Predictive analytics in banking leverages historical data and machine learning algorithms to forecast customer behaviors, credit risks, and market trends, enhancing decision-making and risk management. Speech analytics processes and analyzes customer voice interactions to identify sentiment, detect fraud, and improve customer service efficiency. Explore the distinct advantages of predictive analytics and speech analytics to transform your banking operations.

Why it is important

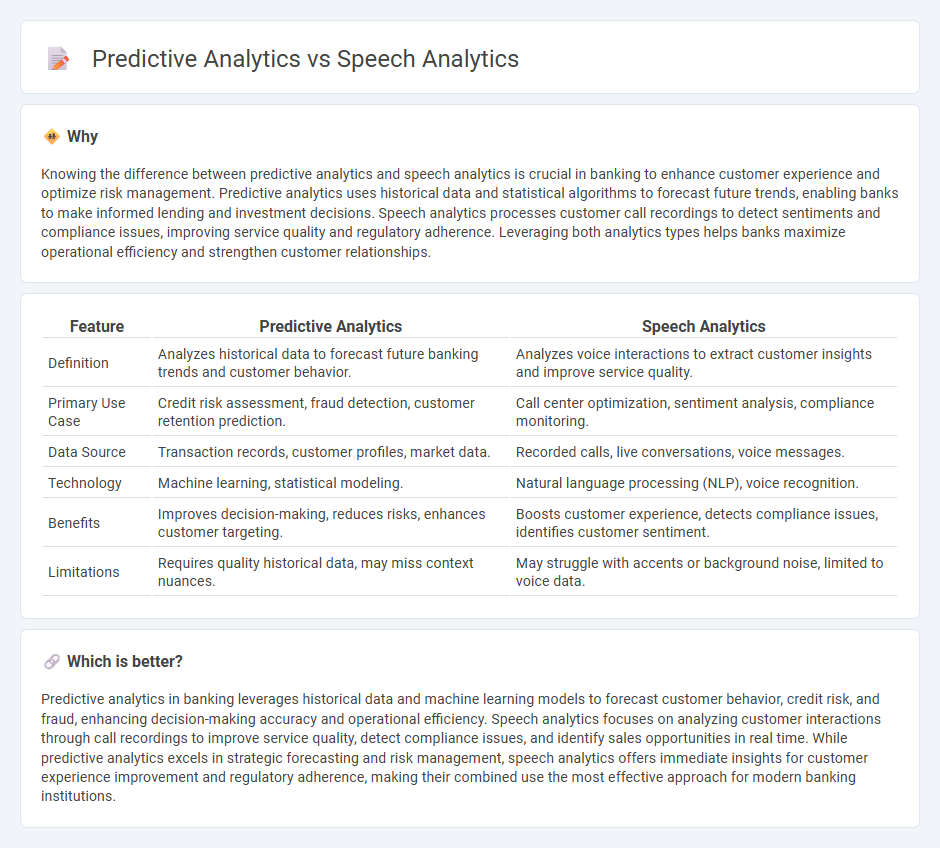

Knowing the difference between predictive analytics and speech analytics is crucial in banking to enhance customer experience and optimize risk management. Predictive analytics uses historical data and statistical algorithms to forecast future trends, enabling banks to make informed lending and investment decisions. Speech analytics processes customer call recordings to detect sentiments and compliance issues, improving service quality and regulatory adherence. Leveraging both analytics types helps banks maximize operational efficiency and strengthen customer relationships.

Comparison Table

| Feature | Predictive Analytics | Speech Analytics |

|---|---|---|

| Definition | Analyzes historical data to forecast future banking trends and customer behavior. | Analyzes voice interactions to extract customer insights and improve service quality. |

| Primary Use Case | Credit risk assessment, fraud detection, customer retention prediction. | Call center optimization, sentiment analysis, compliance monitoring. |

| Data Source | Transaction records, customer profiles, market data. | Recorded calls, live conversations, voice messages. |

| Technology | Machine learning, statistical modeling. | Natural language processing (NLP), voice recognition. |

| Benefits | Improves decision-making, reduces risks, enhances customer targeting. | Boosts customer experience, detects compliance issues, identifies customer sentiment. |

| Limitations | Requires quality historical data, may miss context nuances. | May struggle with accents or background noise, limited to voice data. |

Which is better?

Predictive analytics in banking leverages historical data and machine learning models to forecast customer behavior, credit risk, and fraud, enhancing decision-making accuracy and operational efficiency. Speech analytics focuses on analyzing customer interactions through call recordings to improve service quality, detect compliance issues, and identify sales opportunities in real time. While predictive analytics excels in strategic forecasting and risk management, speech analytics offers immediate insights for customer experience improvement and regulatory adherence, making their combined use the most effective approach for modern banking institutions.

Connection

Predictive analytics in banking leverages historical transaction data and customer behavior patterns to forecast future financial actions and risks. Speech analytics enhances this process by analyzing customer interactions during calls, extracting sentiment and intent that feed into predictive models. This integration enables banks to proactively identify potential defaults, personalize services, and improve customer retention through data-driven insights.

Key Terms

Voice Recognition

Speech analytics leverages voice recognition technology to transcribe and analyze spoken language, extracting insights such as sentiment, keywords, and speaker identification in real time. Predictive analytics, while possibly incorporating voice data, primarily uses historical patterns and machine learning models to forecast future outcomes and trends. Explore how integrating voice recognition enhances predictive capabilities for richer customer engagement insights.

Sentiment Analysis

Speech analytics utilizes advanced natural language processing to extract sentiment from audio data, identifying emotions and customer intent during interactions. Predictive analytics applies historical sentiment data to forecast future customer behavior and trends, improving decision-making and strategy formulation. Explore how combining sentiment analysis in both speech and predictive analytics can enhance your customer experience management.

Risk Scoring

Speech analytics processes and interprets customer conversations to identify patterns and assess risk factors in real-time, enhancing risk scoring accuracy. Predictive analytics leverages historical data and statistical models to forecast risk scores, enabling proactive decision-making based on potential future outcomes. Explore how combining these analytics optimizes risk management and scoring precision.

Source and External Links

What is Speech Analytics? Types, Uses and Benefits - Speech analytics uses AI and natural language processing to process, transcribe, and analyze customer voice interactions, extracting sentiment, compliance data, and performance metrics to generate actionable insights for improving service quality and customer experience.

Speech analytics - Speech analytics analyzes recorded customer calls to uncover information about customer sentiment, behavior, and operational issues, enabling businesses to optimize communication, agent training, and customer service strategies.

What are Speech Analytics? - NiCE - Speech analytics technology converts spoken words into structured data using AI, NLP, and machine learning to extract customer preferences, behavior, and emotions from calls and digital conversations for better customer interaction insights.

dowidth.com

dowidth.com