Predictive analytics in banking leverages historical data and machine learning algorithms to forecast customer behavior and optimize financial decisions, such as credit scoring and loan approvals. Fraud detection focuses on identifying suspicious transactions and patterns in real-time to prevent financial losses and protect customer accounts from cyber threats. Explore how integrating predictive analytics and fraud detection enhances security and efficiency in modern banking systems.

Why it is important

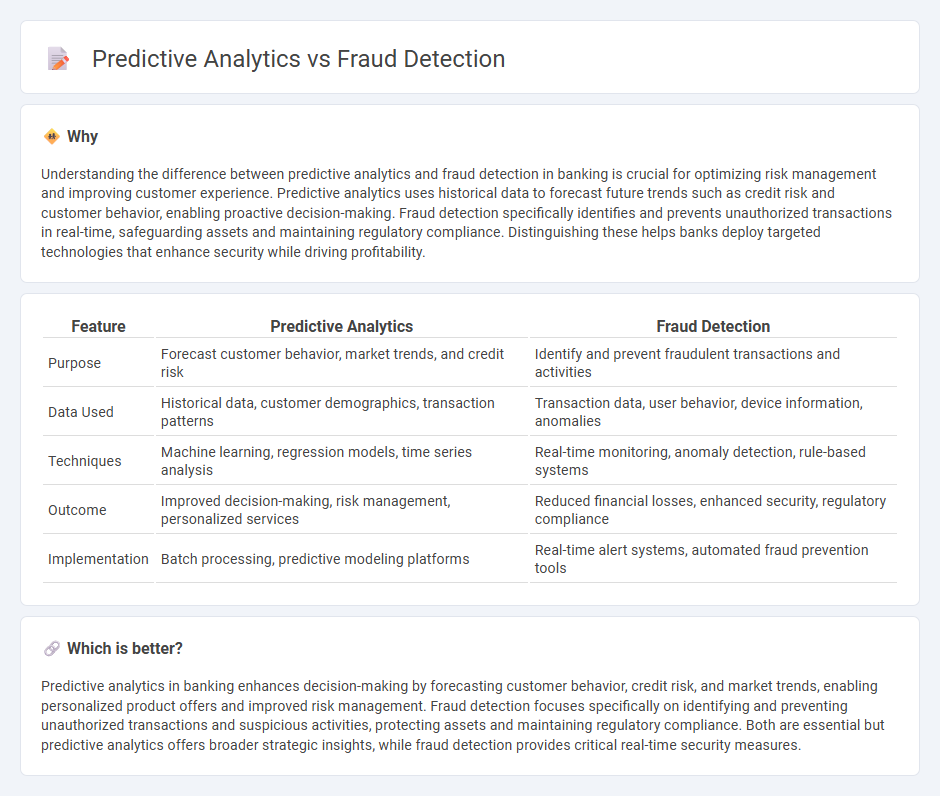

Understanding the difference between predictive analytics and fraud detection in banking is crucial for optimizing risk management and improving customer experience. Predictive analytics uses historical data to forecast future trends such as credit risk and customer behavior, enabling proactive decision-making. Fraud detection specifically identifies and prevents unauthorized transactions in real-time, safeguarding assets and maintaining regulatory compliance. Distinguishing these helps banks deploy targeted technologies that enhance security while driving profitability.

Comparison Table

| Feature | Predictive Analytics | Fraud Detection |

|---|---|---|

| Purpose | Forecast customer behavior, market trends, and credit risk | Identify and prevent fraudulent transactions and activities |

| Data Used | Historical data, customer demographics, transaction patterns | Transaction data, user behavior, device information, anomalies |

| Techniques | Machine learning, regression models, time series analysis | Real-time monitoring, anomaly detection, rule-based systems |

| Outcome | Improved decision-making, risk management, personalized services | Reduced financial losses, enhanced security, regulatory compliance |

| Implementation | Batch processing, predictive modeling platforms | Real-time alert systems, automated fraud prevention tools |

Which is better?

Predictive analytics in banking enhances decision-making by forecasting customer behavior, credit risk, and market trends, enabling personalized product offers and improved risk management. Fraud detection focuses specifically on identifying and preventing unauthorized transactions and suspicious activities, protecting assets and maintaining regulatory compliance. Both are essential but predictive analytics offers broader strategic insights, while fraud detection provides critical real-time security measures.

Connection

Predictive analytics enhances fraud detection in banking by analyzing transaction patterns and customer behavior to identify potential fraudulent activities before they occur. Machine learning algorithms continuously evaluate real-time data, improving accuracy in detecting anomalies and reducing false positives. This integration helps banks minimize financial losses and strengthen security measures against evolving cyber threats.

Key Terms

Fraud Detection:

Fraud detection utilizes advanced algorithms and machine learning techniques to identify and prevent fraudulent activities in real-time, significantly reducing financial losses and enhancing security in sectors like banking and e-commerce. Predictive analytics, while broader, forecasts future outcomes based on historical data but may not be specifically tailored to uncover deceptive patterns as effectively as fraud detection systems. Explore our detailed insights to understand how specialized fraud detection tools outperform general predictive models in combating financial crime.

Anomaly Detection

Fraud detection employs anomaly detection techniques to identify unusual patterns and activities that deviate from normal behavior, leveraging real-time data analysis and machine learning algorithms to flag potential fraudulent transactions. Predictive analytics, while encompassing anomaly detection, extends beyond by using historical data to forecast future trends and behaviors, facilitating proactive decision-making and risk management. Explore more about how anomaly detection enhances fraud prevention strategies and predictive analytics capabilities.

Transaction Monitoring

Transaction monitoring in fraud detection utilizes real-time analysis of transactional data to identify suspicious patterns and prevent fraudulent activities, enhancing security by flagging anomalies such as unusual payment amounts or locations. Predictive analytics employs machine learning algorithms on historical transaction datasets to forecast potential fraud risks and optimize monitoring strategies. Explore advanced methodologies and tools to strengthen your transaction monitoring framework.

Source and External Links

What is fraud detection and why is it needed? - Fraud detection is the process of identifying fraudulent activities by analyzing customer behavior and data patterns, often using AI and machine learning for rapid anomaly detection to prevent financial losses and reputational damage.

How Fraud Detection Works: Common Software and Tools - Fraud detection systems aggregate and preprocess data from multiple sources, then use feature engineering and machine learning models to identify suspicious patterns and anomalies in transactions, user behavior, and market conditions.

Fraud detection: An overview - Fraud detection involves systematic identification and analysis of suspicious activities within financial transactions and data, serving as a key part of fraud risk management that responds to existing fraudulent threats by analyzing patterns over time.

dowidth.com

dowidth.com