Cloud core banking platforms provide financial institutions with scalable, flexible infrastructure allowing real-time transaction processing and seamless integration of banking services. Open banking platforms enable secure data sharing through APIs, fostering innovation by connecting third-party developers with banks to create personalized financial products. Explore how these technologies reshape banking efficiency and customer experience in the digital era.

Why it is important

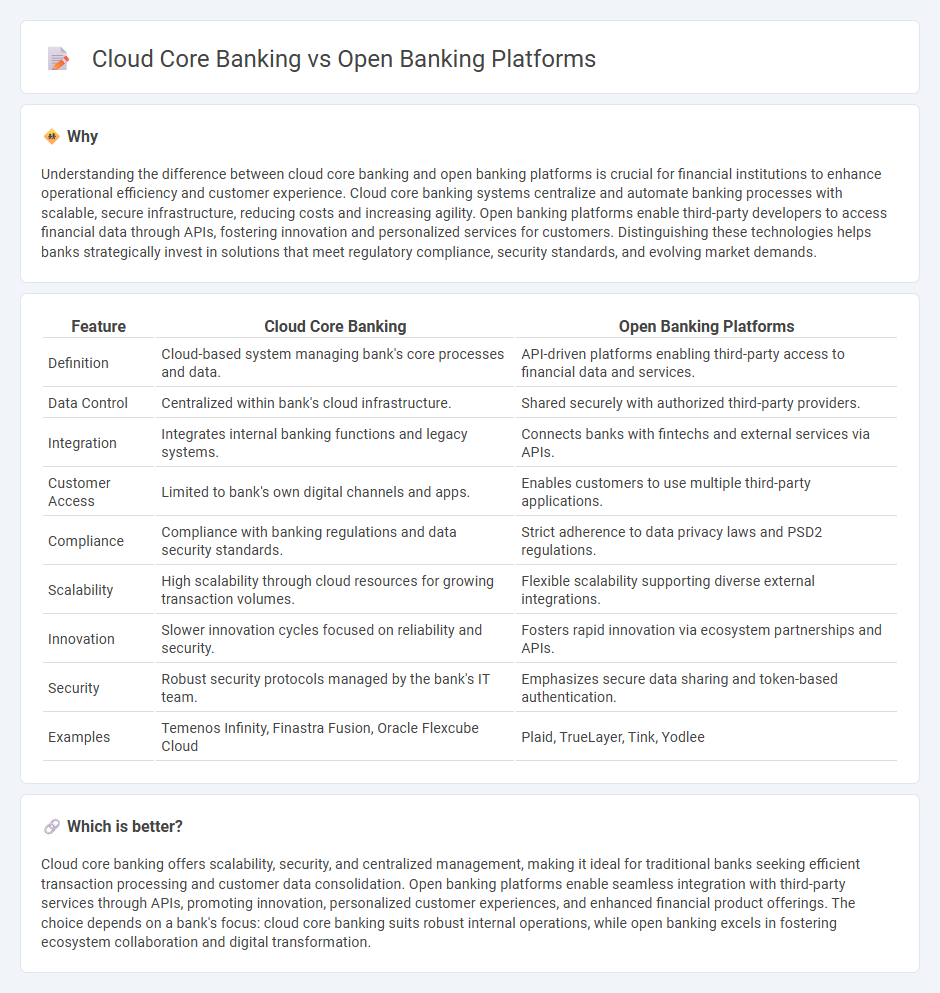

Understanding the difference between cloud core banking and open banking platforms is crucial for financial institutions to enhance operational efficiency and customer experience. Cloud core banking systems centralize and automate banking processes with scalable, secure infrastructure, reducing costs and increasing agility. Open banking platforms enable third-party developers to access financial data through APIs, fostering innovation and personalized services for customers. Distinguishing these technologies helps banks strategically invest in solutions that meet regulatory compliance, security standards, and evolving market demands.

Comparison Table

| Feature | Cloud Core Banking | Open Banking Platforms |

|---|---|---|

| Definition | Cloud-based system managing bank's core processes and data. | API-driven platforms enabling third-party access to financial data and services. |

| Data Control | Centralized within bank's cloud infrastructure. | Shared securely with authorized third-party providers. |

| Integration | Integrates internal banking functions and legacy systems. | Connects banks with fintechs and external services via APIs. |

| Customer Access | Limited to bank's own digital channels and apps. | Enables customers to use multiple third-party applications. |

| Compliance | Compliance with banking regulations and data security standards. | Strict adherence to data privacy laws and PSD2 regulations. |

| Scalability | High scalability through cloud resources for growing transaction volumes. | Flexible scalability supporting diverse external integrations. |

| Innovation | Slower innovation cycles focused on reliability and security. | Fosters rapid innovation via ecosystem partnerships and APIs. |

| Security | Robust security protocols managed by the bank's IT team. | Emphasizes secure data sharing and token-based authentication. |

| Examples | Temenos Infinity, Finastra Fusion, Oracle Flexcube Cloud | Plaid, TrueLayer, Tink, Yodlee |

Which is better?

Cloud core banking offers scalability, security, and centralized management, making it ideal for traditional banks seeking efficient transaction processing and customer data consolidation. Open banking platforms enable seamless integration with third-party services through APIs, promoting innovation, personalized customer experiences, and enhanced financial product offerings. The choice depends on a bank's focus: cloud core banking suits robust internal operations, while open banking excels in fostering ecosystem collaboration and digital transformation.

Connection

Cloud core banking systems provide scalable, real-time processing of financial transactions and data storage, while open banking platforms enable secure third-party access to customer financial information through APIs. This integration fosters seamless interoperability between banks and fintech companies, driving innovation, enhanced customer experiences, and improved data analytics. Combining cloud core banking with open banking platforms accelerates digital transformation in financial services by promoting agility, cost-efficiency, and regulatory compliance.

Key Terms

**Open Banking Platforms:**

Open banking platforms enable seamless integration of third-party financial services through secure APIs, enhancing customer experience and fostering innovation within the banking ecosystem. These platforms prioritize data sharing, compliance with PSD2 regulations, and real-time access to financial data, distinguishing them from traditional cloud core banking systems that focus primarily on back-end operations. Explore the latest advancements in open banking to understand how these platforms transform digital banking services.

API (Application Programming Interface)

Open banking platforms leverage APIs to enable third-party developers to access financial data securely, fostering innovation and personalized financial services through seamless integration. Cloud core banking systems utilize APIs to enhance scalability, agility, and real-time data processing, streamlining backend operations and improving customer experiences. Explore how API-driven strategies transform financial technology by diving deeper into the differences and synergies between open banking and cloud core banking solutions.

Third-Party Providers (TPPs)

Open banking platforms prioritize seamless integration with Third-Party Providers (TPPs) through standardized APIs, enhancing data sharing and customer-centric services, while cloud core banking systems focus on scalable, flexible infrastructure to support core financial operations. TPPs leverage open banking platforms to innovate payment solutions, account aggregation, and personalized banking, whereas cloud core systems ensure robust security and compliance for these integrations. Explore the evolving dynamics between open banking and cloud core banking to understand how TPPs drive financial technology advancements.

Source and External Links

Basiq - Provides Australia's leading Open Banking API platform, enabling developers to access customer financial data for innovative financial solutions.

Tink - Offers a European open banking platform with over 6000 connections to banks and institutions, providing enriched financial data and payment services.

Yapily - ONE of Europe's leading open banking infrastructure platforms, connecting customers to thousands of banks across Europe for financial data access and payment initiation.

dowidth.com

dowidth.com