Virtual cards provide secure, temporary payment details for online transactions, reducing exposure to fraud by generating unique numbers linked to your main account. Prepaid cards offer a fixed spending limit by loading funds in advance, making them ideal for budgeting and controlled expenses without requiring a credit check. Explore the benefits and differences between virtual and prepaid cards to choose the best option for your financial needs.

Why it is important

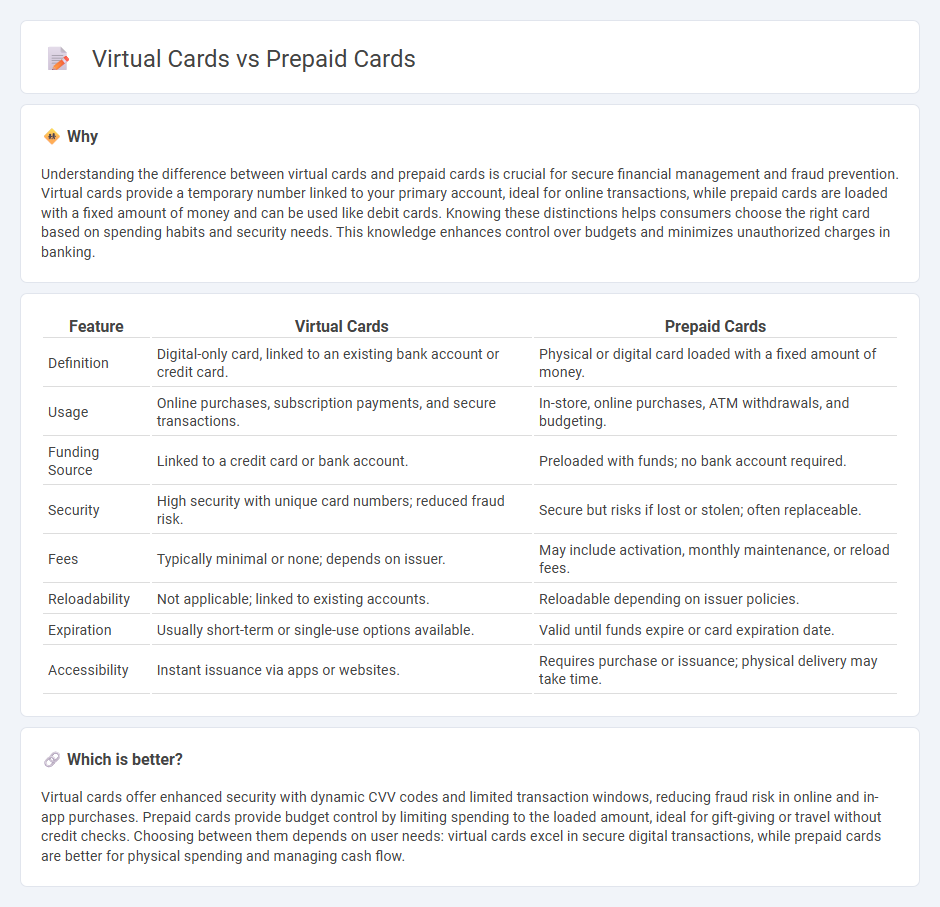

Understanding the difference between virtual cards and prepaid cards is crucial for secure financial management and fraud prevention. Virtual cards provide a temporary number linked to your primary account, ideal for online transactions, while prepaid cards are loaded with a fixed amount of money and can be used like debit cards. Knowing these distinctions helps consumers choose the right card based on spending habits and security needs. This knowledge enhances control over budgets and minimizes unauthorized charges in banking.

Comparison Table

| Feature | Virtual Cards | Prepaid Cards |

|---|---|---|

| Definition | Digital-only card, linked to an existing bank account or credit card. | Physical or digital card loaded with a fixed amount of money. |

| Usage | Online purchases, subscription payments, and secure transactions. | In-store, online purchases, ATM withdrawals, and budgeting. |

| Funding Source | Linked to a credit card or bank account. | Preloaded with funds; no bank account required. |

| Security | High security with unique card numbers; reduced fraud risk. | Secure but risks if lost or stolen; often replaceable. |

| Fees | Typically minimal or none; depends on issuer. | May include activation, monthly maintenance, or reload fees. |

| Reloadability | Not applicable; linked to existing accounts. | Reloadable depending on issuer policies. |

| Expiration | Usually short-term or single-use options available. | Valid until funds expire or card expiration date. |

| Accessibility | Instant issuance via apps or websites. | Requires purchase or issuance; physical delivery may take time. |

Which is better?

Virtual cards offer enhanced security with dynamic CVV codes and limited transaction windows, reducing fraud risk in online and in-app purchases. Prepaid cards provide budget control by limiting spending to the loaded amount, ideal for gift-giving or travel without credit checks. Choosing between them depends on user needs: virtual cards excel in secure digital transactions, while prepaid cards are better for physical spending and managing cash flow.

Connection

Virtual cards and prepaid cards are connected through their shared use of prepaid funds for secure and controlled spending. Virtual cards generate disposable card numbers linked to an underlying prepaid balance, enhancing fraud protection in online transactions. Both card types enable users to manage budgets effectively without exposing primary bank account details.

Key Terms

Funding mechanism

Prepaid cards require users to load funds in advance through cash deposits, bank transfers, or retail locations, providing a fixed spending limit based on the funded amount. Virtual cards are typically linked directly to a primary funding source like a bank account or credit line, enabling real-time authorization without the need to preload funds. Explore the detailed differences in funding mechanisms to choose the best payment solution for your needs.

Physical presence

Prepaid cards require physical handling and can be used in-store or at ATMs, offering tangible access to funds. Virtual cards, generated digitally, lack physical form but provide enhanced security for online transactions and can be created instantly for temporary use. Explore deeper differences in usability and security features to find the best option for your financial needs.

Security features

Prepaid cards provide enhanced security by limiting expenditures to a prepaid amount, reducing the risk of overspending and unauthorized credit impact. Virtual cards offer superior protection through unique, temporary card numbers that minimize exposure to fraud during online transactions. Explore detailed comparisons to understand which option best suits your security needs.

Source and External Links

Visa Prepaid Cards - A reloadable card usable for in-person and online purchases, bill payments, and adding funds, requiring no credit check and protecting against overdraft fees by only allowing spending up to the loaded balance.

Mastercard Prepaid Cards - Versatile cards accepted wherever Mastercard is used, offering secure digital experiences and access to wages or benefits without a bank account or credit check.

GO Prepaid Card | Navy Federal Credit Union - A flexible prepaid card for families and individuals to budget, control spending, track purchases, and manage up to five cardholders, with mobile app support and zero liability for lost or stolen cards.

dowidth.com

dowidth.com