Predictive analytics in banking leverages data mining and machine learning techniques to forecast customer behaviors, optimize risk management, and enhance decision-making processes. Churn prediction, a specific application of predictive analytics, focuses on identifying customers likely to leave a bank by analyzing transaction patterns, account activity, and interaction history. Explore how leading financial institutions use these tools to improve customer retention and profitability.

Why it is important

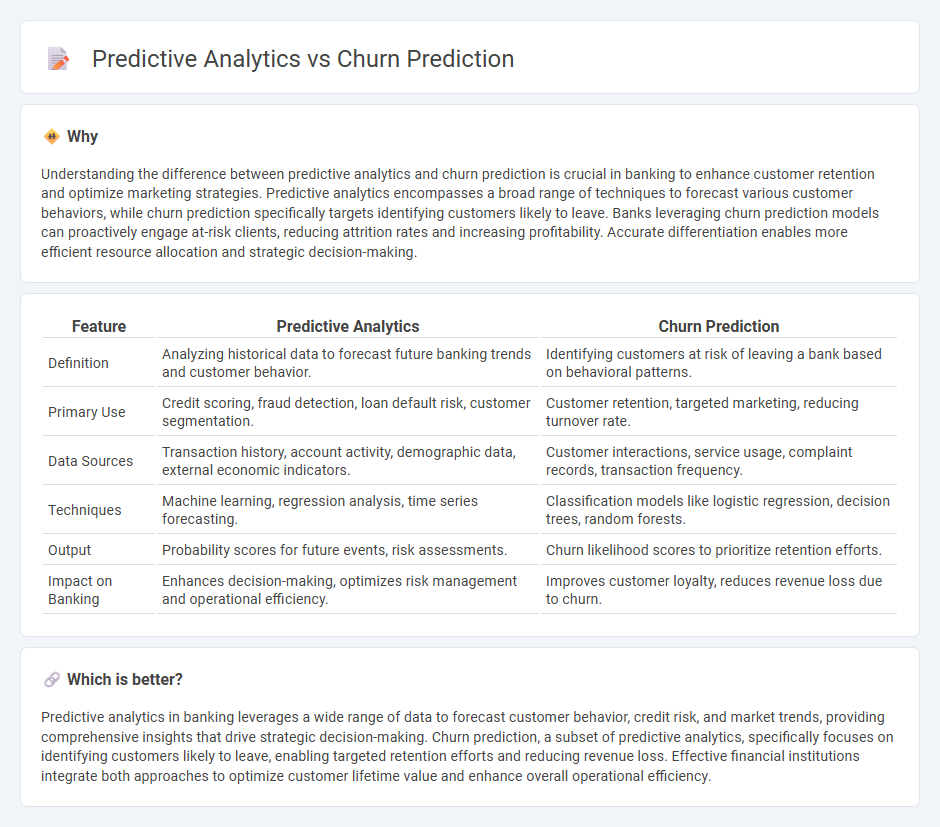

Understanding the difference between predictive analytics and churn prediction is crucial in banking to enhance customer retention and optimize marketing strategies. Predictive analytics encompasses a broad range of techniques to forecast various customer behaviors, while churn prediction specifically targets identifying customers likely to leave. Banks leveraging churn prediction models can proactively engage at-risk clients, reducing attrition rates and increasing profitability. Accurate differentiation enables more efficient resource allocation and strategic decision-making.

Comparison Table

| Feature | Predictive Analytics | Churn Prediction |

|---|---|---|

| Definition | Analyzing historical data to forecast future banking trends and customer behavior. | Identifying customers at risk of leaving a bank based on behavioral patterns. |

| Primary Use | Credit scoring, fraud detection, loan default risk, customer segmentation. | Customer retention, targeted marketing, reducing turnover rate. |

| Data Sources | Transaction history, account activity, demographic data, external economic indicators. | Customer interactions, service usage, complaint records, transaction frequency. |

| Techniques | Machine learning, regression analysis, time series forecasting. | Classification models like logistic regression, decision trees, random forests. |

| Output | Probability scores for future events, risk assessments. | Churn likelihood scores to prioritize retention efforts. |

| Impact on Banking | Enhances decision-making, optimizes risk management and operational efficiency. | Improves customer loyalty, reduces revenue loss due to churn. |

Which is better?

Predictive analytics in banking leverages a wide range of data to forecast customer behavior, credit risk, and market trends, providing comprehensive insights that drive strategic decision-making. Churn prediction, a subset of predictive analytics, specifically focuses on identifying customers likely to leave, enabling targeted retention efforts and reducing revenue loss. Effective financial institutions integrate both approaches to optimize customer lifetime value and enhance overall operational efficiency.

Connection

Predictive analytics in banking leverages historical customer data and machine learning algorithms to identify patterns that indicate potential churn. By analyzing transaction behaviors, service usage, and demographic factors, banks can predict which customers are most likely to leave. This enables targeted retention strategies, reducing customer attrition and enhancing profitability.

Key Terms

**Churn Prediction:**

Churn prediction specifically targets identifying customers likely to discontinue a service or product by analyzing behavioral patterns, transaction history, and engagement metrics to help businesses reduce customer attrition. Predictive analytics encompasses a broader scope, utilizing statistical models and machine learning across various domains to forecast outcomes such as sales trends, risk assessment, and operational efficiency. Discover how leveraging churn prediction techniques can enhance customer retention strategies and drive sustainable growth.

Customer Retention

Churn prediction specifically analyzes customer behavior to identify individuals likely to discontinue service, enabling targeted retention strategies. Predictive analytics uses broader data models to forecast various customer outcomes, including purchase patterns, lifetime value, and churn risk. Explore how combining churn prediction with predictive analytics enhances customer retention efforts and boosts business growth.

Attrition Rate

Churn prediction specifically targets analyzing customer attrition rates to identify patterns that indicate the likelihood of customers leaving a service or subscription. Predictive analytics encompasses a broader scope, using historical data, machine learning, and statistical techniques to forecast various business outcomes, including but not limited to attrition rates. Explore in-depth strategies and tools to enhance customer retention through advanced churn prediction models.

Source and External Links

Mastering Churn Prediction: Strategies for Improved Customer ... - Churn prediction uses customer behavior data and analytics to identify users likely to stop using a product, allowing targeted actions like personalized onboarding and outreach to reduce churn risk.

Predicting & Preventing Churn: Building a Churn Prediction Model - By predicting which customers are at risk of leaving based on behavioral indicators, companies can proactively prevent churn through personalized support and targeted re-engagement campaigns.

Churn prediction explained | Stripe - Effective churn prediction relies on comprehensive, integrated data from transactions, interactions, and social media, combined with rigorous data cleaning and compliance with privacy regulations.

dowidth.com

dowidth.com