Neobanks leverage digital platforms to offer streamlined banking services with lower fees and enhanced user experiences, targeting tech-savvy customers seeking convenience and innovation. Credit unions operate as member-owned, not-for-profit institutions focused on community engagement, providing personalized financial products often with better interest rates and customer support. Discover how each institution uniquely serves your financial needs and which aligns best with your goals.

Why it is important

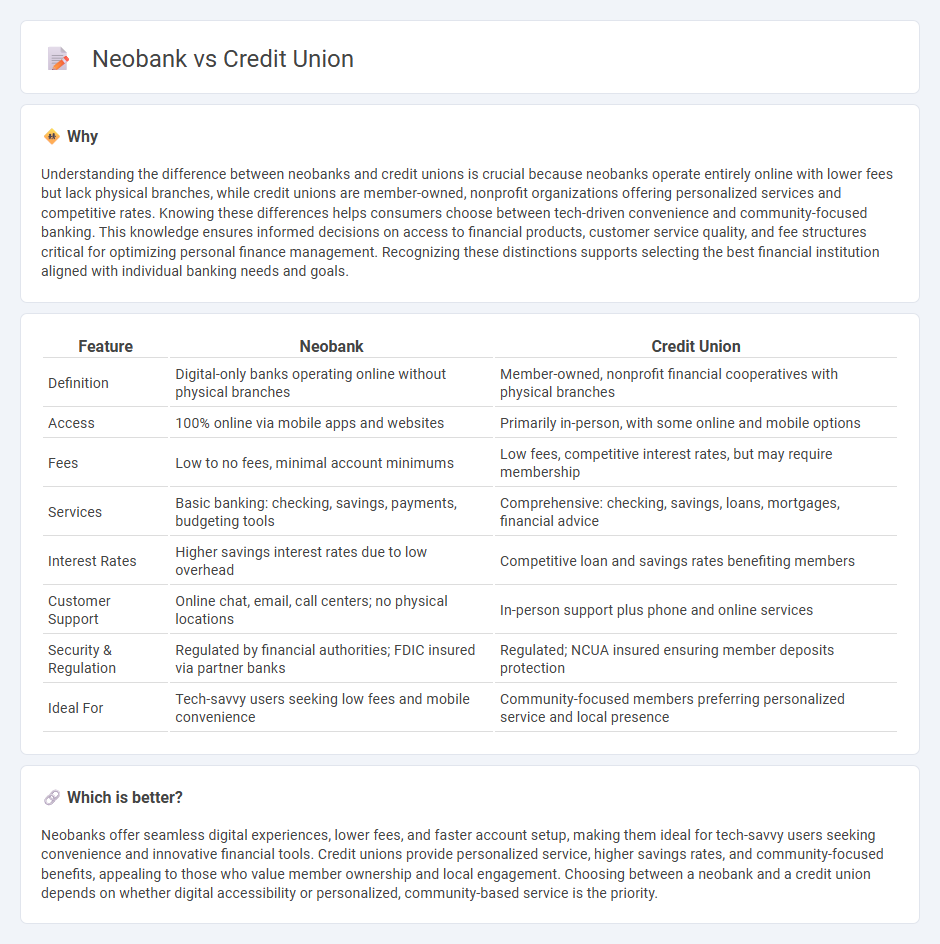

Understanding the difference between neobanks and credit unions is crucial because neobanks operate entirely online with lower fees but lack physical branches, while credit unions are member-owned, nonprofit organizations offering personalized services and competitive rates. Knowing these differences helps consumers choose between tech-driven convenience and community-focused banking. This knowledge ensures informed decisions on access to financial products, customer service quality, and fee structures critical for optimizing personal finance management. Recognizing these distinctions supports selecting the best financial institution aligned with individual banking needs and goals.

Comparison Table

| Feature | Neobank | Credit Union |

|---|---|---|

| Definition | Digital-only banks operating online without physical branches | Member-owned, nonprofit financial cooperatives with physical branches |

| Access | 100% online via mobile apps and websites | Primarily in-person, with some online and mobile options |

| Fees | Low to no fees, minimal account minimums | Low fees, competitive interest rates, but may require membership |

| Services | Basic banking: checking, savings, payments, budgeting tools | Comprehensive: checking, savings, loans, mortgages, financial advice |

| Interest Rates | Higher savings interest rates due to low overhead | Competitive loan and savings rates benefiting members |

| Customer Support | Online chat, email, call centers; no physical locations | In-person support plus phone and online services |

| Security & Regulation | Regulated by financial authorities; FDIC insured via partner banks | Regulated; NCUA insured ensuring member deposits protection |

| Ideal For | Tech-savvy users seeking low fees and mobile convenience | Community-focused members preferring personalized service and local presence |

Which is better?

Neobanks offer seamless digital experiences, lower fees, and faster account setup, making them ideal for tech-savvy users seeking convenience and innovative financial tools. Credit unions provide personalized service, higher savings rates, and community-focused benefits, appealing to those who value member ownership and local engagement. Choosing between a neobank and a credit union depends on whether digital accessibility or personalized, community-based service is the priority.

Connection

Neobanks and credit unions both serve as financial institutions that provide banking services, with a focus on customer-centric and technology-driven solutions. Neobanks leverage digital platforms to offer streamlined services, while credit unions emphasize member ownership and community-oriented financial support. Their connection lies in the shared goal of improving access to affordable, efficient banking alternatives compared to traditional banks.

Key Terms

Membership

Credit unions require membership based on specific eligibility criteria such as geographic location, employer, or association affiliation, fostering a community-focused financial environment. Neobanks, on the other hand, typically have no membership restrictions, offering digital-first services accessible to a broader audience without traditional membership requirements. Explore the distinct membership advantages between credit unions and neobanks to find the best fit for your financial needs.

Digital-only

Credit unions traditionally offer personalized financial services with physical branches, while neobanks operate entirely online, providing digital-only banking solutions with seamless mobile app experiences and lower fees. Neobanks leverage cutting-edge technology to deliver real-time transactions, AI-driven budgeting tools, and instant customer support without the overhead of brick-and-mortar locations. Explore how digital-only neobanks are reshaping the banking landscape and what this means for your financial future.

Not-for-profit

Credit unions operate as not-for-profit financial cooperatives, prioritizing member benefits and reinvesting earnings into improved services and lower fees, whereas neobanks are typically for-profit digital-only institutions aiming to maximize shareholder value. The not-for-profit status of credit unions fosters a community-focused approach, often resulting in more personalized customer service and competitive interest rates on loans and savings. Explore how these fundamental differences impact your financial choices and membership benefits.

Source and External Links

What is a Credit Union? - MyCreditUnion.gov - A credit union is a not-for-profit financial institution owned and controlled by its members, offering banking services like deposits and loans with member benefits such as reduced fees and better rates due to its cooperative structure.

Welcome to Service Credit Union - Banking Services - Service Credit Union provides a wide range of services including savings, checking, auto and personal loans, credit cards, mortgages, and online banking with competitive rates and rewards programs.

First New York Federal Credit Union - This credit union offers banking, lending, and investment services primarily serving members in New York's Capital Region with a member-focused approach.

dowidth.com

dowidth.com