Super apps integrate multiple financial services, including payments, lending, and investments, within a single platform to enhance user convenience and engagement. Banking as a Service (BaaS) provides APIs that allow non-banking companies to offer regulated financial products without building traditional banking infrastructure. Explore how these innovations are reshaping the future of digital finance.

Why it is important

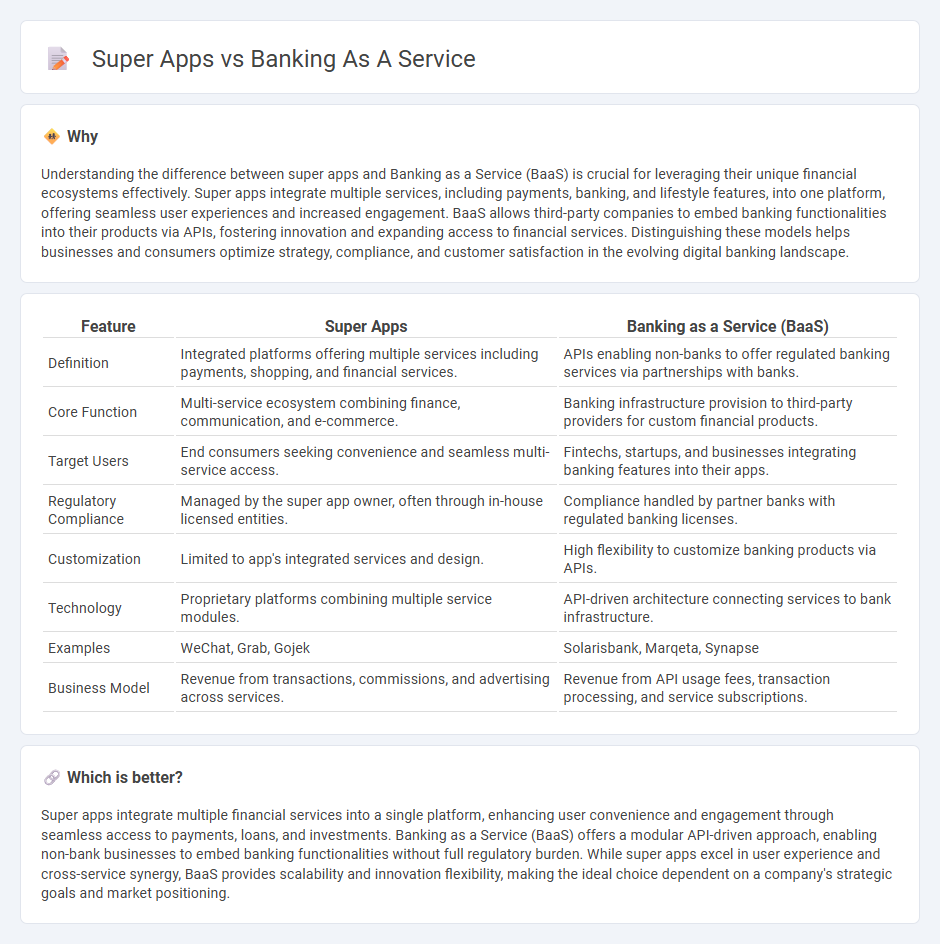

Understanding the difference between super apps and Banking as a Service (BaaS) is crucial for leveraging their unique financial ecosystems effectively. Super apps integrate multiple services, including payments, banking, and lifestyle features, into one platform, offering seamless user experiences and increased engagement. BaaS allows third-party companies to embed banking functionalities into their products via APIs, fostering innovation and expanding access to financial services. Distinguishing these models helps businesses and consumers optimize strategy, compliance, and customer satisfaction in the evolving digital banking landscape.

Comparison Table

| Feature | Super Apps | Banking as a Service (BaaS) |

|---|---|---|

| Definition | Integrated platforms offering multiple services including payments, shopping, and financial services. | APIs enabling non-banks to offer regulated banking services via partnerships with banks. |

| Core Function | Multi-service ecosystem combining finance, communication, and e-commerce. | Banking infrastructure provision to third-party providers for custom financial products. |

| Target Users | End consumers seeking convenience and seamless multi-service access. | Fintechs, startups, and businesses integrating banking features into their apps. |

| Regulatory Compliance | Managed by the super app owner, often through in-house licensed entities. | Compliance handled by partner banks with regulated banking licenses. |

| Customization | Limited to app's integrated services and design. | High flexibility to customize banking products via APIs. |

| Technology | Proprietary platforms combining multiple service modules. | API-driven architecture connecting services to bank infrastructure. |

| Examples | WeChat, Grab, Gojek | Solarisbank, Marqeta, Synapse |

| Business Model | Revenue from transactions, commissions, and advertising across services. | Revenue from API usage fees, transaction processing, and service subscriptions. |

Which is better?

Super apps integrate multiple financial services into a single platform, enhancing user convenience and engagement through seamless access to payments, loans, and investments. Banking as a Service (BaaS) offers a modular API-driven approach, enabling non-bank businesses to embed banking functionalities without full regulatory burden. While super apps excel in user experience and cross-service synergy, BaaS provides scalability and innovation flexibility, making the ideal choice dependent on a company's strategic goals and market positioning.

Connection

Super apps integrate Banking as a Service (BaaS) platforms to embed seamless financial products such as payments, loans, and digital wallets within their ecosystems. BaaS enables these apps to leverage licensed banking infrastructure through APIs, accelerating fintech innovation and customer engagement. This synergy drives enhanced user convenience and expands access to financial services on a single digital platform.

Key Terms

Embedded Finance

Embedded finance integrates banking services directly into non-financial platforms, enabling seamless customer experiences without switching apps. Super apps combine multiple services including embedded finance, offering users a single ecosystem for payments, loans, insurance, and investments. Explore how embedded finance drives innovation within super apps and transforms digital financial interactions.

API Integration

Banking as a Service (BaaS) provides financial institutions and fintechs with API integration that enables them to offer banking products without building the infrastructure from scratch. Super apps rely on extensive API ecosystems to seamlessly embed multiple services, including banking, within a single platform, enhancing user experience and engagement. Explore how API integration drives innovation in both BaaS and super apps for transformative digital banking solutions.

Ecosystem Platform

Banking as a Service (BaaS) platforms enable financial institutions and third-party providers to embed banking services directly into their ecosystems, creating seamless, API-driven experiences for users. Super apps consolidate multiple services, including banking, payments, shopping, and social media, into a single, integrated platform designed to maximize user engagement and retention. Explore the differences in ecosystem platform strategies to understand which model best suits evolving consumer demands.

Source and External Links

Banking as a Service (BaaS): What It Is + Examples - BaaS is a financial framework enabling non-banking businesses to offer banking products through partnerships with licensed banks via APIs, allowing fintechs and other companies to deliver innovative financial services under their own brand.

Top Banking as a Service Companies in 2025 - BaaS providers allow non-banks to leverage traditional banks' infrastructure via APIs to offer financial services such as account creation and payment processing, enabling companies to create financial products without needing a banking license themselves.

Banking As a Service (BaaS) Explained & Industry Outlook - BaaS platforms open banks' APIs to fintechs and other providers, who pay fees to access these platforms, enabling the development of new banking products and revenue opportunities amid growing open banking trends.

dowidth.com

dowidth.com