Digital wealth management leverages AI-driven algorithms and real-time data analytics to deliver personalized investment strategies and portfolio management. Bank branch advisory services provide face-to-face consultations, combining expert financial advice with trust-building and tailored product offerings. Discover how each approach can optimize your wealth management experience.

Why it is important

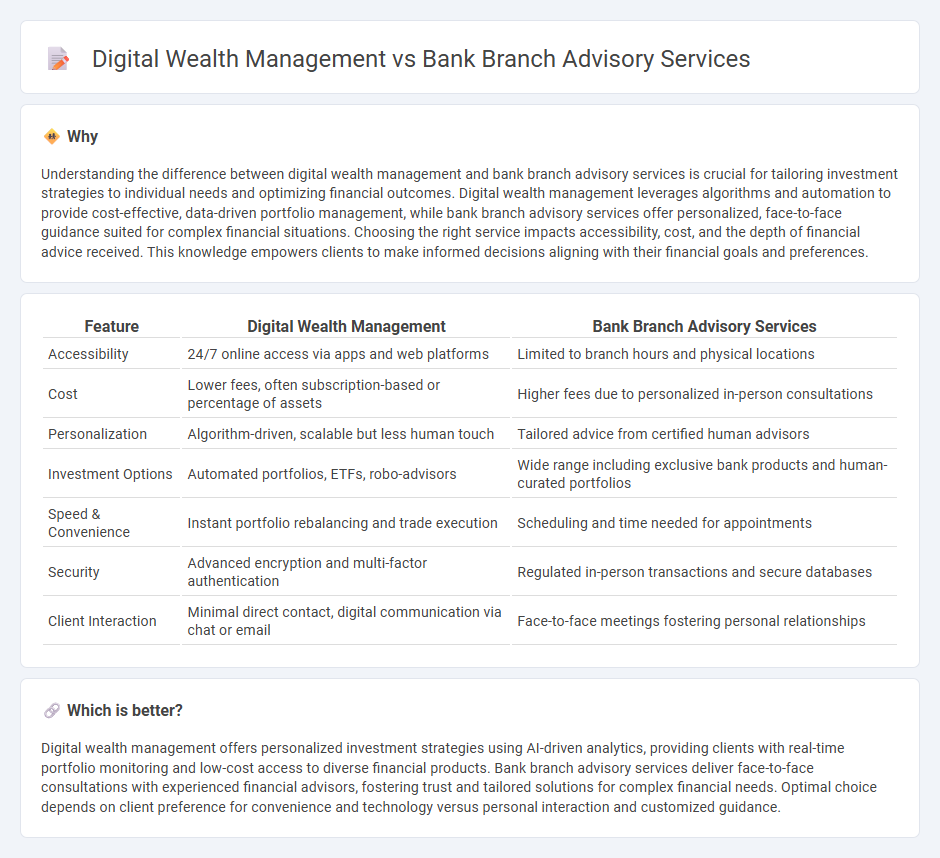

Understanding the difference between digital wealth management and bank branch advisory services is crucial for tailoring investment strategies to individual needs and optimizing financial outcomes. Digital wealth management leverages algorithms and automation to provide cost-effective, data-driven portfolio management, while bank branch advisory services offer personalized, face-to-face guidance suited for complex financial situations. Choosing the right service impacts accessibility, cost, and the depth of financial advice received. This knowledge empowers clients to make informed decisions aligning with their financial goals and preferences.

Comparison Table

| Feature | Digital Wealth Management | Bank Branch Advisory Services |

|---|---|---|

| Accessibility | 24/7 online access via apps and web platforms | Limited to branch hours and physical locations |

| Cost | Lower fees, often subscription-based or percentage of assets | Higher fees due to personalized in-person consultations |

| Personalization | Algorithm-driven, scalable but less human touch | Tailored advice from certified human advisors |

| Investment Options | Automated portfolios, ETFs, robo-advisors | Wide range including exclusive bank products and human-curated portfolios |

| Speed & Convenience | Instant portfolio rebalancing and trade execution | Scheduling and time needed for appointments |

| Security | Advanced encryption and multi-factor authentication | Regulated in-person transactions and secure databases |

| Client Interaction | Minimal direct contact, digital communication via chat or email | Face-to-face meetings fostering personal relationships |

Which is better?

Digital wealth management offers personalized investment strategies using AI-driven analytics, providing clients with real-time portfolio monitoring and low-cost access to diverse financial products. Bank branch advisory services deliver face-to-face consultations with experienced financial advisors, fostering trust and tailored solutions for complex financial needs. Optimal choice depends on client preference for convenience and technology versus personal interaction and customized guidance.

Connection

Digital wealth management integrates advanced data analytics and AI to provide personalized investment strategies, enhancing the advisory capabilities of bank branches. Bank branch advisory services leverage these digital platforms to offer clients tailored financial solutions, improving decision-making efficiency and customer satisfaction. This synergy between digital tools and human advisors fosters seamless wealth management experiences within traditional banking environments.

Key Terms

Personalized Financial Planning

Bank branch advisory services offer personalized financial planning through in-depth consultations, leveraging client relationships and local market insights to tailor investment strategies. Digital wealth management platforms provide automated, data-driven financial planning tools with real-time portfolio tracking and AI-based recommendations for individualized investment growth. Explore how personalized financial planning evolves across these two approaches to optimize your wealth management experience.

Robo-advisory Platforms

Robo-advisory platforms leverage AI algorithms to deliver personalized investment strategies with minimal human intervention, enhancing scalability and reducing costs compared to traditional bank branch advisory services. These digital wealth management tools provide real-time portfolio monitoring, automated rebalancing, and diversified asset allocation to optimize financial outcomes for investors. Explore how integrating robo-advisors into your wealth management approach can maximize efficiency and client satisfaction.

Relationship Manager

Relationship Managers in bank branch advisory services provide personalized financial guidance through face-to-face interactions, leveraging in-depth knowledge of clients' financial goals and local market dynamics. Digital wealth management platforms utilize advanced algorithms and AI-driven analytics to offer scalable, real-time portfolio management with lower operational costs and enhanced data insights. Explore how integrating both approaches can optimize client engagement and portfolio performance.

Source and External Links

Branch Banking Consulting Services - Provides customized advisory services for retail bank branch transformation, offering analytics-based staffing recommendations, branch performance studies, and optimization of service, sales, and cost efficiency across branch networks.

Advisory Services for Banks and Financial Institutions - Offers expert advisory support across portfolio risk, CECL, AML, fraud, and asset/liability management, staffed by experienced former bank executives and examiners to enhance institutional profitability and compliance.

Expanding Consultation and Advisory Services in Banking - Highlights banks expanding beyond basic transactions to provide financial wellness and investment advisory services through licensed relationship bankers to meet growing consumer demand for value-added financial advice in branches.

dowidth.com

dowidth.com