Neo brokerages offer streamlined trading with low fees and direct market access, appealing to active investors seeking control over their portfolios. Micro-investing platforms enable gradual portfolio growth through small, automated contributions, ideal for beginners aiming to build wealth with minimal risk. Explore how these innovative financial tools can shape your investment strategy.

Why it is important

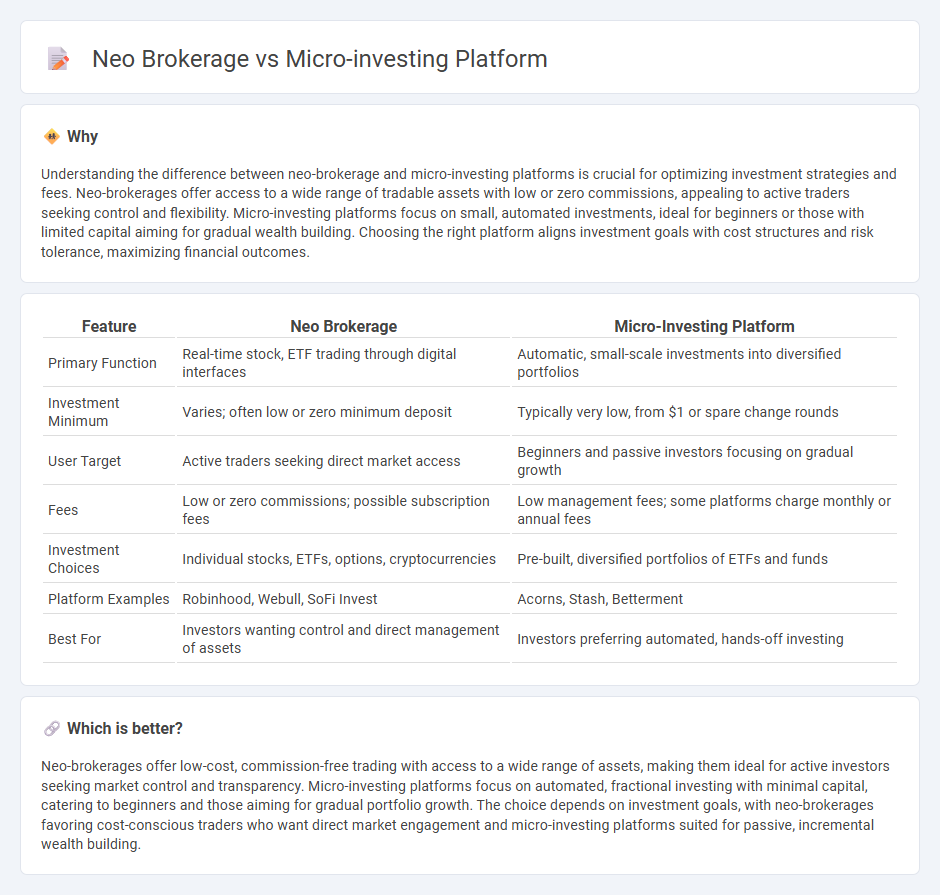

Understanding the difference between neo-brokerage and micro-investing platforms is crucial for optimizing investment strategies and fees. Neo-brokerages offer access to a wide range of tradable assets with low or zero commissions, appealing to active traders seeking control and flexibility. Micro-investing platforms focus on small, automated investments, ideal for beginners or those with limited capital aiming for gradual wealth building. Choosing the right platform aligns investment goals with cost structures and risk tolerance, maximizing financial outcomes.

Comparison Table

| Feature | Neo Brokerage | Micro-Investing Platform |

|---|---|---|

| Primary Function | Real-time stock, ETF trading through digital interfaces | Automatic, small-scale investments into diversified portfolios |

| Investment Minimum | Varies; often low or zero minimum deposit | Typically very low, from $1 or spare change rounds |

| User Target | Active traders seeking direct market access | Beginners and passive investors focusing on gradual growth |

| Fees | Low or zero commissions; possible subscription fees | Low management fees; some platforms charge monthly or annual fees |

| Investment Choices | Individual stocks, ETFs, options, cryptocurrencies | Pre-built, diversified portfolios of ETFs and funds |

| Platform Examples | Robinhood, Webull, SoFi Invest | Acorns, Stash, Betterment |

| Best For | Investors wanting control and direct management of assets | Investors preferring automated, hands-off investing |

Which is better?

Neo-brokerages offer low-cost, commission-free trading with access to a wide range of assets, making them ideal for active investors seeking market control and transparency. Micro-investing platforms focus on automated, fractional investing with minimal capital, catering to beginners and those aiming for gradual portfolio growth. The choice depends on investment goals, with neo-brokerages favoring cost-conscious traders who want direct market engagement and micro-investing platforms suited for passive, incremental wealth building.

Connection

Neo brokerage platforms leverage advanced technology to provide seamless, low-cost trading experiences, attracting micro-investors who contribute small, frequent investments. Micro-investing platforms integrate with neo brokerages by utilizing their infrastructure to offer fractional shares and automated portfolio management tools. This synergy democratizes access to financial markets, enabling users to build diversified portfolios with minimal capital and effort.

Key Terms

Micro-investing platform:

Micro-investing platforms enable users to invest small amounts of money regularly, often by rounding up everyday purchases to the nearest dollar and investing the difference, making investing accessible for beginners. These platforms typically offer automated portfolio management, fractional shares, and low or no minimum investment requirements, facilitating gradual wealth building. Explore more about how micro-investing platforms can help you start investing with minimal capital and build a diversified portfolio.

Fractional Shares

Micro-investing platforms specialize in enabling investors to purchase fractional shares, making it accessible to buy portions of high-priced stocks without committing to full shares. Neo brokerages also offer fractional shares but typically provide advanced trading tools and broader access to financial instruments alongside commission-free trades. Explore the differences further to determine which platform suits your investment goals best.

Round-Ups

Micro-investing platforms leverage Round-Ups to automatically invest spare change by rounding up everyday purchases, enabling effortless portfolio growth for beginners. Neo brokerages offer streamlined, low-cost trading with advanced tools but may lack the automated, incremental investing feature that Round-Ups provide. Explore how integrating Round-Ups can transform your investment strategy on both platform types.

Source and External Links

5 Micro Investing Apps to Consider - SmartAsset - Stash and SoFi are leading platforms that allow users to invest small amounts (even cents), offer diverse portfolios (including ETFs and themed options), and provide automated investing features and educational resources.

Micro-Investing Platform - Overview, How It Works, Benefits - Micro-investing apps let users save and invest tiny amounts periodically, often via fractional shares or by rounding up everyday purchases, with low or no investment minimums and affordable fees.

6 Best Micro-Investing Apps [2025]: Grow Your Spare Change - Platforms like Robinhood, Acorns, SoFi Invest, and Webull offer commission-free trading, fractional shares, and features such as automatic round-ups, with some also providing advanced tools like paper trading for practice.

dowidth.com

dowidth.com