Core banking modernization streamlines legacy systems by enhancing scalability, security, and real-time transaction processing through advanced cloud technologies. Fintech integration introduces innovative solutions such as AI-driven analytics, digital wallets, and blockchain-based payments to improve customer experience and operational efficiency. Explore the evolving landscape of banking technology to understand how these strategies reshape financial services.

Why it is important

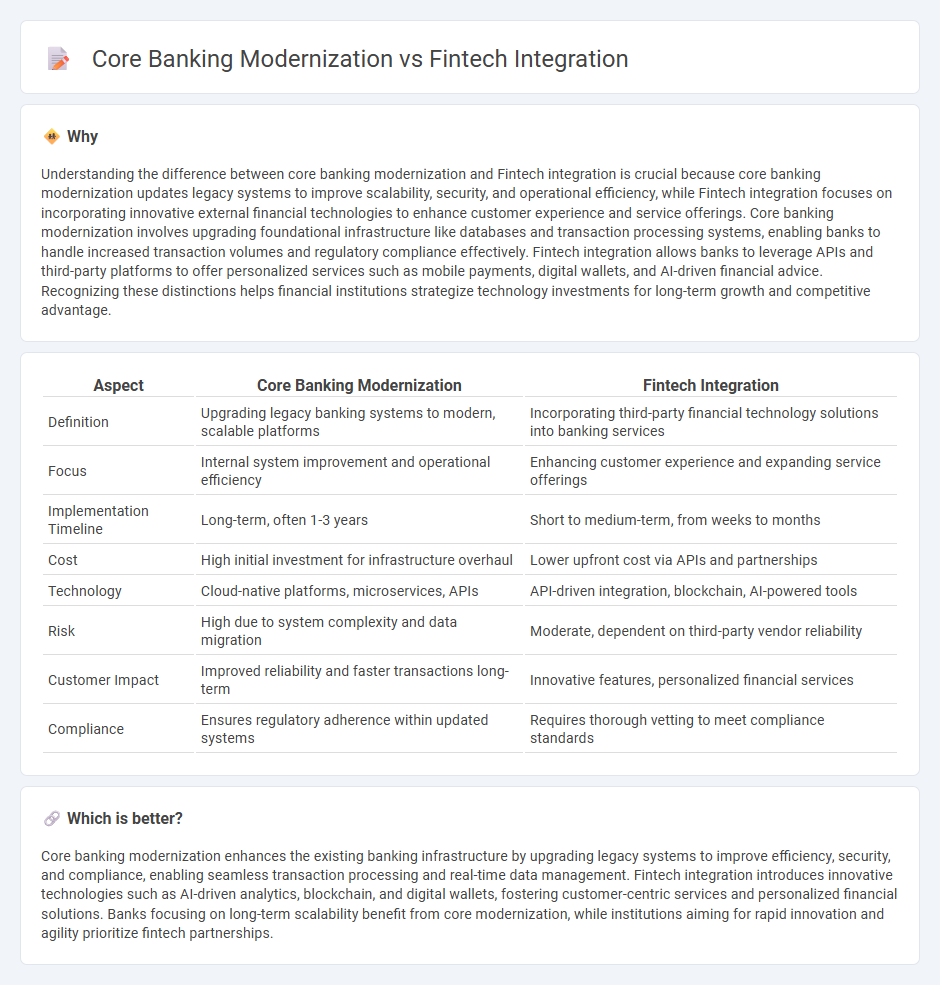

Understanding the difference between core banking modernization and Fintech integration is crucial because core banking modernization updates legacy systems to improve scalability, security, and operational efficiency, while Fintech integration focuses on incorporating innovative external financial technologies to enhance customer experience and service offerings. Core banking modernization involves upgrading foundational infrastructure like databases and transaction processing systems, enabling banks to handle increased transaction volumes and regulatory compliance effectively. Fintech integration allows banks to leverage APIs and third-party platforms to offer personalized services such as mobile payments, digital wallets, and AI-driven financial advice. Recognizing these distinctions helps financial institutions strategize technology investments for long-term growth and competitive advantage.

Comparison Table

| Aspect | Core Banking Modernization | Fintech Integration |

|---|---|---|

| Definition | Upgrading legacy banking systems to modern, scalable platforms | Incorporating third-party financial technology solutions into banking services |

| Focus | Internal system improvement and operational efficiency | Enhancing customer experience and expanding service offerings |

| Implementation Timeline | Long-term, often 1-3 years | Short to medium-term, from weeks to months |

| Cost | High initial investment for infrastructure overhaul | Lower upfront cost via APIs and partnerships |

| Technology | Cloud-native platforms, microservices, APIs | API-driven integration, blockchain, AI-powered tools |

| Risk | High due to system complexity and data migration | Moderate, dependent on third-party vendor reliability |

| Customer Impact | Improved reliability and faster transactions long-term | Innovative features, personalized financial services |

| Compliance | Ensures regulatory adherence within updated systems | Requires thorough vetting to meet compliance standards |

Which is better?

Core banking modernization enhances the existing banking infrastructure by upgrading legacy systems to improve efficiency, security, and compliance, enabling seamless transaction processing and real-time data management. Fintech integration introduces innovative technologies such as AI-driven analytics, blockchain, and digital wallets, fostering customer-centric services and personalized financial solutions. Banks focusing on long-term scalability benefit from core modernization, while institutions aiming for rapid innovation and agility prioritize fintech partnerships.

Connection

Core banking modernization enhances system agility, enabling seamless integration of fintech solutions such as digital wallets, AI-driven analytics, and blockchain technology. This convergence drives improved customer experience, real-time transaction processing, and robust security protocols. Fintech integration leverages modern core platforms to deliver innovative financial products while ensuring regulatory compliance and operational efficiency.

Key Terms

API (Application Programming Interface)

API-driven fintech integration enhances core banking systems by enabling seamless connectivity with external financial services and innovative applications. Core banking modernization prioritizes robust API frameworks to improve scalability, security, and real-time data exchange essential for digital transformation. Discover how adopting advanced API strategies can revolutionize your banking infrastructure by exploring the latest industry insights.

Legacy Systems

Legacy systems in core banking often hinder fintech integration due to outdated infrastructure and limited API support, causing delays in digital transformation. Modernization efforts prioritize scalable, cloud-native architectures with microservices that enable seamless fintech collaboration and enhanced customer experiences. Explore how upgrading legacy platforms can unlock fintech potential and accelerate innovation within banking ecosystems.

Digital Transformation

Fintech integration enhances banking services by incorporating innovative digital solutions such as AI-driven analytics and blockchain technology to improve customer experience and operational efficiency. Core banking modernization involves upgrading legacy systems to cloud-native platforms and adopting APIs for seamless, real-time transaction processing and regulatory compliance. Explore the latest trends and strategies behind successful digital transformation in banking to stay competitive and future-ready.

Source and External Links

Future of Fintech & Banking: Partnerships & Collaboration - Fintech integration, especially partnerships between banks and fintechs, simplifies technical bank integration, optimizes ERP and treasury management, and enables insights through API data sharing to enhance strategic business efforts and growth.

Financial Technology (Fintech) Integration - Salsify - Fintech integration involves embedding finance-oriented capabilities like payments into existing ecommerce or business systems to streamline transactions, improve customer experience, and provide valuable financial analytics.

Fintech integrations - Backbase - Fintech integrations provide banks with API-driven connectors to best-in-class fintech solutions, enabling rapid digital transformation with ready-to-go functionalities that enhance banking apps efficiently and cost-effectively.

dowidth.com

dowidth.com