Invisible payments leverage seamless, real-time transaction processing without requiring explicit customer authorization each time, enhancing user convenience and security. Standing orders, in contrast, are pre-authorized, recurring payment instructions fixed in amount and frequency, commonly used for consistent financial obligations like rent or subscriptions. Discover the nuanced advantages and ideal use cases of invisible payments versus standing orders to optimize your banking strategy.

Why it is important

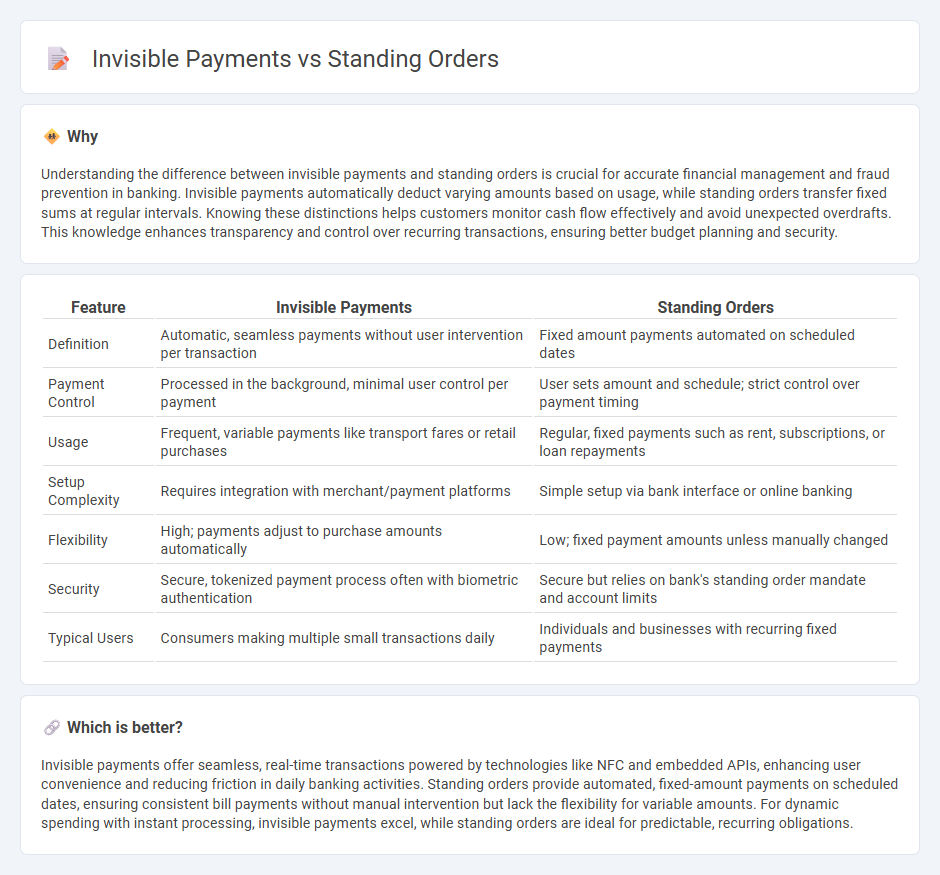

Understanding the difference between invisible payments and standing orders is crucial for accurate financial management and fraud prevention in banking. Invisible payments automatically deduct varying amounts based on usage, while standing orders transfer fixed sums at regular intervals. Knowing these distinctions helps customers monitor cash flow effectively and avoid unexpected overdrafts. This knowledge enhances transparency and control over recurring transactions, ensuring better budget planning and security.

Comparison Table

| Feature | Invisible Payments | Standing Orders |

|---|---|---|

| Definition | Automatic, seamless payments without user intervention per transaction | Fixed amount payments automated on scheduled dates |

| Payment Control | Processed in the background, minimal user control per payment | User sets amount and schedule; strict control over payment timing |

| Usage | Frequent, variable payments like transport fares or retail purchases | Regular, fixed payments such as rent, subscriptions, or loan repayments |

| Setup Complexity | Requires integration with merchant/payment platforms | Simple setup via bank interface or online banking |

| Flexibility | High; payments adjust to purchase amounts automatically | Low; fixed payment amounts unless manually changed |

| Security | Secure, tokenized payment process often with biometric authentication | Secure but relies on bank's standing order mandate and account limits |

| Typical Users | Consumers making multiple small transactions daily | Individuals and businesses with recurring fixed payments |

Which is better?

Invisible payments offer seamless, real-time transactions powered by technologies like NFC and embedded APIs, enhancing user convenience and reducing friction in daily banking activities. Standing orders provide automated, fixed-amount payments on scheduled dates, ensuring consistent bill payments without manual intervention but lack the flexibility for variable amounts. For dynamic spending with instant processing, invisible payments excel, while standing orders are ideal for predictable, recurring obligations.

Connection

Invisible payments streamline transactions by automatically debiting funds without manual input, often facilitated through standing orders set up by account holders. Standing orders provide a fixed, recurring payment schedule, ensuring consistent transfers for services like rent or subscriptions. This seamless automation enhances convenience and accuracy in banking operations.

Key Terms

Regular Payments

Standing orders enable automatic, fixed-amount transfers at regular intervals, ensuring consistent payments for bills or subscriptions without manual intervention. Invisible payments, often driven by backend processes and tokenization, offer seamless, often variable transactions that remain unnoticed by users, enhancing convenience and security. Explore how these payment methods optimize financial management and user experience in recurring transactions.

Automated Transactions

Standing orders automate regular payments by instructing banks to transfer a fixed amount on set dates, ensuring consistency in bill settlements or savings. Invisible payments, often enabled through technologies like contactless card transactions or automated online billing, provide seamless, immediate fund transfers without explicit user action at each instance. Explore the mechanisms and benefits of these automated transactions to optimize financial management strategies.

Non-physical Transfers

Standing orders facilitate scheduled, fixed-amount non-physical transfers between bank accounts, automating payments like rent or subscriptions without manual intervention. Invisible payments, often processed via APIs or embedded financial services, execute seamless non-physical transfers within digital platforms, enabling frictionless user experiences in e-commerce or fintech apps. Explore deeper insights into the mechanisms and advantages of standing orders and invisible payments in modern banking systems.

Source and External Links

Standing order - A standing order can refer to a bank instruction to pay fixed amounts regularly, permanent parliamentary rules, military orders, or medical protocols allowing certain treatments without direct physician orders.

Standing order (banking) - In banking, a standing order is an instruction by an account holder to their bank to pay a fixed amount at regular intervals to another account, commonly used for rent or mortgage payments.

What standing orders can do for your practice - In healthcare, standing orders are written protocols allowing designated medical staff to perform certain clinical tasks without physician approval to improve efficiency and preventive care delivery.

dowidth.com

dowidth.com