Personal financial management tools offer real-time tracking of expenses, budgeting, and account aggregation to help users maintain daily control over their finances. Financial planning software provides advanced features such as retirement planning, investment analysis, and goal forecasting for long-term wealth management. Discover how these solutions can transform your approach to managing money.

Why it is important

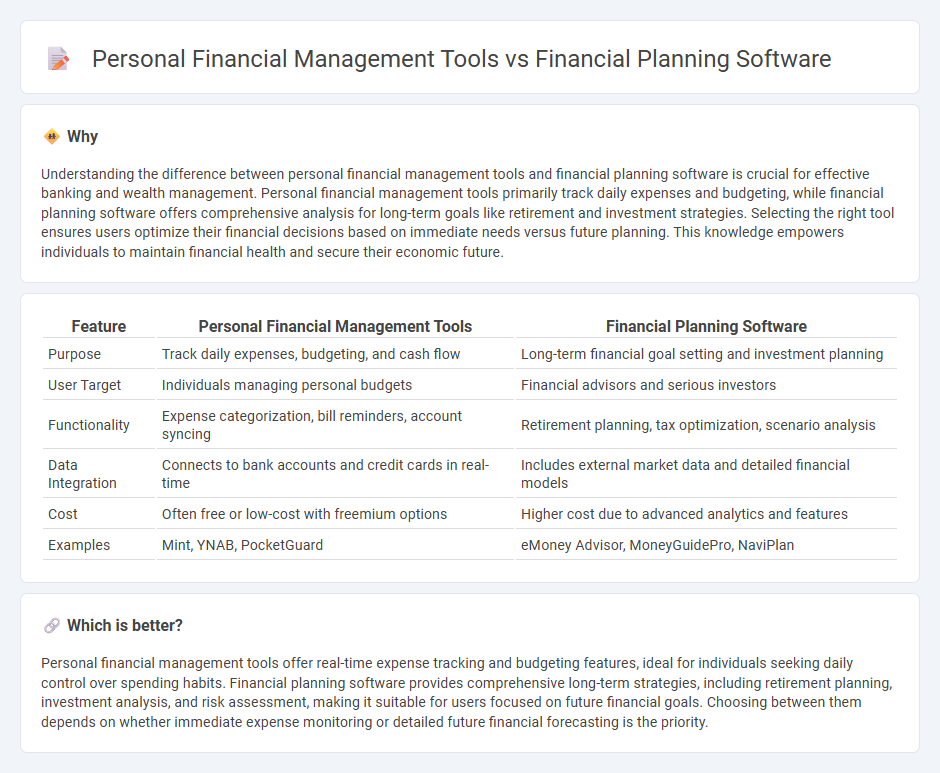

Understanding the difference between personal financial management tools and financial planning software is crucial for effective banking and wealth management. Personal financial management tools primarily track daily expenses and budgeting, while financial planning software offers comprehensive analysis for long-term goals like retirement and investment strategies. Selecting the right tool ensures users optimize their financial decisions based on immediate needs versus future planning. This knowledge empowers individuals to maintain financial health and secure their economic future.

Comparison Table

| Feature | Personal Financial Management Tools | Financial Planning Software |

|---|---|---|

| Purpose | Track daily expenses, budgeting, and cash flow | Long-term financial goal setting and investment planning |

| User Target | Individuals managing personal budgets | Financial advisors and serious investors |

| Functionality | Expense categorization, bill reminders, account syncing | Retirement planning, tax optimization, scenario analysis |

| Data Integration | Connects to bank accounts and credit cards in real-time | Includes external market data and detailed financial models |

| Cost | Often free or low-cost with freemium options | Higher cost due to advanced analytics and features |

| Examples | Mint, YNAB, PocketGuard | eMoney Advisor, MoneyGuidePro, NaviPlan |

Which is better?

Personal financial management tools offer real-time expense tracking and budgeting features, ideal for individuals seeking daily control over spending habits. Financial planning software provides comprehensive long-term strategies, including retirement planning, investment analysis, and risk assessment, making it suitable for users focused on future financial goals. Choosing between them depends on whether immediate expense monitoring or detailed future financial forecasting is the priority.

Connection

Personal financial management tools and financial planning software both enhance users' ability to track expenses, set budgets, and monitor investments, offering a comprehensive view of financial health. These technologies integrate real-time data aggregation from bank accounts, credit cards, and loans to provide personalized insights and actionable recommendations. The seamless synchronization between these tools empowers individuals to optimize savings, debt reduction, and long-term financial goals effectively.

Key Terms

Budgeting

Financial planning software offers comprehensive budgeting capabilities with features like expense tracking, goal setting, and detailed financial forecasting, making it ideal for long-term financial strategy. Personal financial management tools emphasize user-friendly interfaces and real-time expense categorization to help individuals maintain daily budget control. Explore the key differences to choose the best budgeting solution tailored to your financial needs.

Account Aggregation

Financial planning software offers comprehensive account aggregation features that consolidate data from multiple financial institutions, providing users with a holistic view of their assets, liabilities, and investment portfolios. Personal financial management tools typically emphasize budgeting and expense tracking but may lack the robust integration capabilities for seamless account aggregation across diverse financial platforms. Explore further to understand how enhanced account aggregation can elevate your financial insights and decision-making.

Investment Tracking

Financial planning software offers comprehensive investment tracking features, including portfolio diversification analysis, asset allocation, and performance benchmarking across multiple accounts. Personal financial management tools primarily focus on budgeting and expense tracking but have increasingly integrated basic investment tracking capabilities like real-time market updates and transaction monitoring. Explore detailed comparisons to understand which solution aligns best with your investment management needs.

Source and External Links

Best Financial Planning Software Of 2025 | Bankrate - Offers a review of the best financial planning software, highlighting tools like MaxiFi that assist in retirement planning through detailed financial analysis and projection.

ProjectionLab - Provides modern financial and retirement planning tools to simulate financial futures and build personalized financial plans.

Financial Planning Software - Gartner Peer Insights - Lists various financial planning software solutions, including Kepion and JustPerform, which help organizations with budgeting, forecasting, and performance management.

dowidth.com

dowidth.com