Alternative data lending leverages non-traditional information sources such as utility payments, rental history, and online transaction patterns to evaluate creditworthiness beyond conventional credit scores. Social media credit assessment analyzes users' digital footprints, including social interactions and behavior cues, to predict loan repayment potential. Discover how these innovative approaches reshape credit evaluations and expand financial inclusion.

Why it is important

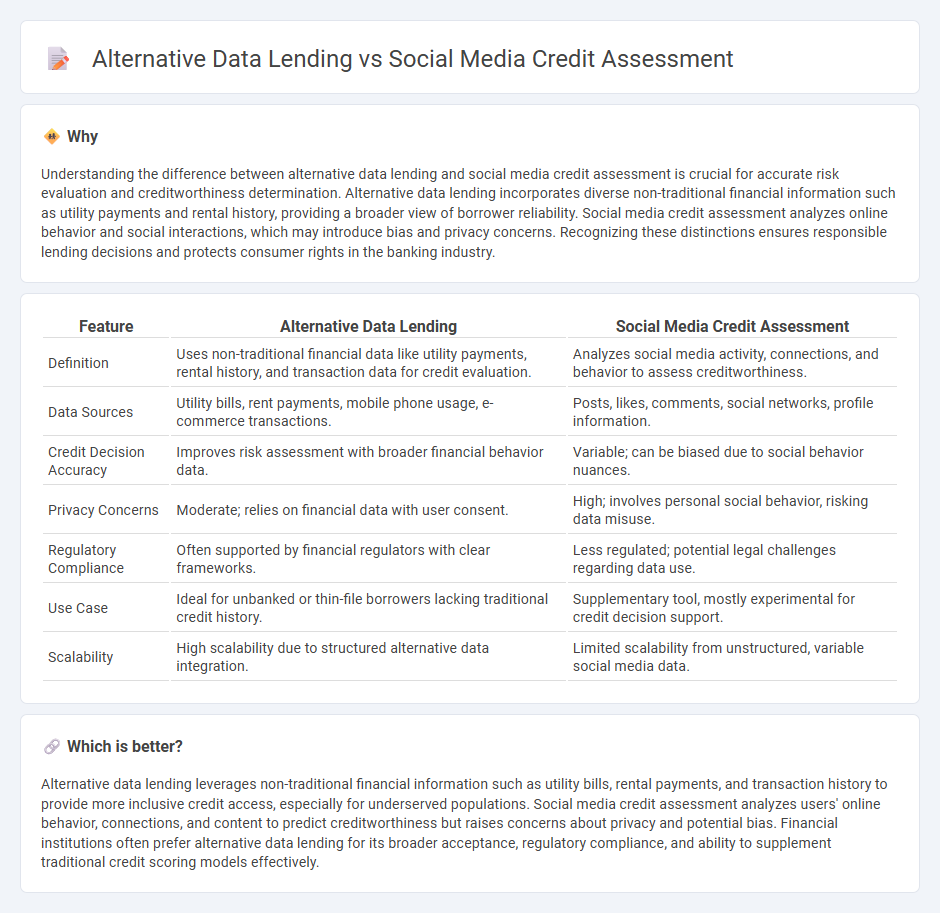

Understanding the difference between alternative data lending and social media credit assessment is crucial for accurate risk evaluation and creditworthiness determination. Alternative data lending incorporates diverse non-traditional financial information such as utility payments and rental history, providing a broader view of borrower reliability. Social media credit assessment analyzes online behavior and social interactions, which may introduce bias and privacy concerns. Recognizing these distinctions ensures responsible lending decisions and protects consumer rights in the banking industry.

Comparison Table

| Feature | Alternative Data Lending | Social Media Credit Assessment |

|---|---|---|

| Definition | Uses non-traditional financial data like utility payments, rental history, and transaction data for credit evaluation. | Analyzes social media activity, connections, and behavior to assess creditworthiness. |

| Data Sources | Utility bills, rent payments, mobile phone usage, e-commerce transactions. | Posts, likes, comments, social networks, profile information. |

| Credit Decision Accuracy | Improves risk assessment with broader financial behavior data. | Variable; can be biased due to social behavior nuances. |

| Privacy Concerns | Moderate; relies on financial data with user consent. | High; involves personal social behavior, risking data misuse. |

| Regulatory Compliance | Often supported by financial regulators with clear frameworks. | Less regulated; potential legal challenges regarding data use. |

| Use Case | Ideal for unbanked or thin-file borrowers lacking traditional credit history. | Supplementary tool, mostly experimental for credit decision support. |

| Scalability | High scalability due to structured alternative data integration. | Limited scalability from unstructured, variable social media data. |

Which is better?

Alternative data lending leverages non-traditional financial information such as utility bills, rental payments, and transaction history to provide more inclusive credit access, especially for underserved populations. Social media credit assessment analyzes users' online behavior, connections, and content to predict creditworthiness but raises concerns about privacy and potential bias. Financial institutions often prefer alternative data lending for its broader acceptance, regulatory compliance, and ability to supplement traditional credit scoring models effectively.

Connection

Alternative data lending leverages non-traditional data sources such as utility payments, rental history, and social media activity to evaluate creditworthiness beyond conventional credit scores. Social media credit assessment analyzes user behavior, social connections, and online interactions to predict financial reliability and risk profiles. Integrating these methods enhances lending accuracy, expands credit access for underserved individuals, and reduces default rates through more comprehensive borrower evaluations.

Key Terms

**Social Media Credit Assessment:**

Social media credit assessment leverages user-generated data from platforms such as Facebook, Twitter, and LinkedIn to evaluate creditworthiness by analyzing behavioral patterns, social connections, and online activity. This method enhances traditional credit scoring by incorporating real-time, dynamic inputs that can predict repayment capability more accurately, especially for thin-file or unbanked borrowers. Explore how social media credit assessment transforms lending decisions and improves financial inclusion.

Digital Footprint

Social media credit assessment leverages digital footprints from platforms like Facebook, Instagram, and Twitter to analyze user behavior, social connections, and online interactions for creditworthiness evaluation. Alternative data lending incorporates various digital footprint elements, including mobile app usage, e-commerce activity, and utility payment history, expanding beyond traditional credit scores to enhance risk prediction accuracy. Discover more about how digital footprints revolutionize credit assessment and lending practices.

Sentiment Analysis

Social media credit assessment leverages sentiment analysis to evaluate borrowers' financial behavior by analyzing tone, opinions, and emotions expressed across platforms, providing insights beyond traditional credit scores. Alternative data lending integrates sentiment analysis with various non-traditional datasets, such as mobile usage or transaction histories, to enhance credit risk evaluation and widen financial inclusion for underserved populations. Explore the latest advancements in sentiment-driven credit models to understand their impact on modern lending.

Source and External Links

Social Media Profiling in Credit Scoring - RiskSeal - Lenders analyze applicants' social media activity, online interactions, and digital footprints to assess creditworthiness, especially when traditional financial data is unavailable, providing a comprehensive digital credit score for informed lending decisions.

Social Media Credit Scoring: Pros, Cons, and How to Do It - SEON - Social media credit scoring uses alternative data from social platforms--such as profile details, job titles, and activity patterns--to help lenders evaluate risk and affordability, often supplementing traditional credit checks.

Social Media can tell a lot More about Your Credit - Qarar - Innovative lenders use social media data to assess thin-file or underbanked borrowers, leveraging public information from platforms to infer lifestyle, spending habits, and potential creditworthiness beyond conventional financial records.

dowidth.com

dowidth.com