Account aggregation consolidates financial data from multiple accounts into a single platform, enabling users to view comprehensive financial insights. Embedded finance integrates banking services directly into non-financial apps, enhancing customer experience by offering seamless transactions within familiar environments. Discover how these innovations reshape banking accessibility and convenience.

Why it is important

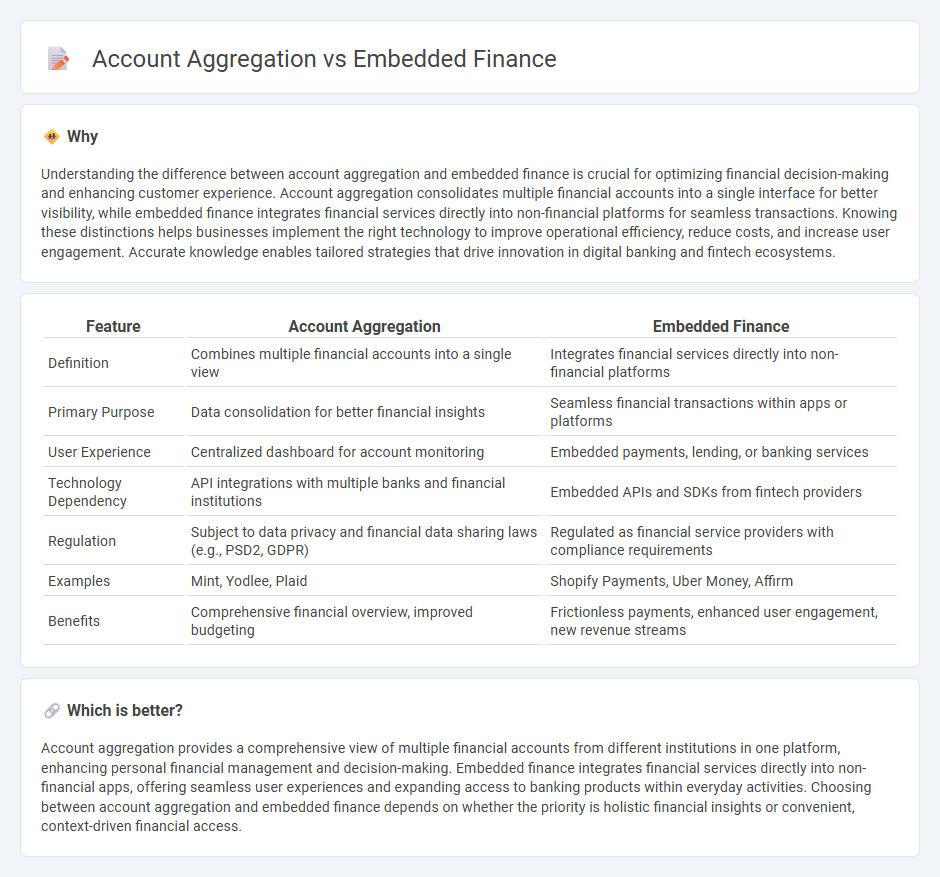

Understanding the difference between account aggregation and embedded finance is crucial for optimizing financial decision-making and enhancing customer experience. Account aggregation consolidates multiple financial accounts into a single interface for better visibility, while embedded finance integrates financial services directly into non-financial platforms for seamless transactions. Knowing these distinctions helps businesses implement the right technology to improve operational efficiency, reduce costs, and increase user engagement. Accurate knowledge enables tailored strategies that drive innovation in digital banking and fintech ecosystems.

Comparison Table

| Feature | Account Aggregation | Embedded Finance |

|---|---|---|

| Definition | Combines multiple financial accounts into a single view | Integrates financial services directly into non-financial platforms |

| Primary Purpose | Data consolidation for better financial insights | Seamless financial transactions within apps or platforms |

| User Experience | Centralized dashboard for account monitoring | Embedded payments, lending, or banking services |

| Technology Dependency | API integrations with multiple banks and financial institutions | Embedded APIs and SDKs from fintech providers |

| Regulation | Subject to data privacy and financial data sharing laws (e.g., PSD2, GDPR) | Regulated as financial service providers with compliance requirements |

| Examples | Mint, Yodlee, Plaid | Shopify Payments, Uber Money, Affirm |

| Benefits | Comprehensive financial overview, improved budgeting | Frictionless payments, enhanced user engagement, new revenue streams |

Which is better?

Account aggregation provides a comprehensive view of multiple financial accounts from different institutions in one platform, enhancing personal financial management and decision-making. Embedded finance integrates financial services directly into non-financial apps, offering seamless user experiences and expanding access to banking products within everyday activities. Choosing between account aggregation and embedded finance depends on whether the priority is holistic financial insights or convenient, context-driven financial access.

Connection

Account aggregation consolidates financial data from multiple accounts into a single interface, enhancing customer insights and ease of management. Embedded finance integrates these aggregated data services directly into non-banking platforms, enabling seamless financial transactions and personalized offers within everyday apps. This synergy allows banks and fintechs to deliver holistic, real-time financial experiences, driving improved user engagement and operational efficiency.

Key Terms

**Embedded Finance:**

Embedded finance integrates financial services directly into non-financial platforms, allowing businesses to offer loans, payments, or insurance without redirecting users to traditional banks. This seamless integration enhances customer experience by leveraging APIs and real-time data to provide personalized financial products within apps or websites. Explore how embedded finance transforms digital banking and commerce by driving innovation and increasing user engagement.

API Integration

Embedded finance integrates financial services directly within non-financial platforms through APIs, enabling seamless payment processing, lending, or insurance without redirecting users. Account aggregation APIs consolidate users' financial data from multiple accounts into a single interface, enhancing financial insights and decision-making. Explore more on how API integration shapes the future of embedded finance and account aggregation solutions.

White-label Banking

White-label banking leverages embedded finance by integrating third-party financial services directly into non-bank platforms, enhancing user experience and engagement. Account aggregation, as a complementary feature, consolidates financial data from multiple sources into a single interface, offering comprehensive insights to customers. Explore the advantages and applications of these solutions in transforming digital banking ecosystems.

Source and External Links

What is embedded finance? 4 ways it will change fintech - Plaid - Embedded finance is the integration of financial services such as payments, lending, or banking directly into non-financial platforms, allowing users to access these services seamlessly within apps or websites they already use, with the embedded finance market projected to grow significantly to $291.3 billion by 2033.

What does embedded finance mean for business? - PwC - Embedded finance enables nonfinancial companies to offer digital banking and financial services integrated into their platforms, creating frictionless experiences that foster loyalty and new revenue streams, while also opening opportunities to serve unbanked populations in emerging markets.

Embedded finance: Who will lead the next payments revolution? - McKinsey - Embedded finance involves placing financial products within everyday digital experiences, improving convenience and accessibility by integrating services like payments and loans into the platforms consumers and businesses already use, driven by digitization and open banking innovations.

dowidth.com

dowidth.com