Wealthtech focuses on digital solutions that enhance wealth management, investment advisory, and portfolio optimization through advanced algorithms and personalized financial planning. Compliancetech specializes in regulatory technology designed to streamline compliance processes, automate risk management, and ensure adherence to financial regulations with AI-powered monitoring. Discover how these innovations are transforming banking efficiency and client experience.

Why it is important

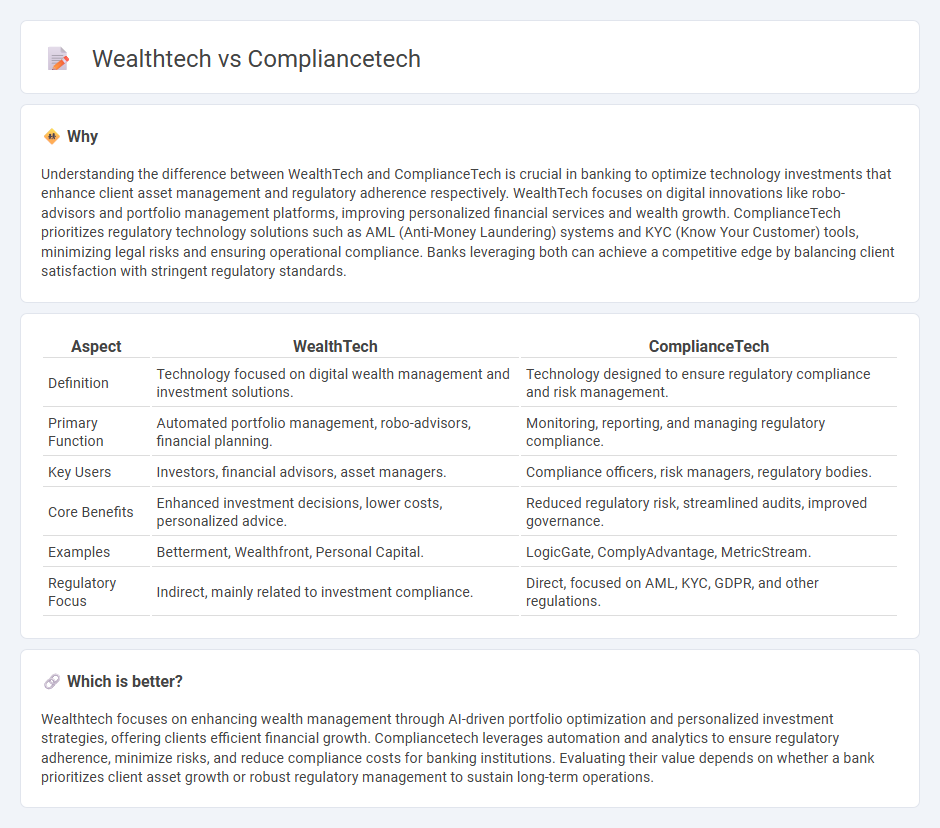

Understanding the difference between WealthTech and ComplianceTech is crucial in banking to optimize technology investments that enhance client asset management and regulatory adherence respectively. WealthTech focuses on digital innovations like robo-advisors and portfolio management platforms, improving personalized financial services and wealth growth. ComplianceTech prioritizes regulatory technology solutions such as AML (Anti-Money Laundering) systems and KYC (Know Your Customer) tools, minimizing legal risks and ensuring operational compliance. Banks leveraging both can achieve a competitive edge by balancing client satisfaction with stringent regulatory standards.

Comparison Table

| Aspect | WealthTech | ComplianceTech |

|---|---|---|

| Definition | Technology focused on digital wealth management and investment solutions. | Technology designed to ensure regulatory compliance and risk management. |

| Primary Function | Automated portfolio management, robo-advisors, financial planning. | Monitoring, reporting, and managing regulatory compliance. |

| Key Users | Investors, financial advisors, asset managers. | Compliance officers, risk managers, regulatory bodies. |

| Core Benefits | Enhanced investment decisions, lower costs, personalized advice. | Reduced regulatory risk, streamlined audits, improved governance. |

| Examples | Betterment, Wealthfront, Personal Capital. | LogicGate, ComplyAdvantage, MetricStream. |

| Regulatory Focus | Indirect, mainly related to investment compliance. | Direct, focused on AML, KYC, GDPR, and other regulations. |

Which is better?

Wealthtech focuses on enhancing wealth management through AI-driven portfolio optimization and personalized investment strategies, offering clients efficient financial growth. Compliancetech leverages automation and analytics to ensure regulatory adherence, minimize risks, and reduce compliance costs for banking institutions. Evaluating their value depends on whether a bank prioritizes client asset growth or robust regulatory management to sustain long-term operations.

Connection

Wealthtech integrates advanced technologies like AI and data analytics to optimize investment management, while compliancetech employs automation and regulatory intelligence to ensure adherence to financial laws. Together, these sectors enable banks to deliver personalized wealth services within strict regulatory frameworks, minimizing risk and enhancing operational efficiency. The synergy between wealthtech and compliancetech supports seamless compliance processes while maximizing client portfolio growth in a rapidly evolving financial landscape.

Key Terms

Regulatory Reporting

ComplianceTech specializes in regulatory reporting solutions that automate data collection, validation, and submission, ensuring adherence to evolving financial regulations such as MiFID II and Dodd-Frank. WealthTech platforms, while focused on portfolio management and client engagement, increasingly integrate compliance modules to streamline reporting requirements and risk assessment. Discover how these technologies revolutionize regulatory reporting in the financial industry.

Robo-Advisory

ComplianceTech in Robo-Advisory emphasizes regulatory adherence, risk management, and automated monitoring to ensure investment platforms meet legal standards. WealthTech focuses on enhancing client wealth management through AI-driven portfolio optimization, personalized financial advice, and seamless user experiences. Explore the evolving landscape of Robo-Advisory to understand how ComplianceTech and WealthTech intersect and drive innovation.

KYC/AML

ComplianceTech focuses on KYC (Know Your Customer) and AML (Anti-Money Laundering) solutions that automate identity verification, risk assessment, and regulatory reporting to ensure adherence to financial laws. WealthTech integrates these compliance processes within broader investment management platforms, enhancing client onboarding while maintaining regulatory standards. Explore how both sectors innovate compliance workflows and improve financial security.

Source and External Links

ComplianceTech - ComplianceTech provides web-based software solutions for lenders to analyze and manage fair lending compliance, including tools for HMDA, CRA, and fair lending risk mitigation, with advanced analytics and reporting features used by lenders and regulators.

ComplianceTech Overview on MortgageAdvisorTools - The company offers technology solutions specialized in mortgage compliance, enabling financial institutions to navigate complex regulations and enhance lending confidence.

ComplianceTech Company Overview on LeadIQ - ComplianceTech is a fair lending software vendor and consultant providing high-tech analytical tools like LendingPatterns(tm), Fair Lending Magic(tm), and HMDA Ready(tm) to address compliance issues in consumer lending.

dowidth.com

dowidth.com