Digital identity verification leverages biometric data and encrypted digital credentials to ensure rapid and secure customer authentication, significantly reducing fraud risk in banking transactions. Knowledge-based authentication (KBA) relies on users answering personal questions derived from credit reports or previous transactions, a method increasingly vulnerable to data breaches and identity theft. Explore how innovative digital identity solutions transform banking security and customer experience.

Why it is important

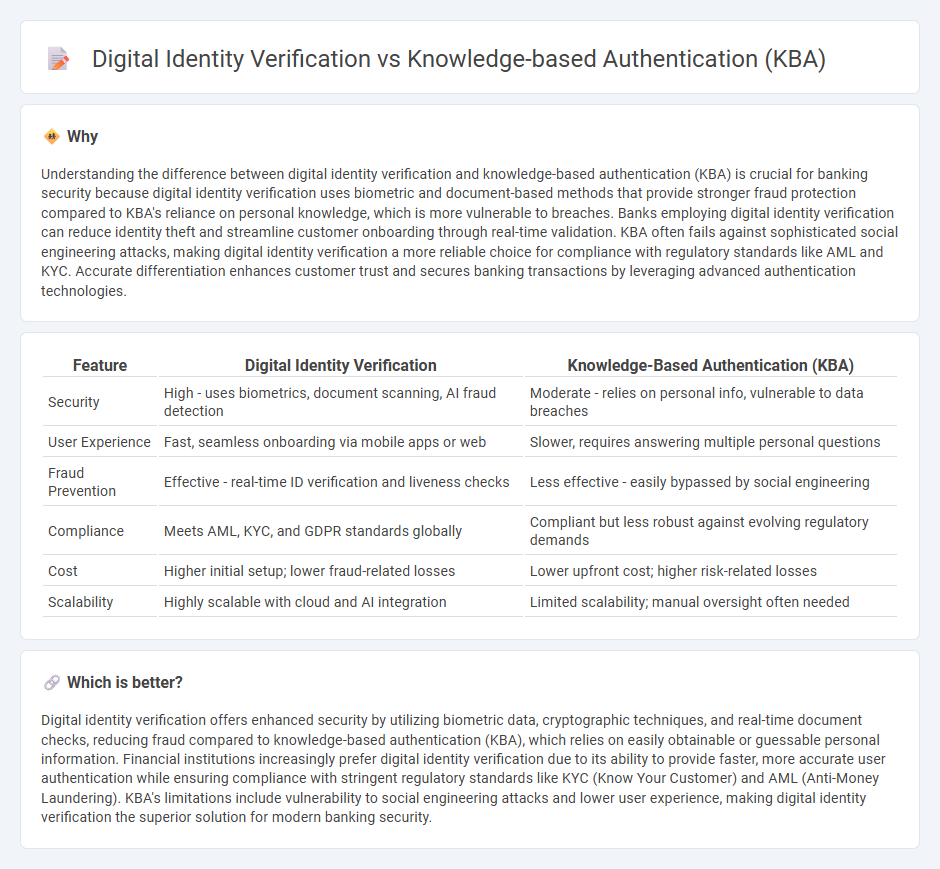

Understanding the difference between digital identity verification and knowledge-based authentication (KBA) is crucial for banking security because digital identity verification uses biometric and document-based methods that provide stronger fraud protection compared to KBA's reliance on personal knowledge, which is more vulnerable to breaches. Banks employing digital identity verification can reduce identity theft and streamline customer onboarding through real-time validation. KBA often fails against sophisticated social engineering attacks, making digital identity verification a more reliable choice for compliance with regulatory standards like AML and KYC. Accurate differentiation enhances customer trust and secures banking transactions by leveraging advanced authentication technologies.

Comparison Table

| Feature | Digital Identity Verification | Knowledge-Based Authentication (KBA) |

|---|---|---|

| Security | High - uses biometrics, document scanning, AI fraud detection | Moderate - relies on personal info, vulnerable to data breaches |

| User Experience | Fast, seamless onboarding via mobile apps or web | Slower, requires answering multiple personal questions |

| Fraud Prevention | Effective - real-time ID verification and liveness checks | Less effective - easily bypassed by social engineering |

| Compliance | Meets AML, KYC, and GDPR standards globally | Compliant but less robust against evolving regulatory demands |

| Cost | Higher initial setup; lower fraud-related losses | Lower upfront cost; higher risk-related losses |

| Scalability | Highly scalable with cloud and AI integration | Limited scalability; manual oversight often needed |

Which is better?

Digital identity verification offers enhanced security by utilizing biometric data, cryptographic techniques, and real-time document checks, reducing fraud compared to knowledge-based authentication (KBA), which relies on easily obtainable or guessable personal information. Financial institutions increasingly prefer digital identity verification due to its ability to provide faster, more accurate user authentication while ensuring compliance with stringent regulatory standards like KYC (Know Your Customer) and AML (Anti-Money Laundering). KBA's limitations include vulnerability to social engineering attacks and lower user experience, making digital identity verification the superior solution for modern banking security.

Connection

Digital identity verification enhances banking security by confirming customer identities using biometric data, government-issued IDs, and real-time document analysis. Knowledge-based authentication (KBA) supplements this process by requiring users to answer personalized security questions derived from their private information, adding an extra layer of fraud prevention. Together, these technologies reduce identity theft risks and streamline compliance with regulatory standards such as KYC (Know Your Customer) and AML (Anti-Money Laundering).

Key Terms

Security Questions (KBA)

Security questions in knowledge-based authentication (KBA) rely on personal information that users must recall, making them vulnerable to data breaches and social engineering attacks. Digital identity verification employs biometric data, document scanning, and database cross-referencing to provide a more secure and reliable method of authentication. Explore the advancements in digital identity verification to enhance your security protocols.

Biometric Authentication (Digital Identity Verification)

Knowledge-based authentication (KBA) relies on users answering personal questions to confirm identity, often vulnerable to social engineering and data breaches. Digital identity verification, especially biometric authentication, uses unique physical traits like fingerprints or facial recognition to provide highly secure and fraud-resistant access control. Explore more about how biometric authentication revolutionizes digital security protocols and user experience.

Document Verification (Digital Identity Verification)

Document verification in digital identity verification uses advanced OCR technology and AI-driven analysis to authenticate identity documents, ensuring accuracy and reducing fraud risks. Knowledge-based authentication (KBA) relies on user-provided answers to personal questions, which can be vulnerable to social engineering and data breaches. Explore more to understand the benefits of integrating document verification in enhancing secure digital identity solutions.

Source and External Links

Knowledge based authentication (KBA) - SailPoint - KBA is a user verification method requiring answers to secret questions known only to the user, with two types: static KBA (pre-set personal questions) and dynamic KBA (real-time generated questions from personal data), commonly used in MFA and password recovery processes.

Knowledge-based authentication (KBA) [explanation and examples] - Incognia - KBA authenticates users by posing knowledge questions that only the true owner of an account should answer, categorized into static and dynamic KBA based on the specificity and source of the questions.

Knowledge-based authentication - Wikipedia - KBA verifies identity using private information, either static (pre-agreed shared secrets) or dynamic (questions from broader personal data), though static KBA has weaknesses like susceptibility to social engineering and publicly available personal info.

dowidth.com

dowidth.com