Crypto custody involves securely storing digital assets such as Bitcoin and Ethereum through specialized wallets and protocols designed to prevent unauthorized access or theft. Gold custody focuses on the physical safeguarding of gold bars or coins within secure vaults managed by trusted financial institutions, ensuring asset protection and liquidity. Explore the distinct features and security measures of crypto and gold custody to make informed investment decisions.

Why it is important

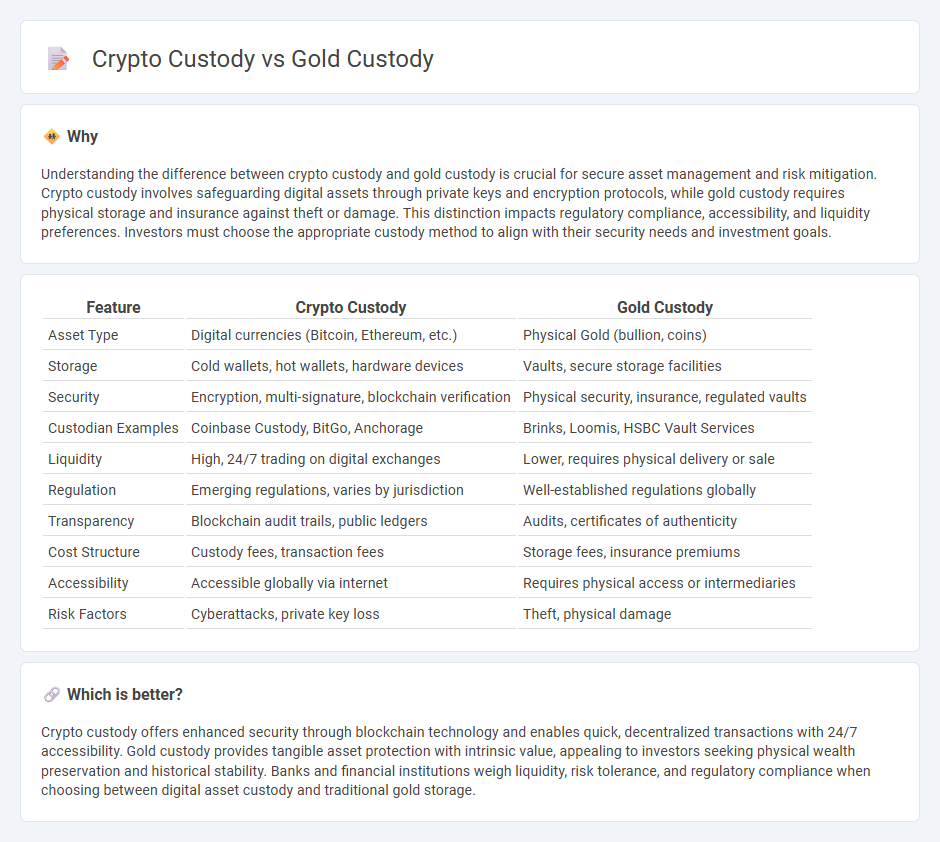

Understanding the difference between crypto custody and gold custody is crucial for secure asset management and risk mitigation. Crypto custody involves safeguarding digital assets through private keys and encryption protocols, while gold custody requires physical storage and insurance against theft or damage. This distinction impacts regulatory compliance, accessibility, and liquidity preferences. Investors must choose the appropriate custody method to align with their security needs and investment goals.

Comparison Table

| Feature | Crypto Custody | Gold Custody |

|---|---|---|

| Asset Type | Digital currencies (Bitcoin, Ethereum, etc.) | Physical Gold (bullion, coins) |

| Storage | Cold wallets, hot wallets, hardware devices | Vaults, secure storage facilities |

| Security | Encryption, multi-signature, blockchain verification | Physical security, insurance, regulated vaults |

| Custodian Examples | Coinbase Custody, BitGo, Anchorage | Brinks, Loomis, HSBC Vault Services |

| Liquidity | High, 24/7 trading on digital exchanges | Lower, requires physical delivery or sale |

| Regulation | Emerging regulations, varies by jurisdiction | Well-established regulations globally |

| Transparency | Blockchain audit trails, public ledgers | Audits, certificates of authenticity |

| Cost Structure | Custody fees, transaction fees | Storage fees, insurance premiums |

| Accessibility | Accessible globally via internet | Requires physical access or intermediaries |

| Risk Factors | Cyberattacks, private key loss | Theft, physical damage |

Which is better?

Crypto custody offers enhanced security through blockchain technology and enables quick, decentralized transactions with 24/7 accessibility. Gold custody provides tangible asset protection with intrinsic value, appealing to investors seeking physical wealth preservation and historical stability. Banks and financial institutions weigh liquidity, risk tolerance, and regulatory compliance when choosing between digital asset custody and traditional gold storage.

Connection

Crypto custody and gold custody both involve secure asset storage solutions designed to safeguard value and prevent theft or loss. Institutions offering custody services implement advanced security protocols, including multi-signature wallets for crypto and insured vaults for gold, ensuring asset integrity and regulatory compliance. By combining digital asset management with physical asset protection, integrated custody solutions provide diversified investment security and facilitate seamless asset transfer between traditional and digital financial sectors.

Key Terms

Vault Storage vs. Digital Wallet

Gold custody involves secure vault storage, often in armored facilities, ensuring physical protection and insurance coverage, while crypto custody relies on digital wallets secured by encryption and private keys to safeguard cryptocurrencies from cyber threats. Vault storage provides tangible asset safety with limited access, whereas digital wallets offer easier transferability but require robust cybersecurity measures to prevent hacking and loss. Explore the critical differences between vault storage and digital wallets to optimize your asset security strategy.

Physical Asset vs. Private Key

Gold custody involves secure storage of physical assets such as bars or coins in vaults with insured protection, ensuring tangible ownership and protection against theft or damage. Crypto custody relies on safeguarding private keys through digital wallets or hardware devices, making control over access the primary security concern due to the risks of hacking or loss. Explore detailed comparisons on how gold and crypto custody methods safeguard assets differently and their unique security challenges.

Auditing (Physical Inspection) vs. Blockchain Verification

Gold custody requires rigorous auditing through physical inspections to verify the presence and condition of the assets, ensuring tangible proof of ownership and preventing fraud. In contrast, crypto custody leverages blockchain verification, utilizing cryptographic proofs and transparent ledger updates to authenticate transactions and holdings without needing physical handling. Explore how these distinct auditing methods impact security and trust in asset custody.

Source and External Links

Gold Vault - FEDERAL RESERVE BANK of NEW YORK - The Federal Reserve Bank of New York provides gold custody services by securely storing gold reserves for central banks, governments, and international organizations in its Manhattan vault, acting as a custodian rather than owner of the gold stored.

What is a gold custodian and why do I need one? - CBS News - A gold custodian is a financial institution or specialized company that manages and securely stores physical gold and precious metals for investors, offering advanced security, insurance, and expert handling of gold assets.

The Fed - Does the Federal Reserve own or hold gold? - The Federal Reserve does not own gold but the Federal Reserve Bank of New York acts as custodian of gold owned by official entities, holding it safely without allowing private individuals or companies to store gold there.

dowidth.com

dowidth.com