Stablecoin rails offer faster, cost-effective cross-border payments by leveraging blockchain technology, reducing reliance on traditional correspondent banking networks characterized by slower processing and higher fees. Correspondent banking remains integral for global financial connectivity but faces challenges like regulatory scrutiny and liquidity constraints. Explore the advantages and limitations of both systems to understand their roles in modern banking infrastructure.

Why it is important

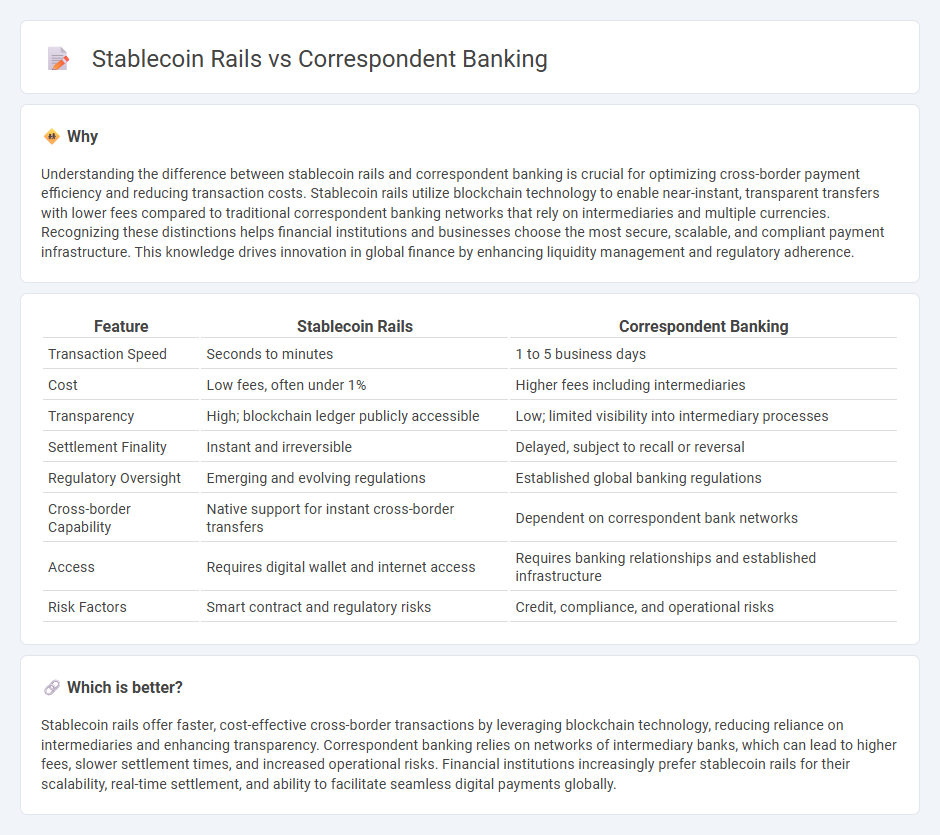

Understanding the difference between stablecoin rails and correspondent banking is crucial for optimizing cross-border payment efficiency and reducing transaction costs. Stablecoin rails utilize blockchain technology to enable near-instant, transparent transfers with lower fees compared to traditional correspondent banking networks that rely on intermediaries and multiple currencies. Recognizing these distinctions helps financial institutions and businesses choose the most secure, scalable, and compliant payment infrastructure. This knowledge drives innovation in global finance by enhancing liquidity management and regulatory adherence.

Comparison Table

| Feature | Stablecoin Rails | Correspondent Banking |

|---|---|---|

| Transaction Speed | Seconds to minutes | 1 to 5 business days |

| Cost | Low fees, often under 1% | Higher fees including intermediaries |

| Transparency | High; blockchain ledger publicly accessible | Low; limited visibility into intermediary processes |

| Settlement Finality | Instant and irreversible | Delayed, subject to recall or reversal |

| Regulatory Oversight | Emerging and evolving regulations | Established global banking regulations |

| Cross-border Capability | Native support for instant cross-border transfers | Dependent on correspondent bank networks |

| Access | Requires digital wallet and internet access | Requires banking relationships and established infrastructure |

| Risk Factors | Smart contract and regulatory risks | Credit, compliance, and operational risks |

Which is better?

Stablecoin rails offer faster, cost-effective cross-border transactions by leveraging blockchain technology, reducing reliance on intermediaries and enhancing transparency. Correspondent banking relies on networks of intermediary banks, which can lead to higher fees, slower settlement times, and increased operational risks. Financial institutions increasingly prefer stablecoin rails for their scalability, real-time settlement, and ability to facilitate seamless digital payments globally.

Connection

Stablecoin rails enhance correspondent banking by enabling faster, transparent cross-border payments with reduced costs and settlement times. They leverage blockchain technology to provide secure, immutable transaction records, addressing traditional correspondent banking challenges such as liquidity constraints and compliance risks. This integration fosters more efficient international banking networks, improving transaction speed and reliability across global financial institutions.

Key Terms

Nostro/Vostro Accounts

Correspondent banking relies heavily on Nostro and Vostro accounts to facilitate cross-border payments, enabling banks to hold deposits in foreign currencies for efficient transaction settlement. Stablecoin rails offer a decentralized alternative by utilizing blockchain technology to bypass traditional intermediaries, which reduces reliance on these accounts and accelerates transaction speeds. Explore how integrating stablecoins with correspondent banking can optimize international payment systems and enhance liquidity management.

SWIFT Network

The SWIFT network remains the backbone of correspondent banking, facilitating secure and standardized international financial messaging among over 11,000 institutions globally. Stablecoin rails provide a faster settlement alternative by using blockchain technology, enabling near-instant cross-border transactions with reduced costs and transparency. Explore the dynamic evolution of global payments by understanding how SWIFT and stablecoin rails compare in efficiency and security.

On-chain Settlement

On-chain settlement in correspondent banking typically involves slower processing times and multiple intermediaries, which increases transaction costs and settlement risk. Stablecoin rails leverage blockchain technology to enable near-instantaneous cross-border payments with enhanced transparency and reduced fees. Explore how these innovative payment infrastructures are reshaping global liquidity and financial inclusion.

Source and External Links

Introduction to Correspondent Banking - Correspondent banking is a relationship where one bank (correspondent) provides banking services to another (respondent), enabling access to foreign markets and facilitating international payments and currency transactions essential for global trade.

What is a Correspondent Bank? - A correspondent bank acts as an intermediary between domestic and foreign banks by processing transactions using nostro and vostro accounts, typically via SWIFT, to settle cross-border payments where direct bank relationships do not exist.

Correspondent Banking Risk - AML Compliance - Correspondent banking involves risk assessments to mitigate money laundering, terrorist financing, and sanctions violations by evaluating the respondent bank's controls, regulatory environment, and reputation to maintain compliance and secure the global financial network.

dowidth.com

dowidth.com