Credit builder cards are designed to help individuals establish or improve their personal credit profiles with manageable credit limits and regular reporting to credit bureaus. Business credit cards, on the other hand, cater to the financial needs of companies by offering higher credit limits, expense tracking, and rewards tailored for business spending. Explore the key differences and benefits to determine which credit card aligns best with your financial goals.

Why it is important

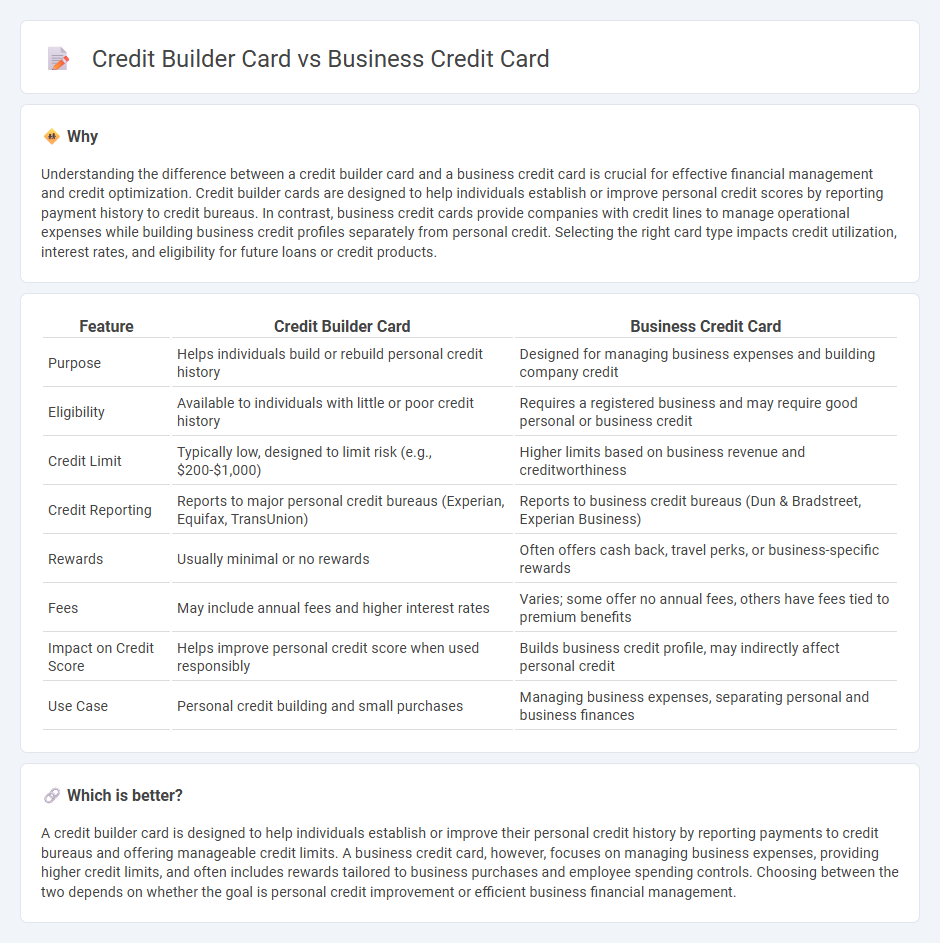

Understanding the difference between a credit builder card and a business credit card is crucial for effective financial management and credit optimization. Credit builder cards are designed to help individuals establish or improve personal credit scores by reporting payment history to credit bureaus. In contrast, business credit cards provide companies with credit lines to manage operational expenses while building business credit profiles separately from personal credit. Selecting the right card type impacts credit utilization, interest rates, and eligibility for future loans or credit products.

Comparison Table

| Feature | Credit Builder Card | Business Credit Card |

|---|---|---|

| Purpose | Helps individuals build or rebuild personal credit history | Designed for managing business expenses and building company credit |

| Eligibility | Available to individuals with little or poor credit history | Requires a registered business and may require good personal or business credit |

| Credit Limit | Typically low, designed to limit risk (e.g., $200-$1,000) | Higher limits based on business revenue and creditworthiness |

| Credit Reporting | Reports to major personal credit bureaus (Experian, Equifax, TransUnion) | Reports to business credit bureaus (Dun & Bradstreet, Experian Business) |

| Rewards | Usually minimal or no rewards | Often offers cash back, travel perks, or business-specific rewards |

| Fees | May include annual fees and higher interest rates | Varies; some offer no annual fees, others have fees tied to premium benefits |

| Impact on Credit Score | Helps improve personal credit score when used responsibly | Builds business credit profile, may indirectly affect personal credit |

| Use Case | Personal credit building and small purchases | Managing business expenses, separating personal and business finances |

Which is better?

A credit builder card is designed to help individuals establish or improve their personal credit history by reporting payments to credit bureaus and offering manageable credit limits. A business credit card, however, focuses on managing business expenses, providing higher credit limits, and often includes rewards tailored to business purchases and employee spending controls. Choosing between the two depends on whether the goal is personal credit improvement or efficient business financial management.

Connection

Credit builder cards and business credit cards are connected through their role in establishing and improving credit profiles; credit builder cards focus on individuals' creditworthiness, while business credit cards enhance the financial credibility of a company. Both types of cards report payment activity to credit bureaus, which helps build credit history essential for accessing larger loans or better financing options. Small business owners often use credit builder cards to personally establish credit before qualifying for business credit cards that support business expenses and cash flow management.

Key Terms

Credit Limit

Business credit cards typically offer higher credit limits to accommodate larger expenses and cash flow needs, often starting from $5,000 or more depending on the business's financial health. Credit builder cards usually provide lower limits, often between $200 and $1,000, designed to help individuals establish or improve their credit profiles gradually. Explore in-depth comparisons to find the card that best aligns with your credit goals and financial requirements.

Interest Rate

Business credit cards typically offer lower interest rates compared to credit builder cards, which often have higher rates to offset the increased risk of lending to individuals with limited credit history. Interest rates on business credit cards can range from 12% to 20% APR, while credit builder cards may have rates upwards of 20% to 30% APR. Explore more to understand how interest rates impact your choice between business credit cards and credit builder cards.

Credit Reporting

Business credit cards report activity to major commercial credit bureaus such as Dun & Bradstreet, Experian Business, and Equifax Small Business, helping build a company's business credit profile. Credit builder cards primarily report to personal credit bureaus like Experian, Equifax, and TransUnion, which assists individuals in improving their personal credit scores. Explore further to understand how each card impacts credit reporting and benefits your financial goals.

Source and External Links

Small Business Credit Cards - Apply Online - PNC Bank - Offers a variety of business credit cards, including cash rewards and travel benefits with options like the PNC Cash Rewards Visa Signature Business Credit Card.

Business Credit Cards - Nav - Provides customized business credit card options from trusted partners, helping businesses find the right card according to their needs.

Business Credit Cards | Wells Fargo - Offers rewards for business purchases, including supplies and equipment, with benefits like cash rewards and travel options.

dowidth.com

dowidth.com