Alternative credit data integrates non-traditional financial information such as utility payments and rental history to assess creditworthiness beyond standard credit scores. Behavioral analytics examines customer interactions and transaction patterns to provide insights into spending habits and potential credit risk. Explore how combining these approaches can enhance lending decisions and financial inclusion.

Why it is important

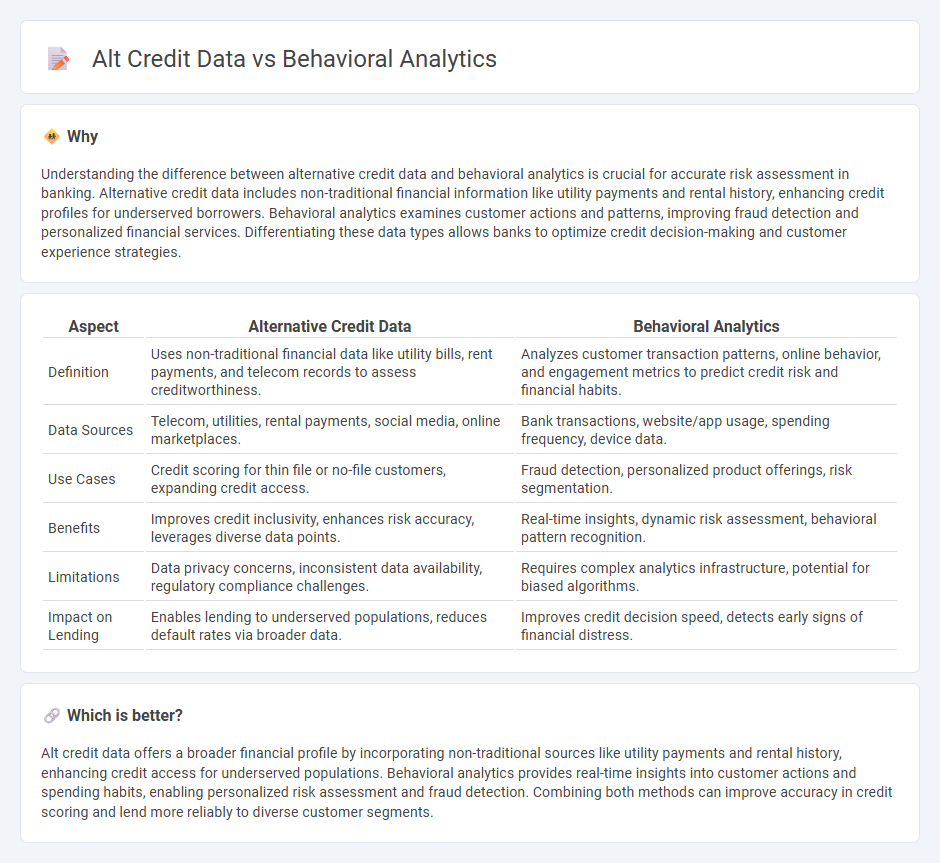

Understanding the difference between alternative credit data and behavioral analytics is crucial for accurate risk assessment in banking. Alternative credit data includes non-traditional financial information like utility payments and rental history, enhancing credit profiles for underserved borrowers. Behavioral analytics examines customer actions and patterns, improving fraud detection and personalized financial services. Differentiating these data types allows banks to optimize credit decision-making and customer experience strategies.

Comparison Table

| Aspect | Alternative Credit Data | Behavioral Analytics |

|---|---|---|

| Definition | Uses non-traditional financial data like utility bills, rent payments, and telecom records to assess creditworthiness. | Analyzes customer transaction patterns, online behavior, and engagement metrics to predict credit risk and financial habits. |

| Data Sources | Telecom, utilities, rental payments, social media, online marketplaces. | Bank transactions, website/app usage, spending frequency, device data. |

| Use Cases | Credit scoring for thin file or no-file customers, expanding credit access. | Fraud detection, personalized product offerings, risk segmentation. |

| Benefits | Improves credit inclusivity, enhances risk accuracy, leverages diverse data points. | Real-time insights, dynamic risk assessment, behavioral pattern recognition. |

| Limitations | Data privacy concerns, inconsistent data availability, regulatory compliance challenges. | Requires complex analytics infrastructure, potential for biased algorithms. |

| Impact on Lending | Enables lending to underserved populations, reduces default rates via broader data. | Improves credit decision speed, detects early signs of financial distress. |

Which is better?

Alt credit data offers a broader financial profile by incorporating non-traditional sources like utility payments and rental history, enhancing credit access for underserved populations. Behavioral analytics provides real-time insights into customer actions and spending habits, enabling personalized risk assessment and fraud detection. Combining both methods can improve accuracy in credit scoring and lend more reliably to diverse customer segments.

Connection

Alt credit data enhances traditional credit assessments by incorporating non-traditional financial behaviors, enabling more accurate risk profiling. Behavioral analytics processes this data to identify spending patterns, repayment tendencies, and financial habits, offering deeper insights into borrower reliability. Combining these approaches allows banks to extend credit access to underbanked populations while reducing default rates.

Key Terms

Transaction Patterns

Behavioral analytics leverages transaction patterns to assess consumer spending habits, frequency, and financial behavior over time, providing dynamic insights beyond traditional metrics. Alternative credit data incorporates these transaction patterns alongside utility payments, rental history, and other non-traditional financial data to enhance credit scoring models for underserved populations. Explore detailed comparisons between behavioral analytics and alternative credit data methodologies to understand their impact on credit risk assessment.

Psychometric Scoring

Psychometric scoring leverages behavioral analytics to assess creditworthiness by analyzing patterns such as decision-making, risk tolerance, and personality traits, providing deeper insights beyond traditional financial data. Unlike alt credit data, which primarily involves unconventional financial information like utility payments or rental history, psychometric scoring captures the borrower's psychological profile to predict credit risk more accurately. Discover how psychometric scoring transforms credit evaluation by combining behavioral science and advanced analytics for more inclusive lending decisions.

Social Media Profiling

Behavioral analytics leverages user interactions and online behavior patterns to assess creditworthiness, while alternative credit data incorporates unconventional sources like social media profiling to enrich credit evaluations. Social media profiling analyzes content, networks, and engagement metrics to identify financial reliability signals beyond traditional credit reports. Explore the impact of social media-driven insights on innovative credit scoring methods to understand emerging trends.

Source and External Links

The Role of Behavioral Analytics in Cybersecurity - Behavioral analytics studies patterns in user and entity activities using AI and machine learning to detect unusual behaviors, particularly for identifying cybersecurity threats like insider attacks and DDoS activity across various organizational components.

What is Behavioral Analytics? - Behavioral analytics focuses on customer behavior by analyzing online interactions with products or services to improve engagement, retention, and conversion rates through insights derived from event data such as clicks, mouse movements, and usage patterns.

What is behavioral analytics? - Behavioral analytics uses machine learning algorithms to analyze large datasets of user and system behaviors, providing actionable insights for sectors like ecommerce and fraud detection by identifying trends, anomalies, and customer segments.

dowidth.com

dowidth.com