Negative interest rates force banks to pay borrowers, disrupting traditional lending models, while zero interest rates halt borrowing costs without penalizing savings. Both impact consumer behavior and financial markets differently, influencing credit availability and investment strategies. Explore the effects of these unconventional monetary policies on your financial decisions.

Why it is important

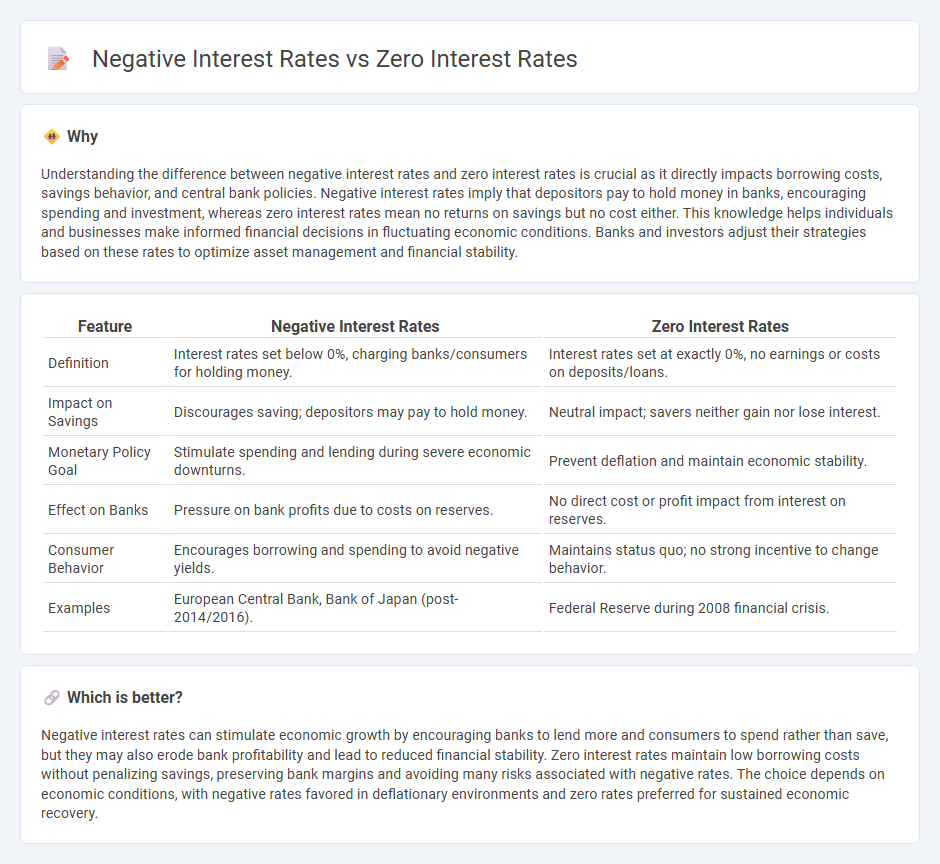

Understanding the difference between negative interest rates and zero interest rates is crucial as it directly impacts borrowing costs, savings behavior, and central bank policies. Negative interest rates imply that depositors pay to hold money in banks, encouraging spending and investment, whereas zero interest rates mean no returns on savings but no cost either. This knowledge helps individuals and businesses make informed financial decisions in fluctuating economic conditions. Banks and investors adjust their strategies based on these rates to optimize asset management and financial stability.

Comparison Table

| Feature | Negative Interest Rates | Zero Interest Rates |

|---|---|---|

| Definition | Interest rates set below 0%, charging banks/consumers for holding money. | Interest rates set at exactly 0%, no earnings or costs on deposits/loans. |

| Impact on Savings | Discourages saving; depositors may pay to hold money. | Neutral impact; savers neither gain nor lose interest. |

| Monetary Policy Goal | Stimulate spending and lending during severe economic downturns. | Prevent deflation and maintain economic stability. |

| Effect on Banks | Pressure on bank profits due to costs on reserves. | No direct cost or profit impact from interest on reserves. |

| Consumer Behavior | Encourages borrowing and spending to avoid negative yields. | Maintains status quo; no strong incentive to change behavior. |

| Examples | European Central Bank, Bank of Japan (post-2014/2016). | Federal Reserve during 2008 financial crisis. |

Which is better?

Negative interest rates can stimulate economic growth by encouraging banks to lend more and consumers to spend rather than save, but they may also erode bank profitability and lead to reduced financial stability. Zero interest rates maintain low borrowing costs without penalizing savings, preserving bank margins and avoiding many risks associated with negative rates. The choice depends on economic conditions, with negative rates favored in deflationary environments and zero rates preferred for sustained economic recovery.

Connection

Negative interest rates and zero interest rates both represent monetary policy tools used by central banks to stimulate economic growth during periods of low inflation and sluggish demand. Zero interest rates set the benchmark lending rate at or near 0%, encouraging borrowing and investment, while negative interest rates go further by effectively charging banks for holding excess reserves, incentivizing them to increase lending. These policies aim to boost consumption and investment, counteracting deflationary pressures and supporting financial stability.

Key Terms

Monetary Policy

Zero interest rates represent a monetary policy tool where central banks set rates at or near 0% to stimulate borrowing and investment during economic downturns, aiming to boost economic growth without penalizing savings. Negative interest rates take this policy further by charging banks for holding excess reserves, encouraging them to lend more aggressively to revive sluggish economies and combat deflation. Explore the implications of both strategies on financial stability and economic recovery to deepen your understanding.

Deposit Rates

Zero interest rates on deposits indicate a baseline scenario where banks offer no additional earnings beyond the principal, maintaining capital stability without incentives for deposit growth. Negative interest rates, conversely, imply depositors effectively pay banks for holding their funds, discouraging savings and encouraging spending or investment to stimulate economic activity. Explore more to understand the implications of deposit rate policies on personal finances and economic strategies.

Central Bank

Central banks implement zero interest rates to stimulate economic growth by lowering borrowing costs, encouraging spending and investment during periods of slow growth or recession. Negative interest rates push this approach further, charging banks for holding excess reserves to incentivize lending and avoid deflation, though they can compress financial sector profits and challenge traditional monetary policy frameworks. Explore the nuanced impacts of zero and negative interest rates on central bank strategies and economic stability.

Source and External Links

Zero interest-rate policy - Wikipedia - ZIRP is a central bank policy maintaining a nominal interest rate near 0% to stimulate the economy during periods of weak growth or deflation, as seen in Japan and the US after major financial crises.

The end of 0% interest rates: what it means for tech startups - ZIRP refers to a period when central banks set interest rates at or below 1%, effectively making borrowing nearly free to encourage spending and investment, especially common globally after the 2008 financial crisis.

The End of Zero Interest Rates - Belfer Center - Some economists argue that the "neutral" real interest rate has fallen below zero, making it difficult for monetary policy to support growth if nominal rates cannot go negative, except in regions like Europe and Japan where negative rates were briefly implemented.

dowidth.com

dowidth.com