Robo advisors leverage advanced algorithms and artificial intelligence to offer cost-effective, automated investment management tailored to individual risk profiles. Mutual fund managers provide active management with personalized expertise, often aiming to outperform market benchmarks through strategic asset selection and market analysis. Explore the key differences between robo advisors and mutual fund managers to determine the best fit for your investment goals.

Why it is important

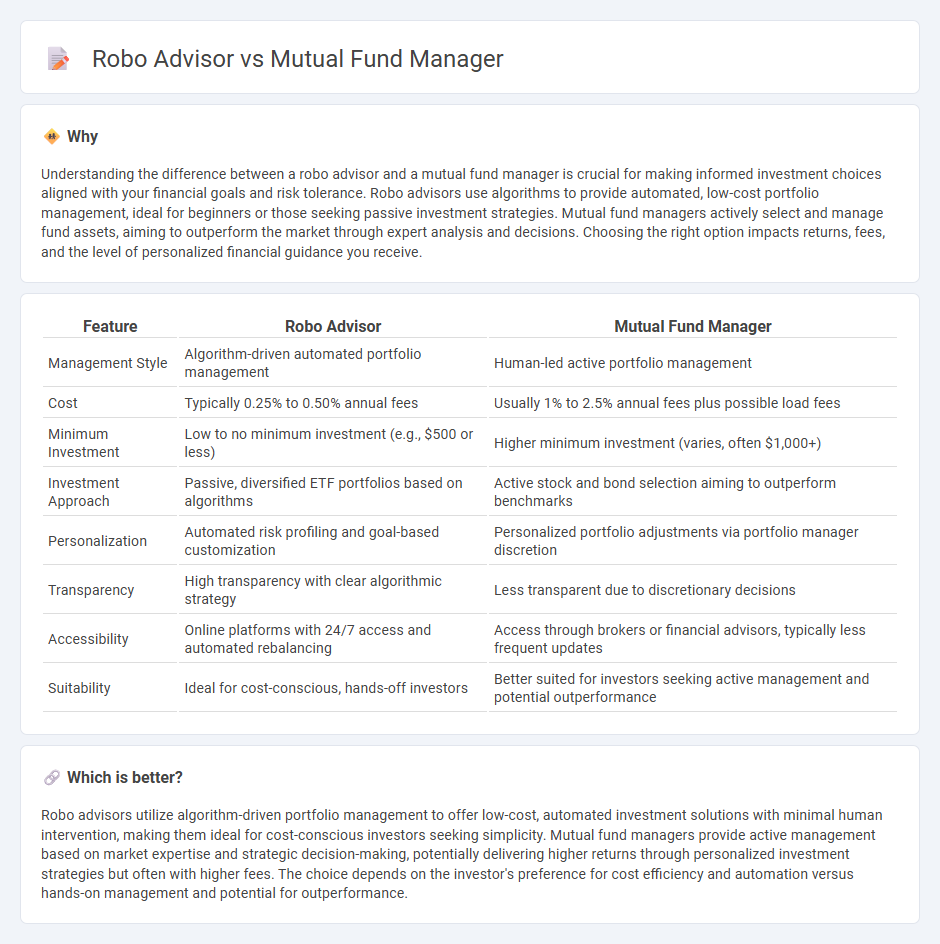

Understanding the difference between a robo advisor and a mutual fund manager is crucial for making informed investment choices aligned with your financial goals and risk tolerance. Robo advisors use algorithms to provide automated, low-cost portfolio management, ideal for beginners or those seeking passive investment strategies. Mutual fund managers actively select and manage fund assets, aiming to outperform the market through expert analysis and decisions. Choosing the right option impacts returns, fees, and the level of personalized financial guidance you receive.

Comparison Table

| Feature | Robo Advisor | Mutual Fund Manager |

|---|---|---|

| Management Style | Algorithm-driven automated portfolio management | Human-led active portfolio management |

| Cost | Typically 0.25% to 0.50% annual fees | Usually 1% to 2.5% annual fees plus possible load fees |

| Minimum Investment | Low to no minimum investment (e.g., $500 or less) | Higher minimum investment (varies, often $1,000+) |

| Investment Approach | Passive, diversified ETF portfolios based on algorithms | Active stock and bond selection aiming to outperform benchmarks |

| Personalization | Automated risk profiling and goal-based customization | Personalized portfolio adjustments via portfolio manager discretion |

| Transparency | High transparency with clear algorithmic strategy | Less transparent due to discretionary decisions |

| Accessibility | Online platforms with 24/7 access and automated rebalancing | Access through brokers or financial advisors, typically less frequent updates |

| Suitability | Ideal for cost-conscious, hands-off investors | Better suited for investors seeking active management and potential outperformance |

Which is better?

Robo advisors utilize algorithm-driven portfolio management to offer low-cost, automated investment solutions with minimal human intervention, making them ideal for cost-conscious investors seeking simplicity. Mutual fund managers provide active management based on market expertise and strategic decision-making, potentially delivering higher returns through personalized investment strategies but often with higher fees. The choice depends on the investor's preference for cost efficiency and automation versus hands-on management and potential for outperformance.

Connection

Robo advisors and mutual fund managers are connected through their reliance on portfolio management algorithms to optimize investment strategies. Robo advisors typically use automated systems to allocate assets in mutual funds based on individual investor risk profiles and financial goals. This integration enhances efficiency and accessibility in mutual fund investing, providing personalized, data-driven financial advice.

Key Terms

Active management

Mutual fund managers employ active management by continuously analyzing market trends and adjusting portfolios to outperform benchmarks, leveraging their expertise and judgment. Robo advisors primarily use algorithm-driven strategies with passive management, focusing on portfolio allocation based on risk tolerance and goals rather than frequent trading. Explore the nuances of active management to understand which option aligns best with your investment style.

Algorithm-based investing

Mutual fund managers rely on professional expertise to actively select and manage investment portfolios, aiming to outperform market benchmarks through market analysis and stock picking. Robo advisors utilize algorithm-based investing, leveraging automated, data-driven models to create diversified portfolios tailored to individual risk profiles with lower fees and continuous rebalancing. Discover more about how algorithm-based investing transforms portfolio management and investor experience.

Expense ratio

Mutual fund managers typically charge higher expense ratios, often ranging from 0.50% to 2.00%, reflecting active management and research costs, while robo advisors offer a lower expense ratio usually between 0.25% and 0.50%, leveraging automated algorithms for portfolio management. Lower expense ratios in robo advisors contribute to cost-efficiency and potential higher net returns over time compared to actively managed mutual funds. Explore detailed comparisons of expense ratios and cost structures to determine the best investment approach for your financial goals.

Source and External Links

Understanding the role of a fund manager in mutual funds - Fund managers are financial professionals who oversee the investment decisions of mutual funds, selecting and managing portfolios to optimize returns and manage risk for investors.

What is Fund Manager - Meaning and Role in Mutual Fund - A mutual fund manager is a financial expert responsible for managing the fund's portfolio, executing investment strategies, and ensuring performance aligns with the fund's stated objectives.

Top Fund Managers in India 2025 - Prominent fund managers in India, such as Sankaran Naren and Sohini Andani, oversee large assets and bring extensive experience to their funds, directly influencing fund performance and investor outcomes.

dowidth.com

dowidth.com