Alternative credit data encompasses non-traditional financial information such as utility payments, rental history, and employment records, providing lenders with a broader view of a borrower's creditworthiness. Social media data, capturing behavioral patterns and social interactions, offers innovative yet privacy-sensitive insights that can complement traditional credit evaluations. Explore how integrating these data sources transforms risk assessment and lending decisions in modern banking.

Why it is important

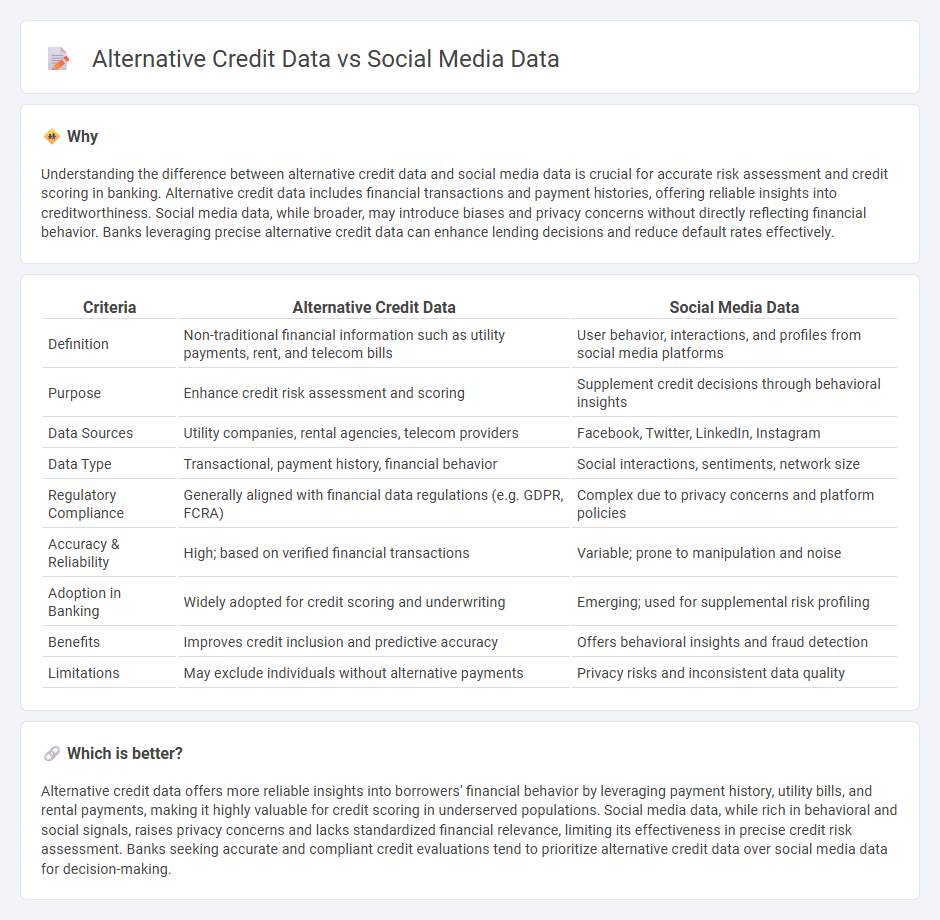

Understanding the difference between alternative credit data and social media data is crucial for accurate risk assessment and credit scoring in banking. Alternative credit data includes financial transactions and payment histories, offering reliable insights into creditworthiness. Social media data, while broader, may introduce biases and privacy concerns without directly reflecting financial behavior. Banks leveraging precise alternative credit data can enhance lending decisions and reduce default rates effectively.

Comparison Table

| Criteria | Alternative Credit Data | Social Media Data |

|---|---|---|

| Definition | Non-traditional financial information such as utility payments, rent, and telecom bills | User behavior, interactions, and profiles from social media platforms |

| Purpose | Enhance credit risk assessment and scoring | Supplement credit decisions through behavioral insights |

| Data Sources | Utility companies, rental agencies, telecom providers | Facebook, Twitter, LinkedIn, Instagram |

| Data Type | Transactional, payment history, financial behavior | Social interactions, sentiments, network size |

| Regulatory Compliance | Generally aligned with financial data regulations (e.g. GDPR, FCRA) | Complex due to privacy concerns and platform policies |

| Accuracy & Reliability | High; based on verified financial transactions | Variable; prone to manipulation and noise |

| Adoption in Banking | Widely adopted for credit scoring and underwriting | Emerging; used for supplemental risk profiling |

| Benefits | Improves credit inclusion and predictive accuracy | Offers behavioral insights and fraud detection |

| Limitations | May exclude individuals without alternative payments | Privacy risks and inconsistent data quality |

Which is better?

Alternative credit data offers more reliable insights into borrowers' financial behavior by leveraging payment history, utility bills, and rental payments, making it highly valuable for credit scoring in underserved populations. Social media data, while rich in behavioral and social signals, raises privacy concerns and lacks standardized financial relevance, limiting its effectiveness in precise credit risk assessment. Banks seeking accurate and compliant credit evaluations tend to prioritize alternative credit data over social media data for decision-making.

Connection

Alternative credit data, including utility payments and rental history, complements traditional credit reports by providing a broader view of a borrower's financial behavior. Social media data offers insights into customer preferences, spending habits, and lifestyle patterns, which can enhance credit risk assessment models. Integrating these data sources enables banks to improve credit scoring accuracy and expand financial inclusion for underbanked populations.

Key Terms

Digital Footprint

Social media data captures user behavior, interests, and interactions, providing dynamic insights into creditworthiness through digital footprints such as posts, likes, and network connections. Alternative credit data extends beyond traditional financial records by utilizing digital footprint elements like social media activity to assess risk, often improving inclusivity for underserved populations. Explore the comparative benefits of social media and alternative credit data to optimize credit scoring models.

Non-traditional Data Sources

Social media data provides real-time insights into consumer behavior and social interactions, offering valuable signals for credit risk assessment beyond traditional financial records. Alternative credit data, including utility payments, rental history, and mobile phone usage, expands creditworthiness evaluation to individuals with limited credit history. Explore how leveraging these non-traditional data sources can enhance credit decision models and financial inclusion.

Credit Scoring Models

Social media data provides insights into user behavior, network connections, and online interactions, which can enhance credit scoring models by revealing non-traditional risk indicators. Alternative credit data includes utility payments, rental history, and digital financial transactions, offering a broader financial picture for individuals lacking conventional credit history. Explore how integrating these diverse data sources can improve credit risk assessments and financial inclusion.

Source and External Links

The What, Why, and How of Social Media Data - Social media data refers to raw insights collected from user interactions on platforms like LinkedIn, Facebook, and X, measuring metrics such as engagement rate, reach, sentiment, and follower demographics to assess marketing performance and competitor analysis.

What Is Social Media Data? (Plus How To Use It) - Social media data captures user behavior on networks and is used for business insights like audience segmentation, lead nurturing, sales outreach, and content creation to tailor marketing strategies.

Social Media Analytics: Everything You Need to Know - Social media analytics goes beyond counting likes and shares, providing deeper insights into customer sentiment, product popularity, and brand reputation through analysis of collected social media data and social listening.

dowidth.com

dowidth.com