Neo banking leverages advanced digital platforms to offer seamless, low-cost banking services primarily through mobile apps, targeting tech-savvy customers seeking convenience and speed. Community banks focus on personalized customer relationships, local economic support, and in-branch services, fostering trust within specific geographic regions. Explore the distinct advantages and limitations of neo banks versus community banks to determine which suits your financial needs best.

Why it is important

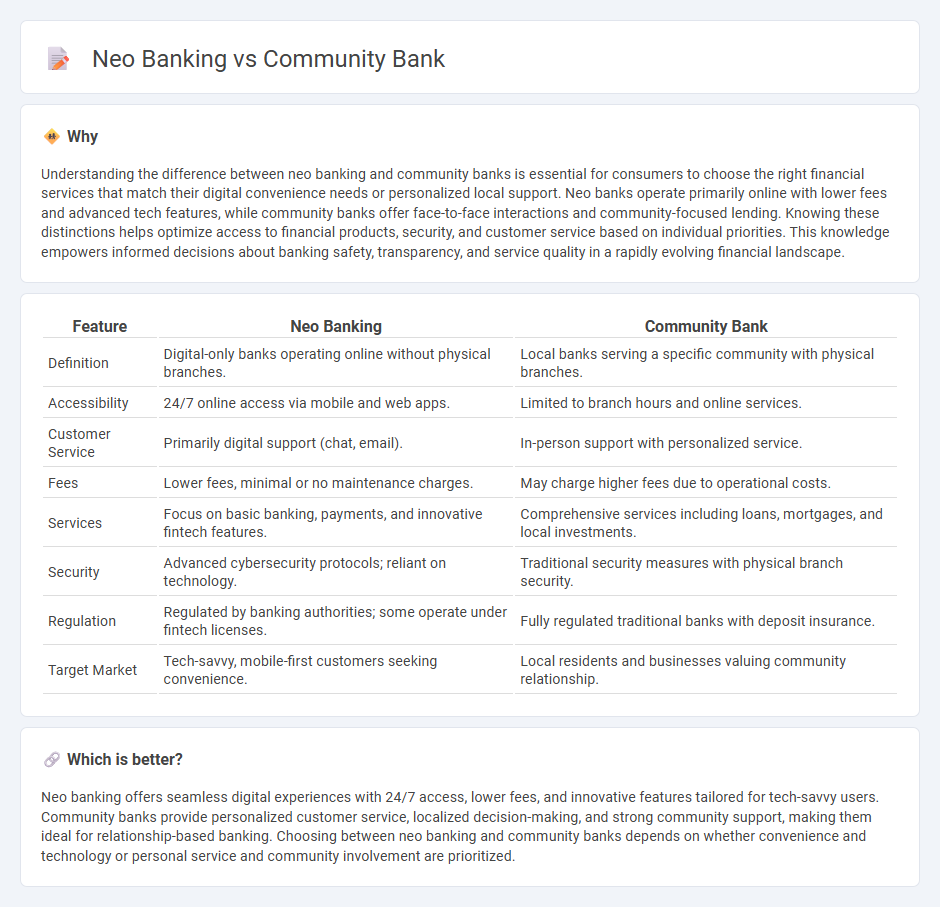

Understanding the difference between neo banking and community banks is essential for consumers to choose the right financial services that match their digital convenience needs or personalized local support. Neo banks operate primarily online with lower fees and advanced tech features, while community banks offer face-to-face interactions and community-focused lending. Knowing these distinctions helps optimize access to financial products, security, and customer service based on individual priorities. This knowledge empowers informed decisions about banking safety, transparency, and service quality in a rapidly evolving financial landscape.

Comparison Table

| Feature | Neo Banking | Community Bank |

|---|---|---|

| Definition | Digital-only banks operating online without physical branches. | Local banks serving a specific community with physical branches. |

| Accessibility | 24/7 online access via mobile and web apps. | Limited to branch hours and online services. |

| Customer Service | Primarily digital support (chat, email). | In-person support with personalized service. |

| Fees | Lower fees, minimal or no maintenance charges. | May charge higher fees due to operational costs. |

| Services | Focus on basic banking, payments, and innovative fintech features. | Comprehensive services including loans, mortgages, and local investments. |

| Security | Advanced cybersecurity protocols; reliant on technology. | Traditional security measures with physical branch security. |

| Regulation | Regulated by banking authorities; some operate under fintech licenses. | Fully regulated traditional banks with deposit insurance. |

| Target Market | Tech-savvy, mobile-first customers seeking convenience. | Local residents and businesses valuing community relationship. |

Which is better?

Neo banking offers seamless digital experiences with 24/7 access, lower fees, and innovative features tailored for tech-savvy users. Community banks provide personalized customer service, localized decision-making, and strong community support, making them ideal for relationship-based banking. Choosing between neo banking and community banks depends on whether convenience and technology or personal service and community involvement are prioritized.

Connection

Neobanking and community banks intersect through their shared focus on personalized customer experiences and local engagement. Community banks leverage neobanking technology to offer seamless digital services, enhancing convenience for their customers without sacrificing local trust and relationships. This integration helps community banks remain competitive by combining innovative fintech solutions with community-oriented values.

Key Terms

Source and External Links

About Community Banking - ICBA - Community banks focus on reinvesting local dollars back into the community, offering personalized relationship banking, nimble local loan decisions, and are the small business lender of choice with high satisfaction rates among customers.

Community Bank - We're a bank that knows community - This community bank boasts over 115 years of experience and commits to being a true partner to its community.

Community Bank of the Bay: Home - As a local community development financial institution, this bank supports diverse members and environmentally impactful projects, focusing on personalized financial solutions and community reinvestment.

dowidth.com

dowidth.com