Social trading enables investors to replicate the strategies of experienced traders by following their trades in real time, fostering a collaborative investment environment. Algorithmic trading relies on computer algorithms to execute predefined trading strategies at high speed, optimizing decision-making through data analysis and automation. Explore the key differences and benefits of social trading and algorithmic trading to enhance your investment approach.

Why it is important

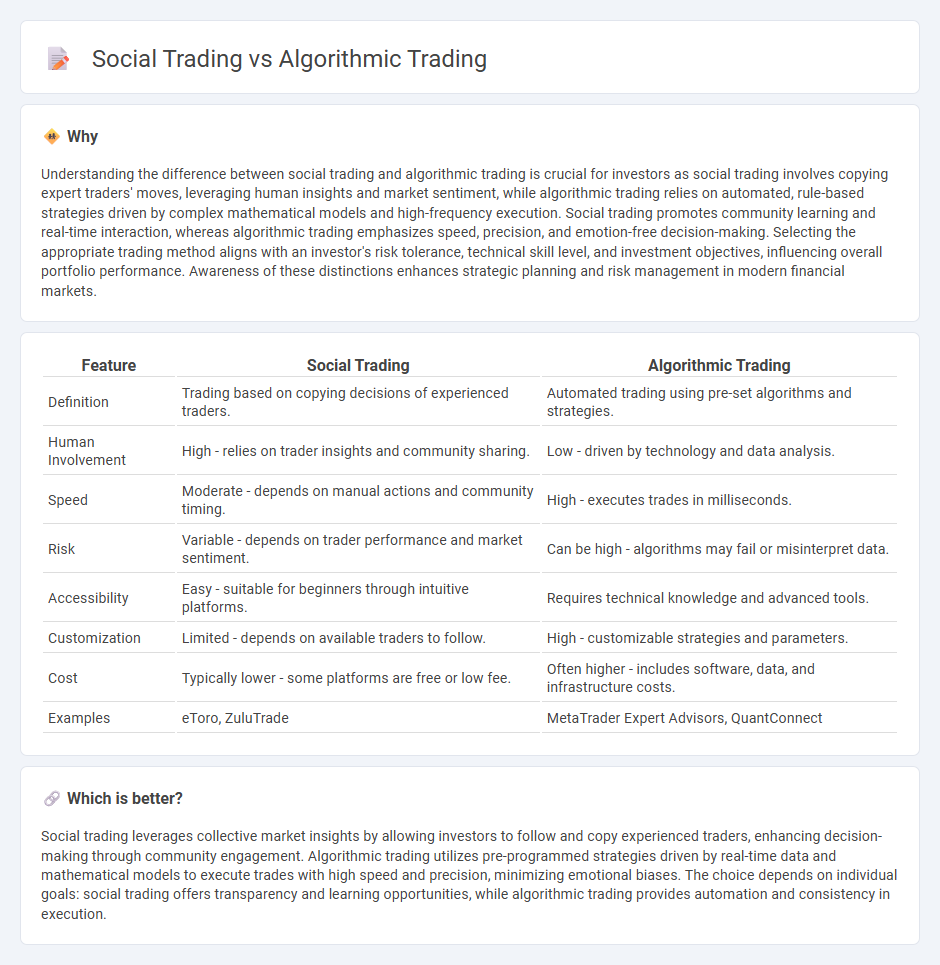

Understanding the difference between social trading and algorithmic trading is crucial for investors as social trading involves copying expert traders' moves, leveraging human insights and market sentiment, while algorithmic trading relies on automated, rule-based strategies driven by complex mathematical models and high-frequency execution. Social trading promotes community learning and real-time interaction, whereas algorithmic trading emphasizes speed, precision, and emotion-free decision-making. Selecting the appropriate trading method aligns with an investor's risk tolerance, technical skill level, and investment objectives, influencing overall portfolio performance. Awareness of these distinctions enhances strategic planning and risk management in modern financial markets.

Comparison Table

| Feature | Social Trading | Algorithmic Trading |

|---|---|---|

| Definition | Trading based on copying decisions of experienced traders. | Automated trading using pre-set algorithms and strategies. |

| Human Involvement | High - relies on trader insights and community sharing. | Low - driven by technology and data analysis. |

| Speed | Moderate - depends on manual actions and community timing. | High - executes trades in milliseconds. |

| Risk | Variable - depends on trader performance and market sentiment. | Can be high - algorithms may fail or misinterpret data. |

| Accessibility | Easy - suitable for beginners through intuitive platforms. | Requires technical knowledge and advanced tools. |

| Customization | Limited - depends on available traders to follow. | High - customizable strategies and parameters. |

| Cost | Typically lower - some platforms are free or low fee. | Often higher - includes software, data, and infrastructure costs. |

| Examples | eToro, ZuluTrade | MetaTrader Expert Advisors, QuantConnect |

Which is better?

Social trading leverages collective market insights by allowing investors to follow and copy experienced traders, enhancing decision-making through community engagement. Algorithmic trading utilizes pre-programmed strategies driven by real-time data and mathematical models to execute trades with high speed and precision, minimizing emotional biases. The choice depends on individual goals: social trading offers transparency and learning opportunities, while algorithmic trading provides automation and consistency in execution.

Connection

Social trading leverages collective market insights by allowing investors to follow and copy the trades of experienced traders, enhancing decision-making efficiency. Algorithmic trading uses computer algorithms to execute trades at high speed based on predefined criteria, maximizing accuracy and reducing human error. The connection lies in algorithmic strategies being integrated into social trading platforms, enabling automated replication of expert traders' moves to optimize portfolio performance.

Key Terms

Automated Execution (Algorithmic Trading)

Algorithmic trading uses pre-programmed instructions and mathematical models to execute trades at high speed and frequency, minimizing human error and emotional bias. This automated execution allows for precise timing and consistent application of complex strategies across multiple markets. Explore how leveraging algorithmic trading can enhance your investment efficiency and outcomes.

Collective Intelligence (Social Trading)

Collective intelligence in social trading harnesses the power of community-driven decision-making by aggregating diverse investor insights and strategies, contrasting with algorithmic trading's reliance on predefined mathematical models and automated executions. Social trading platforms leverage real-time data from multiple traders to adapt and optimize investment choices dynamically, promoting transparency and collaborative learning. Explore how combining collective intelligence with algorithmic precision can transform your trading approach.

Strategy Transparency

Algorithmic trading employs pre-programmed, quantitative models to execute trades automatically, offering limited strategy transparency to individual investors due to proprietary algorithms. Social trading emphasizes strategy transparency by allowing traders to observe, replicate, and interact with the performance and methodologies of experienced investors in real time. Explore the differences in strategy transparency and how they impact your trading decisions to determine the optimal approach for your investment goals.

Source and External Links

What is Algorithmic Trading and How Do You Get Started? - IG - Algorithmic trading uses computer programs to execute trades based on set rules, with key strategies including price action, technical analysis, and combination approaches tailored to markets and timing.

Algorithmic Trading - Definition, Example, Pros, Cons - Algorithmic trading involves automated execution of trades via computer code based on predefined rules, for example buying or selling shares depending on their price relative to moving averages.

Algorithmic trading - Wikipedia - Algorithmic trading has evolved to incorporate machine learning techniques like deep reinforcement learning, enabling algorithms to adapt dynamically to market conditions and improve trade timing in volatile markets.

dowidth.com

dowidth.com