Super apps integrate multiple financial services into a single platform, offering seamless user experiences by combining payments, investments, loans, and insurance. Open banking enables secure data sharing between traditional banks and third-party providers through APIs, fostering innovation and personalized financial products. Explore how super apps and open banking are transforming the future of digital finance.

Why it is important

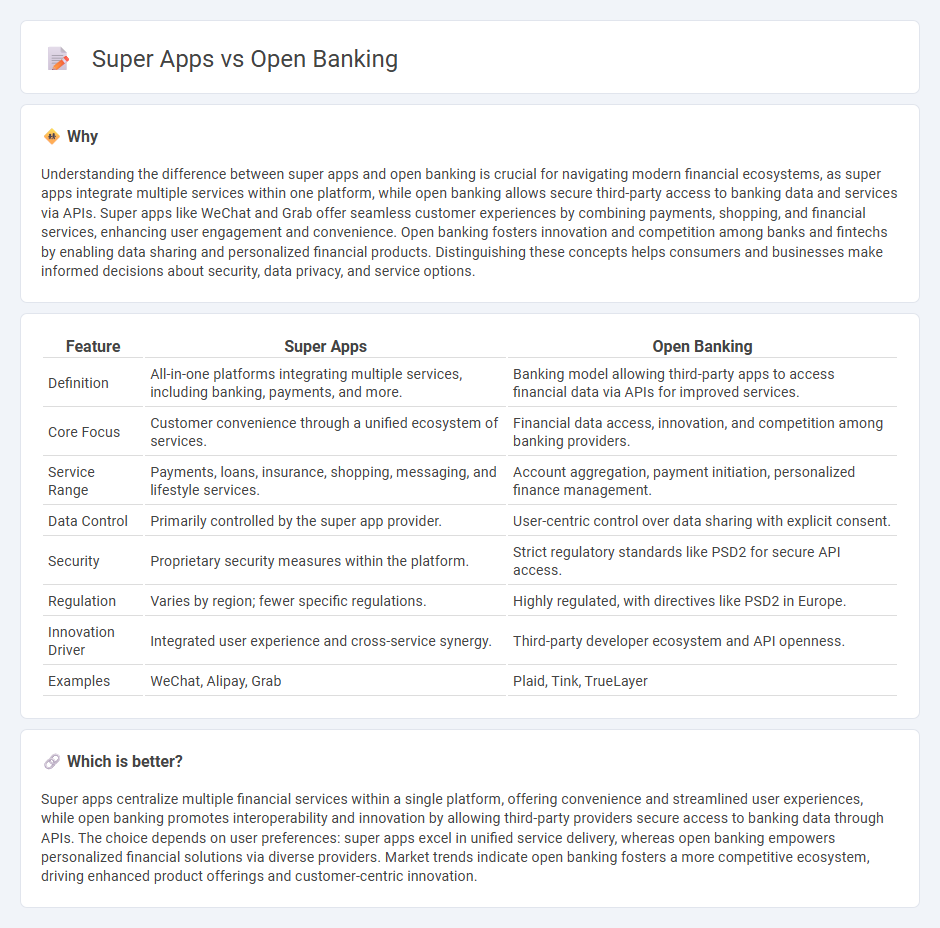

Understanding the difference between super apps and open banking is crucial for navigating modern financial ecosystems, as super apps integrate multiple services within one platform, while open banking allows secure third-party access to banking data and services via APIs. Super apps like WeChat and Grab offer seamless customer experiences by combining payments, shopping, and financial services, enhancing user engagement and convenience. Open banking fosters innovation and competition among banks and fintechs by enabling data sharing and personalized financial products. Distinguishing these concepts helps consumers and businesses make informed decisions about security, data privacy, and service options.

Comparison Table

| Feature | Super Apps | Open Banking |

|---|---|---|

| Definition | All-in-one platforms integrating multiple services, including banking, payments, and more. | Banking model allowing third-party apps to access financial data via APIs for improved services. |

| Core Focus | Customer convenience through a unified ecosystem of services. | Financial data access, innovation, and competition among banking providers. |

| Service Range | Payments, loans, insurance, shopping, messaging, and lifestyle services. | Account aggregation, payment initiation, personalized finance management. |

| Data Control | Primarily controlled by the super app provider. | User-centric control over data sharing with explicit consent. |

| Security | Proprietary security measures within the platform. | Strict regulatory standards like PSD2 for secure API access. |

| Regulation | Varies by region; fewer specific regulations. | Highly regulated, with directives like PSD2 in Europe. |

| Innovation Driver | Integrated user experience and cross-service synergy. | Third-party developer ecosystem and API openness. |

| Examples | WeChat, Alipay, Grab | Plaid, Tink, TrueLayer |

Which is better?

Super apps centralize multiple financial services within a single platform, offering convenience and streamlined user experiences, while open banking promotes interoperability and innovation by allowing third-party providers secure access to banking data through APIs. The choice depends on user preferences: super apps excel in unified service delivery, whereas open banking empowers personalized financial solutions via diverse providers. Market trends indicate open banking fosters a more competitive ecosystem, driving enhanced product offerings and customer-centric innovation.

Connection

Super apps leverage open banking APIs to integrate multiple financial services seamlessly within a single platform, enhancing customer convenience and engagement. Open banking facilitates secure data sharing between banks and third-party providers, enabling super apps to offer personalized banking, payments, and investment solutions. This synergy drives innovation in digital banking by expanding service ecosystems and promoting financial inclusivity.

Key Terms

APIs

Open banking leverages APIs to securely share financial data across multiple platforms, enabling third-party developers to create innovative banking services tailored to user needs. Super apps integrate a variety of services, including payments, messaging, and financial tools, through APIs to offer a seamless, all-in-one user experience. Explore how API-driven open banking and super apps are transforming digital finance ecosystems.

Ecosystem

Open banking fosters a decentralized financial ecosystem by enabling third-party developers to build services via APIs, promoting innovation and competition among banks and fintechs. Super apps create a centralized ecosystem by integrating diverse services such as payments, social media, and e-commerce within a single platform, enhancing user convenience and engagement. Explore detailed comparisons to understand how these ecosystems impact financial inclusivity and digital experiences.

Data Sharing

Open banking empowers financial institutions to securely share customer data through standardized APIs, enhancing transparency and fostering innovation in fintech ecosystems. Super apps aggregate diverse services, leveraging shared data to deliver seamless, personalized user experiences across payments, shopping, and messaging platforms. Explore in-depth insights on how data sharing differentiates open banking models from super app ecosystems.

Source and External Links

Open Banking - Open banking is a system that securely shares financial data with authorized providers through standardized APIs, enhancing financial transparency and innovation.

What is Open Banking? A Guide to the Future of Finance - This guide explains open banking as a system allowing consumers to share financial data with third-party providers, promoting innovation and efficiency in financial services.

Open Banking 101 - This resource provides an overview of open banking as a means to securely share financial data, enabling innovative financial experiences and broader access to financial services.

dowidth.com

dowidth.com