Wealthtech platforms leverage technology to offer personalized investment and wealth management solutions, optimizing financial growth through AI-driven analytics and automation. Superapps integrate diverse financial services, including banking, payments, and wealth management, into a single interface to enhance user convenience and engagement. Explore how these innovative digital tools are reshaping the future of banking and personal finance.

Why it is important

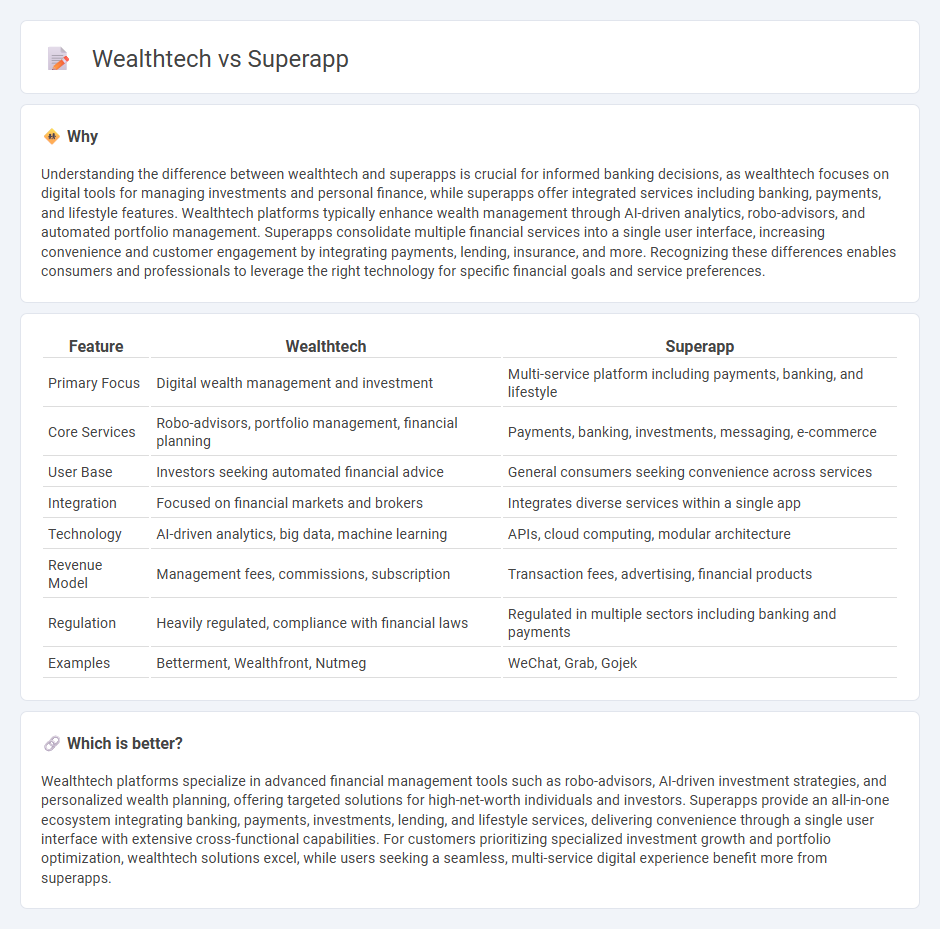

Understanding the difference between wealthtech and superapps is crucial for informed banking decisions, as wealthtech focuses on digital tools for managing investments and personal finance, while superapps offer integrated services including banking, payments, and lifestyle features. Wealthtech platforms typically enhance wealth management through AI-driven analytics, robo-advisors, and automated portfolio management. Superapps consolidate multiple financial services into a single user interface, increasing convenience and customer engagement by integrating payments, lending, insurance, and more. Recognizing these differences enables consumers and professionals to leverage the right technology for specific financial goals and service preferences.

Comparison Table

| Feature | Wealthtech | Superapp |

|---|---|---|

| Primary Focus | Digital wealth management and investment | Multi-service platform including payments, banking, and lifestyle |

| Core Services | Robo-advisors, portfolio management, financial planning | Payments, banking, investments, messaging, e-commerce |

| User Base | Investors seeking automated financial advice | General consumers seeking convenience across services |

| Integration | Focused on financial markets and brokers | Integrates diverse services within a single app |

| Technology | AI-driven analytics, big data, machine learning | APIs, cloud computing, modular architecture |

| Revenue Model | Management fees, commissions, subscription | Transaction fees, advertising, financial products |

| Regulation | Heavily regulated, compliance with financial laws | Regulated in multiple sectors including banking and payments |

| Examples | Betterment, Wealthfront, Nutmeg | WeChat, Grab, Gojek |

Which is better?

Wealthtech platforms specialize in advanced financial management tools such as robo-advisors, AI-driven investment strategies, and personalized wealth planning, offering targeted solutions for high-net-worth individuals and investors. Superapps provide an all-in-one ecosystem integrating banking, payments, investments, lending, and lifestyle services, delivering convenience through a single user interface with extensive cross-functional capabilities. For customers prioritizing specialized investment growth and portfolio optimization, wealthtech solutions excel, while users seeking a seamless, multi-service digital experience benefit more from superapps.

Connection

Wealthtech integrates advanced financial technologies to deliver personalized investment and wealth management solutions within superapps, creating seamless user experiences. Superapps unify multiple banking, payment, and investment services into a single platform, leveraging wealthtech algorithms to optimize asset allocation and financial planning. This synergy enhances customer engagement by providing real-time insights, automated portfolio management, and diversified financial products in one comprehensive digital ecosystem.

Key Terms

Ecosystem Integration

Superapps integrate multiple services such as payments, social media, and e-commerce into a unified platform, creating a seamless user experience and fostering high customer engagement through ecosystem integration. Wealthtech platforms specialize in financial services like investment management, portfolio monitoring, and robo-advisory, leveraging technology to offer personalized wealth solutions within their niche. Explore how ecosystem integration strategies differentiate superapps and wealthtech to optimize user value and business scalability.

Digital Wealth Management

Superapps integrate multiple financial services, offering users seamless access to digital wealth management alongside payments, insurance, and lending within a single platform. Wealthtech firms specialize in advanced digital wealth management solutions, leveraging AI-driven portfolio management, robo-advisors, and personalized investment strategies for optimized asset growth. Explore how these distinct approaches reshape digital wealth management and empower smarter financial decisions.

Financial Marketplace

Superapps integrate diverse financial services such as payments, lending, and insurance within a single platform, offering users seamless access and enhanced convenience. Wealthtech platforms emphasize advanced investment management tools, personalized portfolio construction, and AI-driven financial advisory to optimize wealth growth. Explore the evolving dynamics between superapps and wealthtech to understand which financial marketplace model best suits your needs.

Source and External Links

Super App - Super is a platform that allows users to log in and manage their accounts, with additional sign-in options via Google and Apple.

SuperApp TNET on the App Store - SuperApp TNET is an all-in-one mobile application for Georgian users, offering services like ticket purchases, online payments, currency exchange, fuel price tracking, vehicle management, and public service registrations, all consolidated into a single platform.

What Is a Superapp? - Gartner - A superapp is a platform that combines core features with a marketplace of independently created miniapps, allowing users to activate various tools as needed in a unified experience, and is increasingly replacing multiple single-purpose apps.

dowidth.com

dowidth.com