Negative interest rates occur when central banks set rates below zero to stimulate economic activity by encouraging borrowing and spending, contrasting with nominal interest rates that remain positive and reflect the stated cost of borrowing without adjusting for inflation. While nominal rates influence consumer loans and savings returns, negative rates can erode bank profitability and savings incentives, presenting unique challenges for financial institutions and policy-makers. Explore the implications of both negative and nominal interest rates to understand their impact on banking strategies and economic growth.

Why it is important

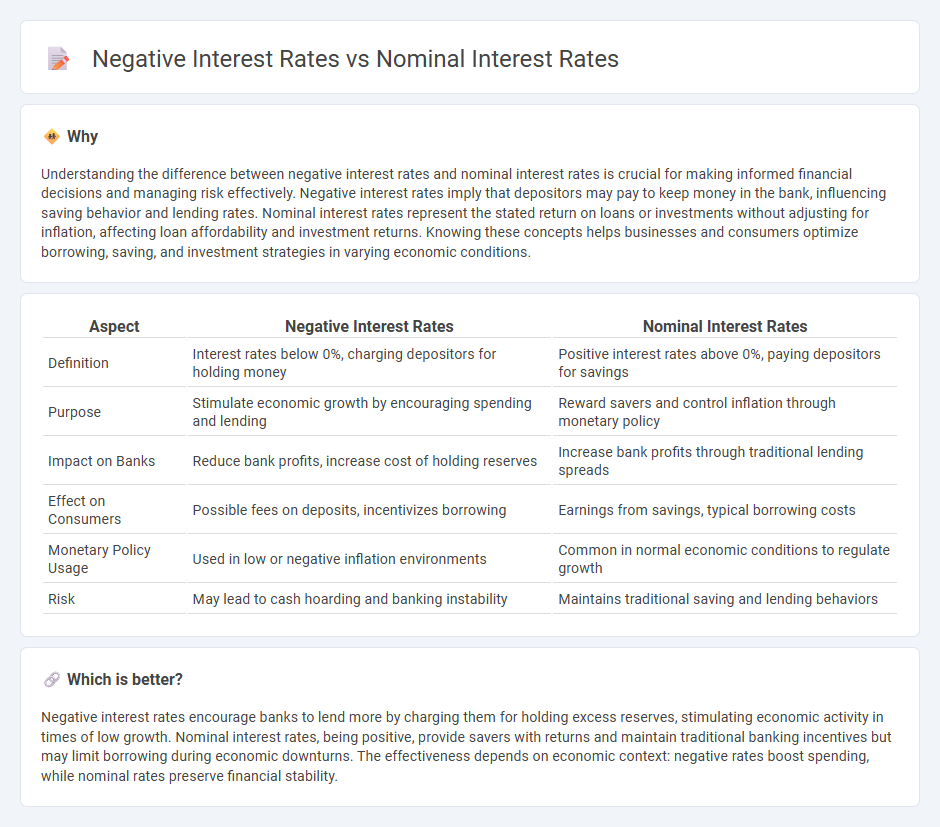

Understanding the difference between negative interest rates and nominal interest rates is crucial for making informed financial decisions and managing risk effectively. Negative interest rates imply that depositors may pay to keep money in the bank, influencing saving behavior and lending rates. Nominal interest rates represent the stated return on loans or investments without adjusting for inflation, affecting loan affordability and investment returns. Knowing these concepts helps businesses and consumers optimize borrowing, saving, and investment strategies in varying economic conditions.

Comparison Table

| Aspect | Negative Interest Rates | Nominal Interest Rates |

|---|---|---|

| Definition | Interest rates below 0%, charging depositors for holding money | Positive interest rates above 0%, paying depositors for savings |

| Purpose | Stimulate economic growth by encouraging spending and lending | Reward savers and control inflation through monetary policy |

| Impact on Banks | Reduce bank profits, increase cost of holding reserves | Increase bank profits through traditional lending spreads |

| Effect on Consumers | Possible fees on deposits, incentivizes borrowing | Earnings from savings, typical borrowing costs |

| Monetary Policy Usage | Used in low or negative inflation environments | Common in normal economic conditions to regulate growth |

| Risk | May lead to cash hoarding and banking instability | Maintains traditional saving and lending behaviors |

Which is better?

Negative interest rates encourage banks to lend more by charging them for holding excess reserves, stimulating economic activity in times of low growth. Nominal interest rates, being positive, provide savers with returns and maintain traditional banking incentives but may limit borrowing during economic downturns. The effectiveness depends on economic context: negative rates boost spending, while nominal rates preserve financial stability.

Connection

Negative interest rates occur when central banks set nominal interest rates below zero to stimulate economic activity by encouraging borrowing and spending. Nominal interest rates represent the stated interest rate on loans or deposits without adjusting for inflation, and their movement into negative territory indicates an unconventional monetary policy approach. The relationship between negative and nominal interest rates reflects central banks' efforts to influence financial markets and promote economic growth during periods of low inflation or economic stagnation.

Key Terms

Real Interest Rate

Nominal interest rates represent the stated interest rate on loans or investments without adjusting for inflation, whereas negative interest rates occur when nominal rates fall below zero, effectively charging borrowers for holding money. The real interest rate, calculated as the nominal rate minus inflation, provides a clearer measure of borrowing costs or investment returns by accounting for purchasing power changes. Explore the dynamics between nominal, negative, and real interest rates to understand their impact on economic behavior and financial decision-making.

Inflation

Nominal interest rates represent the stated return on investments without adjusting for inflation, directly influencing borrowing costs and consumer spending. Negative interest rates occur when central banks set nominal rates below zero to stimulate economic activity during deflationary periods, often aiming to increase inflation towards target levels. Explore how these interest rate policies impact inflation dynamics and economic growth.

Central Bank Policy

Central bank policy shapes nominal interest rates, which typically remain positive to encourage lending and economic growth, while negative interest rates aim to stimulate spending during deflationary periods by charging banks for holding excess reserves. Nominal interest rates reflect the central bank's monetary policy stance, inflation expectations, and economic conditions, whereas negative rates are unconventional tools used primarily in the Eurozone and Japan to combat low inflation and sluggish demand. Explore how central banks balance these rate policies to influence financial markets and economic stability.

Source and External Links

Nominal Interest Rate | Formula + Calculator - Wall Street Prep - The nominal interest rate is the quoted price on loans or savings and combines the real interest rate plus the expected inflation rate, calculated as \((1 + \text{real rate}) \times (1 + \text{inflation rate}) - 1\), typically used by lenders to set target yields.

Nominal Rate | Definition, Formula & Examples - Lesson - Study.com - The nominal interest rate represents the stated interest on a loan or investment without adjusting for inflation and is roughly found by adding the real interest rate and expected inflation rate.

Effective and Nominal Interest and Discount Rates (Finance) - The nominal interest rate is the annual rate quoted without compounding, often used in practice to represent interest payable periodically (e.g., quarterly), differing from the effective interest rate which accounts for compounding.

dowidth.com

dowidth.com