Negative interest rates occur when central banks set nominal interest rates below zero, effectively charging depositors for holding money, which contrasts sharply with simple interest where lenders earn a fixed percentage based solely on the principal amount. This unconventional monetary policy aims to stimulate economic activity by encouraging spending and investment, while simple interest remains a traditional, predictable method for calculating returns on loans or savings. Discover how these contrasting interest rate mechanisms impact financial decisions and economic stability.

Why it is important

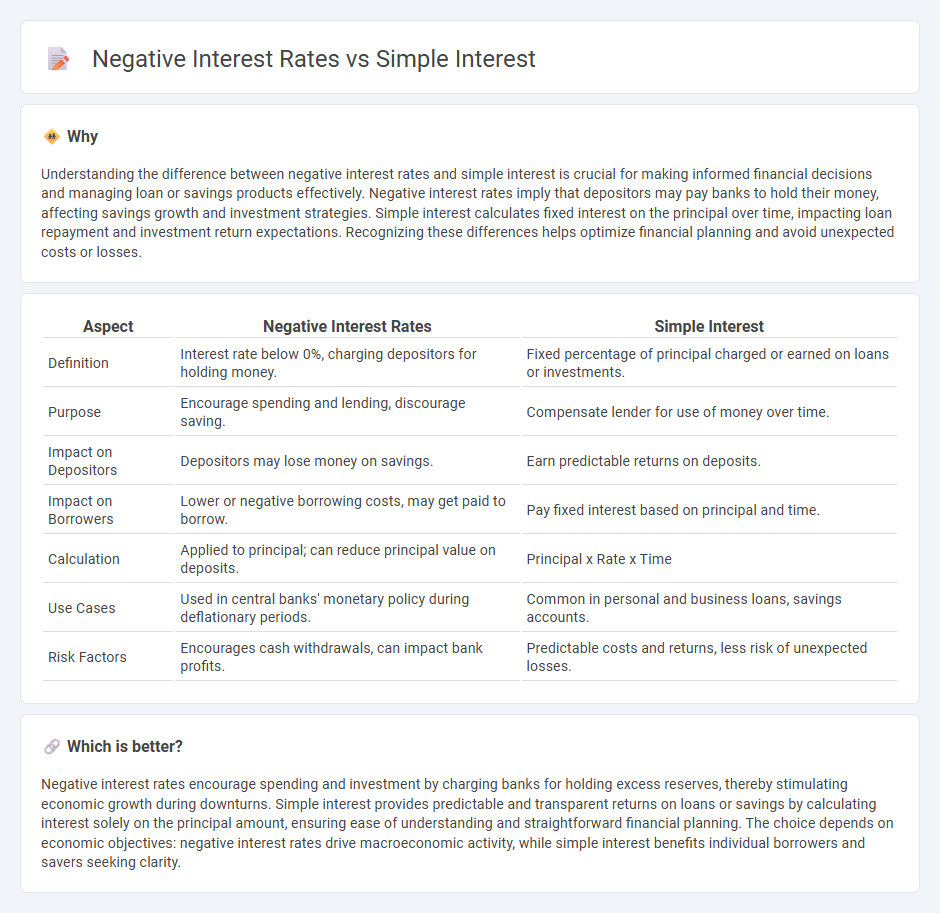

Understanding the difference between negative interest rates and simple interest is crucial for making informed financial decisions and managing loan or savings products effectively. Negative interest rates imply that depositors may pay banks to hold their money, affecting savings growth and investment strategies. Simple interest calculates fixed interest on the principal over time, impacting loan repayment and investment return expectations. Recognizing these differences helps optimize financial planning and avoid unexpected costs or losses.

Comparison Table

| Aspect | Negative Interest Rates | Simple Interest |

|---|---|---|

| Definition | Interest rate below 0%, charging depositors for holding money. | Fixed percentage of principal charged or earned on loans or investments. |

| Purpose | Encourage spending and lending, discourage saving. | Compensate lender for use of money over time. |

| Impact on Depositors | Depositors may lose money on savings. | Earn predictable returns on deposits. |

| Impact on Borrowers | Lower or negative borrowing costs, may get paid to borrow. | Pay fixed interest based on principal and time. |

| Calculation | Applied to principal; can reduce principal value on deposits. | Principal x Rate x Time |

| Use Cases | Used in central banks' monetary policy during deflationary periods. | Common in personal and business loans, savings accounts. |

| Risk Factors | Encourages cash withdrawals, can impact bank profits. | Predictable costs and returns, less risk of unexpected losses. |

Which is better?

Negative interest rates encourage spending and investment by charging banks for holding excess reserves, thereby stimulating economic growth during downturns. Simple interest provides predictable and transparent returns on loans or savings by calculating interest solely on the principal amount, ensuring ease of understanding and straightforward financial planning. The choice depends on economic objectives: negative interest rates drive macroeconomic activity, while simple interest benefits individual borrowers and savers seeking clarity.

Connection

Negative interest rates invert the traditional concept of earning interest on deposits, resulting in banks charging customers for holding their money, which contrasts with simple interest where borrowers pay a fixed percentage on the principal over time. Both concepts revolve around interest calculations but operate under different economic conditions and implications for savings and loans. Negative interest rates can impact the calculation and perception of simple interest by altering expected returns in banking operations.

Key Terms

Principal

Simple interest calculates the interest earned solely on the principal amount over a specific period, ensuring predictable returns based on the initial investment. Negative interest rates, on the other hand, can decrease the principal's value by charging fees or penalties on deposits, effectively reducing the initial capital over time. Explore how these contrasting impacts on principal influence your investment strategies and risk management.

Interest Rate

Simple interest calculates interest as a fixed percentage of the principal amount over time, providing predictable returns based on the agreed interest rate. Negative interest rates occur when central banks set benchmark rates below zero, effectively charging banks to hold reserves, which can lead to lower or even negative returns on deposits and loans. Explore more about how these contrasting interest rate mechanisms impact savings and borrowing strategies.

Inflation

Simple interest calculates earnings or costs on the initial principal without compounding, often fixed and predictable, while negative interest rates require lenders to pay borrowers, aiming to stimulate spending during inflationary pressures. Inflation reduces the real value of interest earned in simple interest scenarios, making negative rates a tool to discourage saving and encourage investment, counteracting deflation risks. Explore how these financial mechanisms influence economic stability and inflation control.

Source and External Links

Simple Interest - Definition, Formula, Examples - Simple interest is the interest calculated only on the principal amount for a given time at a fixed rate, using the formula SI = (PRT)/100 where P is principal, R is rate, and T is time period.

What is Simple Interest? Definition, Formula, and Examples - Simple interest is interest earned or charged only on the original principal amount, remaining constant regardless of time, commonly used for loans and short-term savings.

Simple Interest Formula - Simple interest is a straightforward method of calculating interest on a principal amount at a fixed rate over time, widely used in banking and loans where interest does not compound.

dowidth.com

dowidth.com