Stablecoin rails enable instantaneous, low-cost cross-border payments by utilizing blockchain technology, contrasting with SWIFT's traditional, slower interbank messaging system that relies on correspondent banks. While SWIFT remains essential for legacy financial transactions, stablecoin rails offer enhanced transparency, reduced settlement times, and increased accessibility for global remittances. Explore how these payment infrastructure options are reshaping the future of international banking.

Why it is important

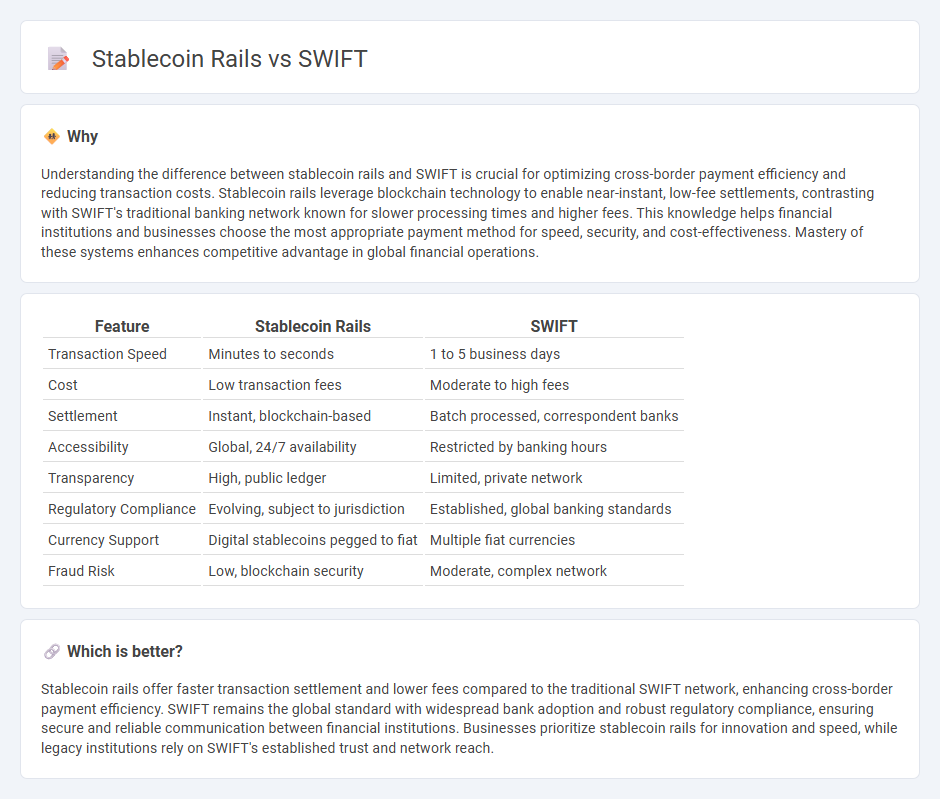

Understanding the difference between stablecoin rails and SWIFT is crucial for optimizing cross-border payment efficiency and reducing transaction costs. Stablecoin rails leverage blockchain technology to enable near-instant, low-fee settlements, contrasting with SWIFT's traditional banking network known for slower processing times and higher fees. This knowledge helps financial institutions and businesses choose the most appropriate payment method for speed, security, and cost-effectiveness. Mastery of these systems enhances competitive advantage in global financial operations.

Comparison Table

| Feature | Stablecoin Rails | SWIFT |

|---|---|---|

| Transaction Speed | Minutes to seconds | 1 to 5 business days |

| Cost | Low transaction fees | Moderate to high fees |

| Settlement | Instant, blockchain-based | Batch processed, correspondent banks |

| Accessibility | Global, 24/7 availability | Restricted by banking hours |

| Transparency | High, public ledger | Limited, private network |

| Regulatory Compliance | Evolving, subject to jurisdiction | Established, global banking standards |

| Currency Support | Digital stablecoins pegged to fiat | Multiple fiat currencies |

| Fraud Risk | Low, blockchain security | Moderate, complex network |

Which is better?

Stablecoin rails offer faster transaction settlement and lower fees compared to the traditional SWIFT network, enhancing cross-border payment efficiency. SWIFT remains the global standard with widespread bank adoption and robust regulatory compliance, ensuring secure and reliable communication between financial institutions. Businesses prioritize stablecoin rails for innovation and speed, while legacy institutions rely on SWIFT's established trust and network reach.

Connection

Stablecoin rails integrate with SWIFT by leveraging blockchain technology to enhance cross-border payment efficiency and reduce settlement times. SWIFT, the global interbank messaging network, facilitates communication between traditional banks, while stablecoin rails enable near-instantaneous value transfer through tokenized fiat currencies on distributed ledgers. This synergy aims to streamline international banking operations by combining SWIFT's widespread network with the transparency and speed of stablecoin transactions.

Key Terms

Cross-border payments

SWIFT remains the dominant network for cross-border payments, facilitating secure and standardized messaging between over 11,000 financial institutions globally. Stablecoin rails offer faster transaction speeds and lower fees by leveraging blockchain technology, enabling near-instant settlement and reducing reliance on traditional correspondent banking. Explore the evolving landscape of cross-border payments to understand how stablecoin integration could transform global financial interoperability.

Decentralization

SWIFT operates as a centralized financial messaging network, relying on regulated intermediaries and financial institutions worldwide, while stablecoin rails leverage blockchain technology to facilitate decentralized, peer-to-peer transactions with reduced reliance on traditional banking infrastructure. This decentralization in stablecoin rails enhances transparency, improves settlement times, and lowers transaction costs compared to SWIFT's constrained cross-border transfer processes. Explore how decentralization in stablecoin networks is reshaping the future of global payments.

Settlement speed

SWIFT processes international payments typically within 1 to 5 business days, facing delays due to intermediary banks and compliance checks. Stablecoin rails enable near-instant settlement, often finalizing transactions within seconds on blockchain networks, significantly reducing processing times and enhancing liquidity. Explore the advantages of stablecoin settlement speed and its impact on global finance for more insights.

Source and External Links

SWIFT - Wikipedia - SWIFT is a global cooperative providing secure messaging services for financial transactions, without holding funds or performing settlement functions, and is widely used by banks and financial institutions worldwide.

Swift: Homepage - Swift is a global financial messaging network and standards body that enables secure, standardized, and efficient cross-border payments and securities transactions, while also supporting risk, compliance, and interoperability solutions for the industry.

Swift.org - Welcome to Swift.org - Swift is a high-performance, open-source programming language developed by Apple for building apps on iOS, macOS, watchOS, and tvOS, known for its speed, safety, and modern syntax.

dowidth.com

dowidth.com