Banking as a Service (BaaS) enables third-party providers to offer banking products through APIs without maintaining a full banking license, streamlining the integration of financial services. Core banking systems form the backbone of traditional banks by managing daily transactions, customer accounts, and regulatory compliance within a centralized infrastructure. Explore the key differences and benefits between BaaS and core banking to optimize your financial technology strategy.

Why it is important

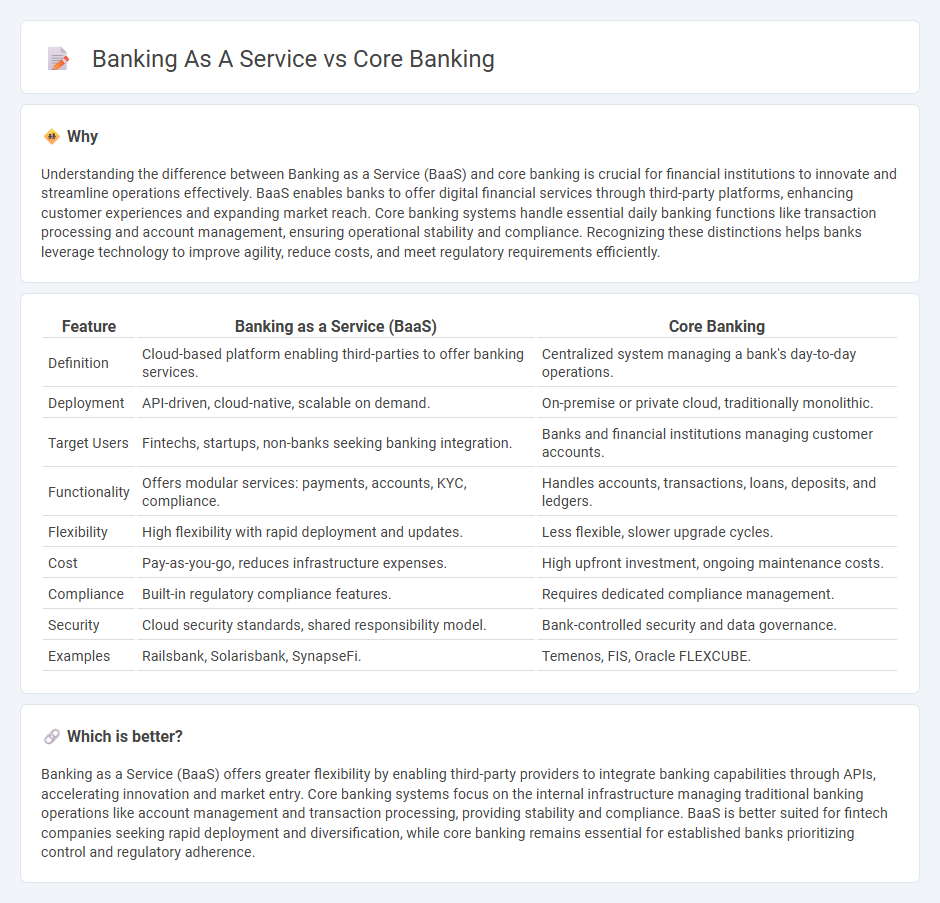

Understanding the difference between Banking as a Service (BaaS) and core banking is crucial for financial institutions to innovate and streamline operations effectively. BaaS enables banks to offer digital financial services through third-party platforms, enhancing customer experiences and expanding market reach. Core banking systems handle essential daily banking functions like transaction processing and account management, ensuring operational stability and compliance. Recognizing these distinctions helps banks leverage technology to improve agility, reduce costs, and meet regulatory requirements efficiently.

Comparison Table

| Feature | Banking as a Service (BaaS) | Core Banking |

|---|---|---|

| Definition | Cloud-based platform enabling third-parties to offer banking services. | Centralized system managing a bank's day-to-day operations. |

| Deployment | API-driven, cloud-native, scalable on demand. | On-premise or private cloud, traditionally monolithic. |

| Target Users | Fintechs, startups, non-banks seeking banking integration. | Banks and financial institutions managing customer accounts. |

| Functionality | Offers modular services: payments, accounts, KYC, compliance. | Handles accounts, transactions, loans, deposits, and ledgers. |

| Flexibility | High flexibility with rapid deployment and updates. | Less flexible, slower upgrade cycles. |

| Cost | Pay-as-you-go, reduces infrastructure expenses. | High upfront investment, ongoing maintenance costs. |

| Compliance | Built-in regulatory compliance features. | Requires dedicated compliance management. |

| Security | Cloud security standards, shared responsibility model. | Bank-controlled security and data governance. |

| Examples | Railsbank, Solarisbank, SynapseFi. | Temenos, FIS, Oracle FLEXCUBE. |

Which is better?

Banking as a Service (BaaS) offers greater flexibility by enabling third-party providers to integrate banking capabilities through APIs, accelerating innovation and market entry. Core banking systems focus on the internal infrastructure managing traditional banking operations like account management and transaction processing, providing stability and compliance. BaaS is better suited for fintech companies seeking rapid deployment and diversification, while core banking remains essential for established banks prioritizing control and regulatory adherence.

Connection

Banking as a Service (BaaS) integrates with core banking systems by providing APIs that enable fintech companies and third-party providers to access essential banking functions such as account management, payments, and compliance. Core banking platforms serve as the foundational infrastructure, managing customer accounts, transactions, and data in real-time, which BaaS leverages to offer seamless, scalable financial services. This connection enhances agility and innovation in the financial sector by allowing rapid deployment of new products while maintaining regulatory standards.

Key Terms

Centralized System (Core Banking)

Core banking systems centralize financial operations by integrating banking functions into a unified platform that manages accounts, transactions, and customer data in real time. This centralized system enables banks to efficiently handle multiple branches and deliver consistent services while maintaining regulatory compliance and security. Explore how centralized core banking streamlines workflows, reduces operational costs, and enhances customer experiences for deeper insights.

API Integration (Banking as a Service)

Core banking systems provide the fundamental infrastructure for managing a bank's internal processes, transactions, and customer accounts, while Banking as a Service (BaaS) leverages API integration to enable third parties to embed banking services directly into their platforms. API integration in BaaS offers seamless access to banking functions such as payments, account management, and compliance without the need for traditional banking infrastructure. Explore how API-driven BaaS transforms financial services by enhancing flexibility, scalability, and customer experience.

White-label Solutions (Banking as a Service)

White-label solutions in Banking as a Service (BaaS) enable fintech companies and non-banking entities to offer fully branded banking products powered by core banking infrastructure through APIs. This model contrasts with traditional core banking systems, which are primarily designed for internal use by banks to manage accounts, transactions, and compliance. Explore how white-label BaaS platforms can accelerate go-to-market strategies and enhance customer experiences without building banking infrastructure from scratch.

Source and External Links

What is Core Banking? - Core banking is a centralized back-end system connecting multiple branches of a bank, enabling customers to perform transactions like deposits, withdrawals, loans, and new accounts seamlessly in a secure, real-time environment.

Core banking - Wikipedia - Core banking refers to banking services offered across a network of branches where customers can access accounts and make transactions from any location, supported by software that centralizes record keeping and updates transactions in real-time.

What Is Core Banking: Definition, Features, Benefits - Core banking systems improve operational efficiency, enhance customer experience, increase revenue through new services, and reduce risk by providing a secure platform for managing daily banking operations and transactions.

dowidth.com

dowidth.com