Real-time payments enable instant fund transfers between bank accounts, offering immediate transaction confirmation and enhanced liquidity management compared to traditional SEPA transfers, which typically require one business day for settlement across European borders. SEPA (Single Euro Payments Area) facilitates standardized euro payments within member countries, ensuring cost-efficiency and harmonization but lacks the speed of real-time processing. Discover how these payment systems are transforming the financial landscape and what suits your banking needs best.

Why it is important

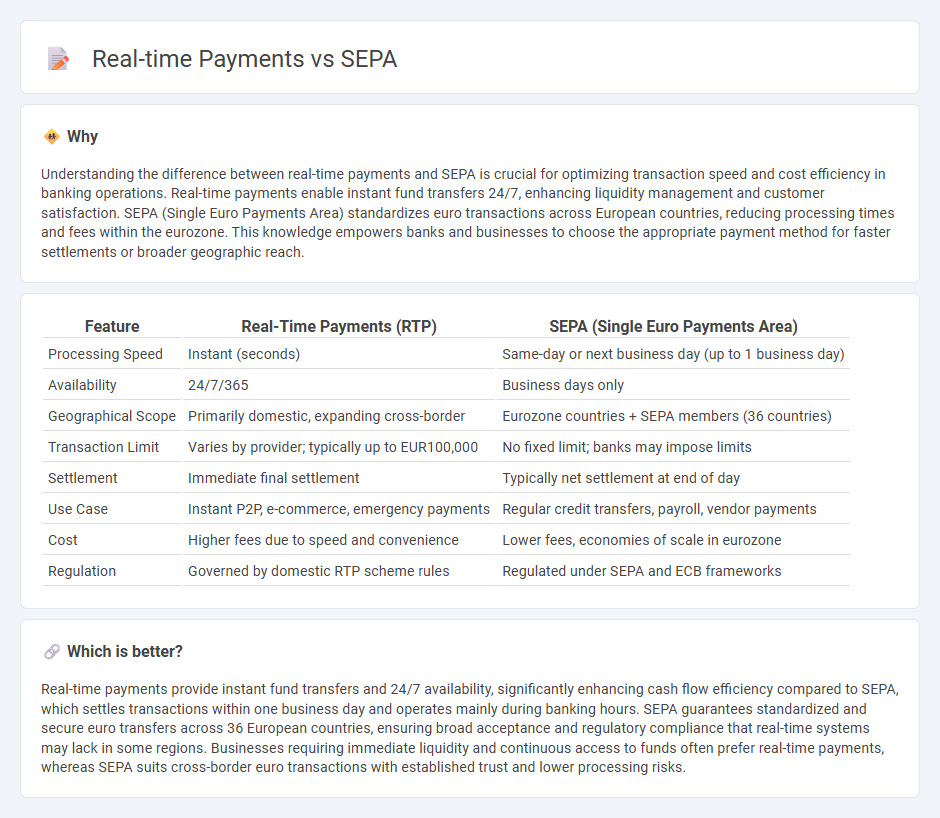

Understanding the difference between real-time payments and SEPA is crucial for optimizing transaction speed and cost efficiency in banking operations. Real-time payments enable instant fund transfers 24/7, enhancing liquidity management and customer satisfaction. SEPA (Single Euro Payments Area) standardizes euro transactions across European countries, reducing processing times and fees within the eurozone. This knowledge empowers banks and businesses to choose the appropriate payment method for faster settlements or broader geographic reach.

Comparison Table

| Feature | Real-Time Payments (RTP) | SEPA (Single Euro Payments Area) |

|---|---|---|

| Processing Speed | Instant (seconds) | Same-day or next business day (up to 1 business day) |

| Availability | 24/7/365 | Business days only |

| Geographical Scope | Primarily domestic, expanding cross-border | Eurozone countries + SEPA members (36 countries) |

| Transaction Limit | Varies by provider; typically up to EUR100,000 | No fixed limit; banks may impose limits |

| Settlement | Immediate final settlement | Typically net settlement at end of day |

| Use Case | Instant P2P, e-commerce, emergency payments | Regular credit transfers, payroll, vendor payments |

| Cost | Higher fees due to speed and convenience | Lower fees, economies of scale in eurozone |

| Regulation | Governed by domestic RTP scheme rules | Regulated under SEPA and ECB frameworks |

Which is better?

Real-time payments provide instant fund transfers and 24/7 availability, significantly enhancing cash flow efficiency compared to SEPA, which settles transactions within one business day and operates mainly during banking hours. SEPA guarantees standardized and secure euro transfers across 36 European countries, ensuring broad acceptance and regulatory compliance that real-time systems may lack in some regions. Businesses requiring immediate liquidity and continuous access to funds often prefer real-time payments, whereas SEPA suits cross-border euro transactions with established trust and lower processing risks.

Connection

Real-time payments enable instant fund transfers across banks, enhancing the efficiency of the Single Euro Payments Area (SEPA) by supporting immediate credit transfers within the eurozone. SEPA Instant Credit Transfer (SCT Inst) scheme facilitates these real-time transactions, allowing payments to be processed within seconds, 24/7. This integration advances cross-border payment harmonization, reduces settlement risks, and improves cash flow management for individuals and businesses in Europe.

Key Terms

Settlement Speed

SEPA payments typically settle within one business day, supporting efficient euro transactions across Europe but lacking instantaneous processing. Real-time payment systems enable immediate fund transfer and settlement, ensuring transactions clear within seconds regardless of bank operating hours. Discover the advantages and technical insights behind both payment methods to optimize transaction speed for your financial needs.

Geographic Coverage

SEPA (Single Euro Payments Area) enables seamless cross-border euro transactions across 36 European countries, fostering regional economic integration with a standardized payment infrastructure. Real-time payments, such as the SCT Inst scheme within SEPA, provide instant transaction processing but are often limited to specific countries or payment networks globally, restricting universal reach. Explore further to understand how geographic coverage affects your payment strategies and options.

Transaction Processing

SEPA transactions typically process within one business day, offering reliable end-of-day settlement across Eurozone banks. Real-time payments enable instant fund transfers, with settlement occurring within seconds, ensuring immediate availability and enhanced liquidity. Explore the advantages and limitations of each payment system to optimize your transaction processing strategy.

Source and External Links

Single Euro Payments Area (SEPA) - European Central Bank - SEPA enables fast, safe, and efficient cashless euro payments across European Union and some non-EU countries by harmonizing credit transfers and direct debits.

Single Euro Payments Area - Wikipedia - SEPA is an EU payment integration initiative simplifying euro bank transfers with schemes like SEPA Credit Transfer, Instant Credit Transfer, and Direct Debit for consumers and businesses.

What is SEPA Direct Debit? - GoCardless - SEPA Direct Debit is a pan-European system allowing merchants to collect euro payments from accounts in 36 SEPA countries, standardizing payments across the Eurozone.

dowidth.com

dowidth.com