Regulatory sandboxes offer a controlled environment for fintech companies to test innovative banking products under regulator supervision, minimizing risks before market launch. Live testing involves real-world deployment where new banking solutions face actual customer interactions and operational challenges, ensuring robustness and compliance in dynamic conditions. Explore our detailed comparison to understand which approach best accelerates your fintech innovation safely.

Why it is important

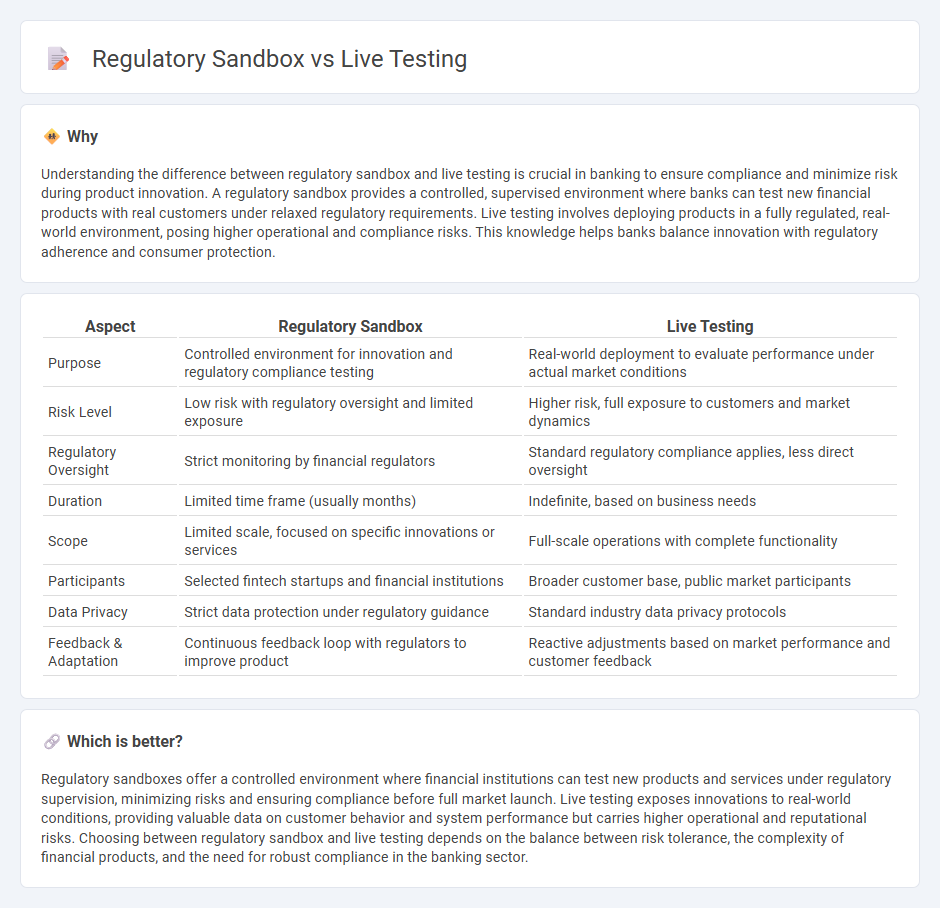

Understanding the difference between regulatory sandbox and live testing is crucial in banking to ensure compliance and minimize risk during product innovation. A regulatory sandbox provides a controlled, supervised environment where banks can test new financial products with real customers under relaxed regulatory requirements. Live testing involves deploying products in a fully regulated, real-world environment, posing higher operational and compliance risks. This knowledge helps banks balance innovation with regulatory adherence and consumer protection.

Comparison Table

| Aspect | Regulatory Sandbox | Live Testing |

|---|---|---|

| Purpose | Controlled environment for innovation and regulatory compliance testing | Real-world deployment to evaluate performance under actual market conditions |

| Risk Level | Low risk with regulatory oversight and limited exposure | Higher risk, full exposure to customers and market dynamics |

| Regulatory Oversight | Strict monitoring by financial regulators | Standard regulatory compliance applies, less direct oversight |

| Duration | Limited time frame (usually months) | Indefinite, based on business needs |

| Scope | Limited scale, focused on specific innovations or services | Full-scale operations with complete functionality |

| Participants | Selected fintech startups and financial institutions | Broader customer base, public market participants |

| Data Privacy | Strict data protection under regulatory guidance | Standard industry data privacy protocols |

| Feedback & Adaptation | Continuous feedback loop with regulators to improve product | Reactive adjustments based on market performance and customer feedback |

Which is better?

Regulatory sandboxes offer a controlled environment where financial institutions can test new products and services under regulatory supervision, minimizing risks and ensuring compliance before full market launch. Live testing exposes innovations to real-world conditions, providing valuable data on customer behavior and system performance but carries higher operational and reputational risks. Choosing between regulatory sandbox and live testing depends on the balance between risk tolerance, the complexity of financial products, and the need for robust compliance in the banking sector.

Connection

Regulatory sandbox environments enable banks and fintech firms to conduct live testing of innovative financial products under relaxed regulatory conditions, facilitating real-world experimentation while ensuring consumer protection. Live testing within these sandboxes generates valuable data that regulators analyze to evaluate risks, compliance, and market readiness before broader deployment. This connection accelerates innovation in banking by balancing regulatory oversight with the need for practical validation of new services.

Key Terms

Real-world Environment

Live testing involves deploying products or services in real-world environments where actual users interact with the offerings, generating authentic data that reflects genuine usage patterns and behaviors. Regulatory sandbox settings provide a controlled environment established by regulators to test innovations under supervision, balancing innovation with consumer protection and compliance risk management. Explore more to understand which approach best supports your product development and regulatory strategy.

Regulatory Oversight

Regulatory oversight in live testing involves continuous, real-time monitoring by authorities to ensure compliance with existing laws while managing risks in a fully operational environment. In contrast, a regulatory sandbox offers a controlled setting where new financial products or services undergo limited live trials under relaxed regulations to safeguard consumers and maintain market integrity. Explore more to understand how these approaches balance innovation with regulatory compliance.

Risk Mitigation

Live testing involves real-time trials of financial products in actual market conditions, exposing institutions to genuine risks but providing valuable insights for risk mitigation strategies. Regulatory sandboxes offer controlled environments where innovative solutions are tested under regulatory supervision, significantly reducing potential risks by limiting exposure to real customers. Explore deeper to understand how each approach balances innovation with risk control in financial services.

Source and External Links

What is Live Testing? Guide To Do Live Testing In-depth - Live testing involves testing software in real-world situations with real users and actual data, allowing testers to assess software quality in authentic usage conditions and highlighting device- or usability-specific issues often ignored in simulations.

Live Testing: What It Is and Why It's Important - DEV Community - Live testing is performed near the end of development by deploying software to real users to gather feedback on user experience and usability, enabling developers to refine the product based on actual usage scenarios.

Live Testing Explained: Benefits, Process & Best Practices - Devzery - Live testing is used across various stages including pre-launch, beta testing, and ongoing maintenance by running tests in production-like environments with real users, following planned steps from defining goals to analyzing results and reporting findings.

dowidth.com

dowidth.com