay Monthly | PayPal US - PayPal provides BNPL plans with options to pay in 4 interest-free bi-weekly payments or monthly installments over longer terms, with no sign-up or late fees and purchase protection included.

dowidth.com

dowidth.com