Regulatory sandboxes provide a controlled environment where fintech startups can test new financial products under regulator supervision without full compliance burdens, accelerating safe market entry. Innovation hubs act as collaborative platforms offering guidance, resources, and direct dialogue between regulators and firms to foster compliance-driven product development. Discover how these frameworks revolutionize banking innovation and regulatory compliance.

Why it is important

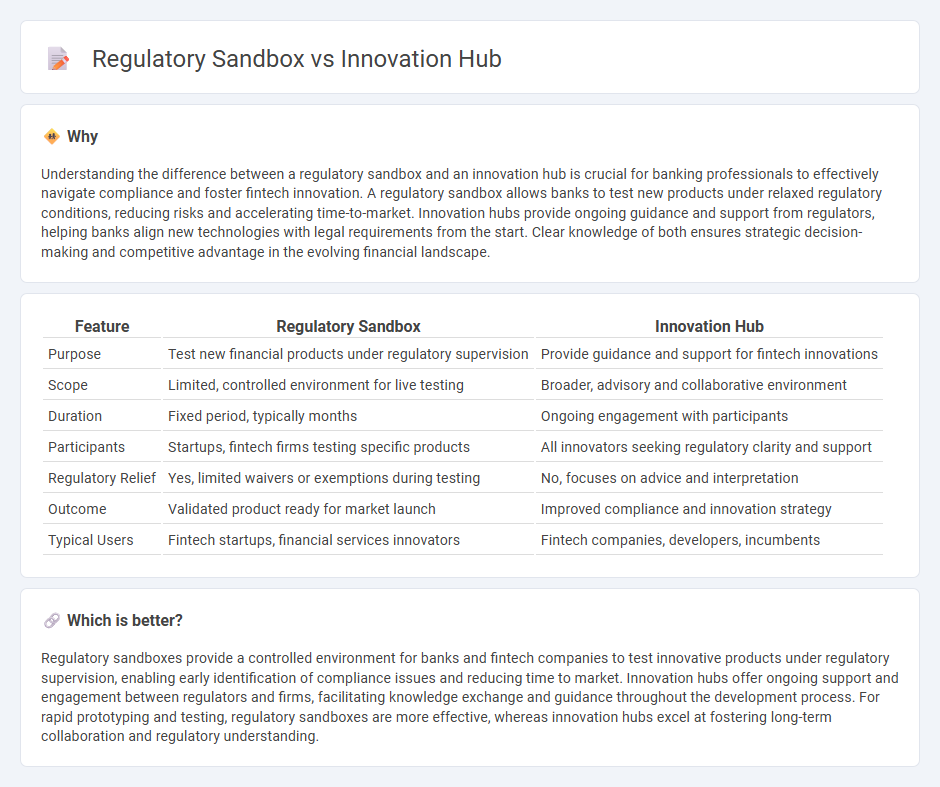

Understanding the difference between a regulatory sandbox and an innovation hub is crucial for banking professionals to effectively navigate compliance and foster fintech innovation. A regulatory sandbox allows banks to test new products under relaxed regulatory conditions, reducing risks and accelerating time-to-market. Innovation hubs provide ongoing guidance and support from regulators, helping banks align new technologies with legal requirements from the start. Clear knowledge of both ensures strategic decision-making and competitive advantage in the evolving financial landscape.

Comparison Table

| Feature | Regulatory Sandbox | Innovation Hub |

|---|---|---|

| Purpose | Test new financial products under regulatory supervision | Provide guidance and support for fintech innovations |

| Scope | Limited, controlled environment for live testing | Broader, advisory and collaborative environment |

| Duration | Fixed period, typically months | Ongoing engagement with participants |

| Participants | Startups, fintech firms testing specific products | All innovators seeking regulatory clarity and support |

| Regulatory Relief | Yes, limited waivers or exemptions during testing | No, focuses on advice and interpretation |

| Outcome | Validated product ready for market launch | Improved compliance and innovation strategy |

| Typical Users | Fintech startups, financial services innovators | Fintech companies, developers, incumbents |

Which is better?

Regulatory sandboxes provide a controlled environment for banks and fintech companies to test innovative products under regulatory supervision, enabling early identification of compliance issues and reducing time to market. Innovation hubs offer ongoing support and engagement between regulators and firms, facilitating knowledge exchange and guidance throughout the development process. For rapid prototyping and testing, regulatory sandboxes are more effective, whereas innovation hubs excel at fostering long-term collaboration and regulatory understanding.

Connection

Regulatory sandboxes and innovation hubs both foster financial technology advancements by providing controlled environments for testing new banking products and services. Sandboxes allow startups and banks to experiment with real-world applications under regulatory supervision, minimizing risks while innovation hubs offer resources, mentorship, and collaboration opportunities to accelerate development. Together, they bridge regulatory compliance with cutting-edge banking innovations, driving sector growth and customer-centric solutions.

Key Terms

Innovation Hub:

An Innovation Hub provides a collaborative environment where startups, financial institutions, and regulators work together to test new financial technologies in a controlled setting, facilitating real-time feedback and regulatory guidance. Unlike a Regulatory Sandbox, which typically limits testing to specific products or services within a predefined timeframe, an Innovation Hub offers ongoing support and broader engagement to nurture innovation across multiple domains. Discover how an Innovation Hub can accelerate the development and adoption of cutting-edge fintech solutions.

Fintech Support

Innovation hubs and regulatory sandboxes both play crucial roles in fintech support, with innovation hubs providing a collaborative space for startups to access resources, mentorship, and networking opportunities. Regulatory sandboxes offer a controlled environment for fintech companies to test new products and services under regulatory supervision, reducing risks and ensuring compliance. Explore the unique benefits and applications of innovation hubs and regulatory sandboxes in advancing fintech innovation.

Collaboration Platform

An innovation hub serves as a collaborative platform where startups, corporates, and regulators co-develop solutions, fostering an ecosystem for joint innovation and knowledge sharing. A regulatory sandbox, by contrast, allows companies to test new products or services in a controlled environment under regulatory supervision, emphasizing risk management and compliance validation. Explore more about how these platforms drive industry transformation and regulatory evolution.

Source and External Links

Innovation Hub: Home - Riverside - A dynamic initiative that unifies and strengthens entrepreneurial support organizations, accelerators, and incubators to empower high-potential ventures with resources to accelerate product development, secure capital, and reach markets, especially in Inland Southern California.

Regional Technology and Innovation Hubs (Tech Hubs) - A federal program investing $10 billion over five years to transform U.S. regions into globally competitive innovation centers, fostering technology development and good jobs under the CHIPS and Science Act of 2022.

Innovation Hub index - A university-based hub at California State University, San Marcos, providing prototyping equipment, fostering collaboration, and supporting student innovation, entrepreneurship, and community engagement through events and resources.

dowidth.com

dowidth.com