Digital identity verification leverages biometric data and secure databases to authenticate users swiftly and reduce fraud in banking transactions. Blockchain-based identity offers decentralized, tamper-proof records that enhance privacy and enable seamless cross-platform verification without centralized control. Explore how these technologies reshape secure banking experiences.

Why it is important

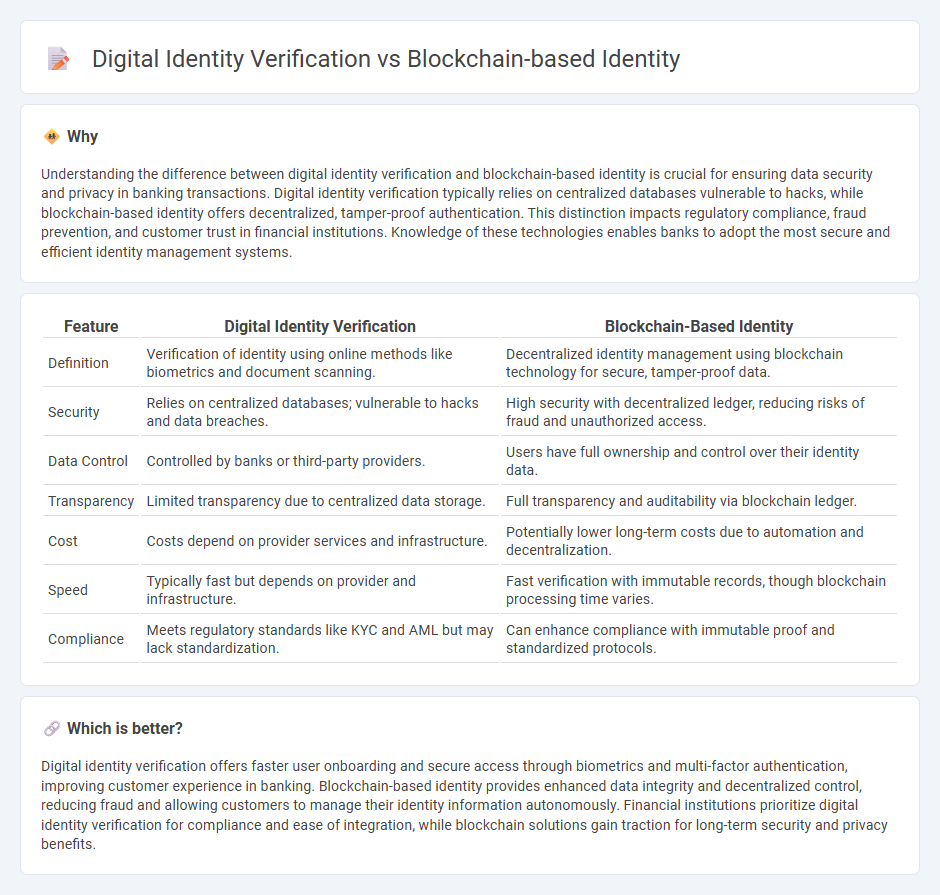

Understanding the difference between digital identity verification and blockchain-based identity is crucial for ensuring data security and privacy in banking transactions. Digital identity verification typically relies on centralized databases vulnerable to hacks, while blockchain-based identity offers decentralized, tamper-proof authentication. This distinction impacts regulatory compliance, fraud prevention, and customer trust in financial institutions. Knowledge of these technologies enables banks to adopt the most secure and efficient identity management systems.

Comparison Table

| Feature | Digital Identity Verification | Blockchain-Based Identity |

|---|---|---|

| Definition | Verification of identity using online methods like biometrics and document scanning. | Decentralized identity management using blockchain technology for secure, tamper-proof data. |

| Security | Relies on centralized databases; vulnerable to hacks and data breaches. | High security with decentralized ledger, reducing risks of fraud and unauthorized access. |

| Data Control | Controlled by banks or third-party providers. | Users have full ownership and control over their identity data. |

| Transparency | Limited transparency due to centralized data storage. | Full transparency and auditability via blockchain ledger. |

| Cost | Costs depend on provider services and infrastructure. | Potentially lower long-term costs due to automation and decentralization. |

| Speed | Typically fast but depends on provider and infrastructure. | Fast verification with immutable records, though blockchain processing time varies. |

| Compliance | Meets regulatory standards like KYC and AML but may lack standardization. | Can enhance compliance with immutable proof and standardized protocols. |

Which is better?

Digital identity verification offers faster user onboarding and secure access through biometrics and multi-factor authentication, improving customer experience in banking. Blockchain-based identity provides enhanced data integrity and decentralized control, reducing fraud and allowing customers to manage their identity information autonomously. Financial institutions prioritize digital identity verification for compliance and ease of integration, while blockchain solutions gain traction for long-term security and privacy benefits.

Connection

Digital identity verification leverages blockchain technology to enhance security, transparency, and immutability of personal data in banking transactions. Blockchain-based identity systems create decentralized digital identities that reduce fraud risks by providing verifiable credentials without relying on centralized authorities. Banks adopting these technologies benefit from faster customer onboarding, compliance with KYC and AML regulations, and improved trust in digital banking ecosystems.

Key Terms

Decentralization

Blockchain-based identity leverages decentralized ledger technology to distribute user data across multiple nodes, reducing reliance on a central authority and enhancing security against single points of failure. Digital identity verification often depends on centralized databases, which can be vulnerable to breaches and data manipulation. Explore the transformative potential of decentralized identity solutions and how they redefine user privacy and control.

Cryptographic Authentication

Blockchain-based identity leverages decentralized ledger technology to enhance security and control over personal data through cryptographic authentication methods such as digital signatures and zero-knowledge proofs. Digital identity verification typically relies on centralized databases and protocols that verify identity credentials but can be vulnerable to data breaches or single points of failure. Explore deeper insights into how cryptographic authentication underpins secure and privacy-preserving identity solutions.

Centralized Databases

Blockchain-based identity systems eliminate reliance on centralized databases by decentralizing data storage across distributed ledgers, enhancing security and reducing single points of failure common in traditional digital identity verification methods. Centralized databases in digital identity verification pose risks such as data breaches, unauthorized access, and concerns over data ownership and privacy. Explore how blockchain technology offers a resilient alternative and transforms identity management.

Source and External Links

Blockchain Identity Management: A Complete Guide - 1Kosmos - Decentralized identity systems on the blockchain give users full control over their identity data, enabling secure, transparent, and immutable verification without reliance on central authorities.

The Big Shift: Digital Identity in Web3 | Kinexys by J.P. Morgan - Web3-based digital identity empowers users to selectively share personal information, enhances security by eliminating single points of failure, and ensures identity records are tamper-proof through blockchain encryption.

Compliance Strategies for Blockchain-Based Identity Management Solutions - Blockchain-based identity management advocates for self-sovereign identity (SSI), where users store and control their data on personal devices, reducing risks of mass data breaches and ensuring compliance with privacy regulations.

dowidth.com

dowidth.com