Digital KYC leverages advanced technologies such as biometric verification, artificial intelligence, and secure digital platforms to streamline customer onboarding, reduce processing time, and enhance accuracy compared to traditional paper-based KYC methods. Paper-based KYC relies on physical documents and manual verification processes, often resulting in slower approval times and higher risk of errors or fraud. Explore how digital KYC transforms banking compliance and customer experience.

Why it is important

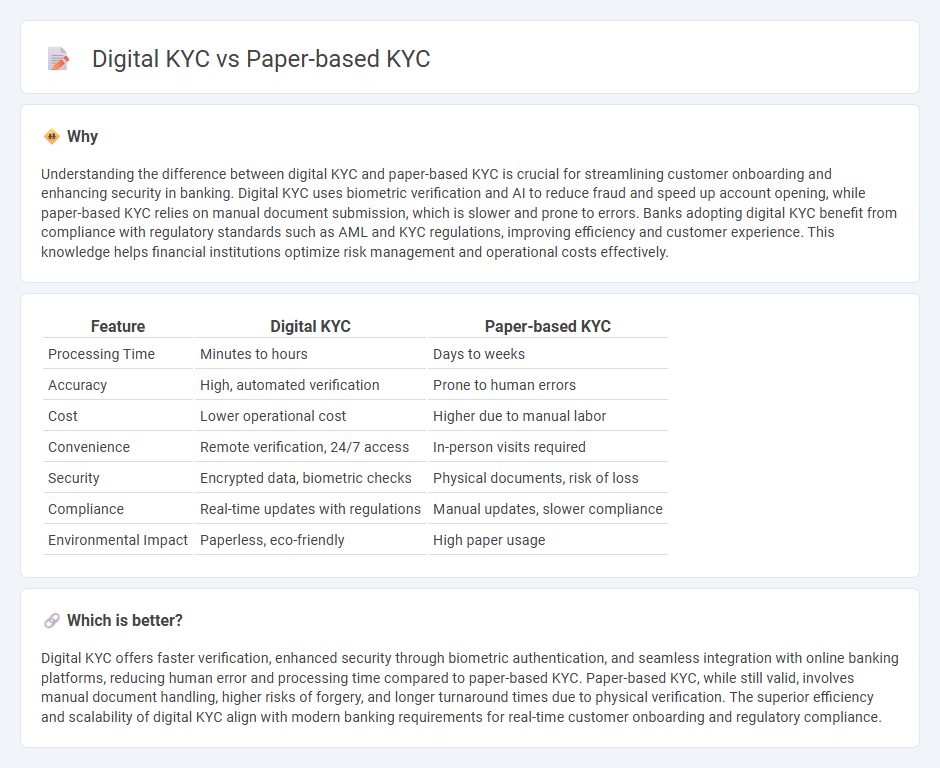

Understanding the difference between digital KYC and paper-based KYC is crucial for streamlining customer onboarding and enhancing security in banking. Digital KYC uses biometric verification and AI to reduce fraud and speed up account opening, while paper-based KYC relies on manual document submission, which is slower and prone to errors. Banks adopting digital KYC benefit from compliance with regulatory standards such as AML and KYC regulations, improving efficiency and customer experience. This knowledge helps financial institutions optimize risk management and operational costs effectively.

Comparison Table

| Feature | Digital KYC | Paper-based KYC |

|---|---|---|

| Processing Time | Minutes to hours | Days to weeks |

| Accuracy | High, automated verification | Prone to human errors |

| Cost | Lower operational cost | Higher due to manual labor |

| Convenience | Remote verification, 24/7 access | In-person visits required |

| Security | Encrypted data, biometric checks | Physical documents, risk of loss |

| Compliance | Real-time updates with regulations | Manual updates, slower compliance |

| Environmental Impact | Paperless, eco-friendly | High paper usage |

Which is better?

Digital KYC offers faster verification, enhanced security through biometric authentication, and seamless integration with online banking platforms, reducing human error and processing time compared to paper-based KYC. Paper-based KYC, while still valid, involves manual document handling, higher risks of forgery, and longer turnaround times due to physical verification. The superior efficiency and scalability of digital KYC align with modern banking requirements for real-time customer onboarding and regulatory compliance.

Connection

Digital KYC and paper-based KYC are connected through their shared objective of verifying customer identities to comply with regulatory requirements and prevent fraud in banking. Digital KYC leverages technology such as biometric authentication and automated data verification, enhancing the speed and accuracy compared to traditional paper-based KYC, which relies on physical document submission and manual checks. Both methods serve as critical components in the customer onboarding process, ensuring secure and compliant access to banking services.

Key Terms

Document Verification

Paper-based KYC involves manual document verification requiring physical submission and in-person validation, which often results in longer processing times and higher risks of human error. Digital KYC leverages automated document verification technologies such as Optical Character Recognition (OCR) and Artificial Intelligence (AI) to quickly authenticate identity documents with enhanced accuracy and security. Explore how digital KYC's efficient document verification can streamline compliance and improve customer experience.

Biometric Authentication

Biometric authentication in digital KYC leverages fingerprint scanning, facial recognition, and iris scans to verify identity with high accuracy and speed, significantly reducing fraud compared to paper-based KYC. Paper-based KYC relies on physical documents and manual verification, increasing risks of forgery, delays, and human error. Explore how biometric technologies transform KYC processes and enhance security in the financial industry.

Turnaround Time

Paper-based KYC processes typically involve manual document verification, resulting in longer turnaround times often ranging from several days to weeks due to physical document handling and human error. Digital KYC leverages automated identity verification technologies like biometric recognition and AI, enabling processing times reduced to minutes or even seconds. Explore how adopting digital KYC can dramatically accelerate customer onboarding and compliance workflows.

Source and External Links

What is KYC - This webpage explains that paper-based KYC involves collecting physical documents from customers to verify their identity and address, which is a traditional method requiring photocopies of ID proofs.

Know Your Customer (KYC) - Paper-based KYC allows customers to submit documents via mail for verification by businesses or trusted third parties.

Understanding KYC for Banks - This article contrasts paper-based KYC methods with modern ID document readers, highlighting how traditional paper-based approaches are prone to human error and fraud.

dowidth.com

dowidth.com