Super apps integrate diverse financial services, including payments, loans, and insurance, providing a seamless user experience within a single platform. Digital-only banks operate exclusively online, offering full banking services without physical branches, emphasizing convenience and lower fees. Explore how these innovative financial models are reshaping the future of banking.

Why it is important

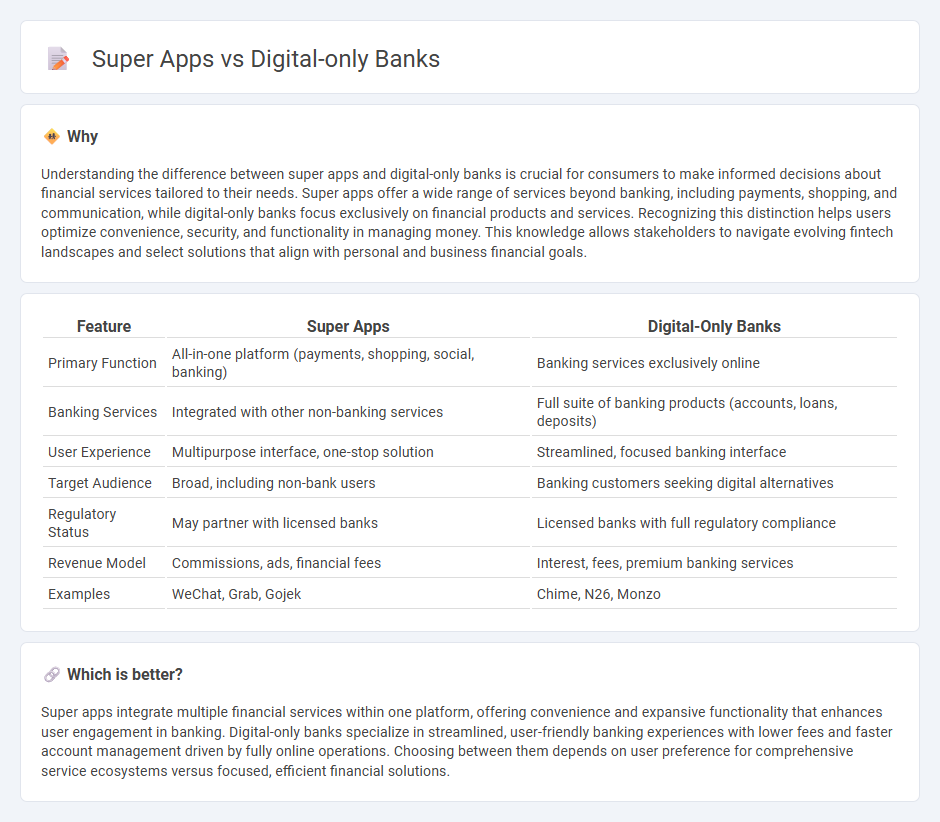

Understanding the difference between super apps and digital-only banks is crucial for consumers to make informed decisions about financial services tailored to their needs. Super apps offer a wide range of services beyond banking, including payments, shopping, and communication, while digital-only banks focus exclusively on financial products and services. Recognizing this distinction helps users optimize convenience, security, and functionality in managing money. This knowledge allows stakeholders to navigate evolving fintech landscapes and select solutions that align with personal and business financial goals.

Comparison Table

| Feature | Super Apps | Digital-Only Banks |

|---|---|---|

| Primary Function | All-in-one platform (payments, shopping, social, banking) | Banking services exclusively online |

| Banking Services | Integrated with other non-banking services | Full suite of banking products (accounts, loans, deposits) |

| User Experience | Multipurpose interface, one-stop solution | Streamlined, focused banking interface |

| Target Audience | Broad, including non-bank users | Banking customers seeking digital alternatives |

| Regulatory Status | May partner with licensed banks | Licensed banks with full regulatory compliance |

| Revenue Model | Commissions, ads, financial fees | Interest, fees, premium banking services |

| Examples | WeChat, Grab, Gojek | Chime, N26, Monzo |

Which is better?

Super apps integrate multiple financial services within one platform, offering convenience and expansive functionality that enhances user engagement in banking. Digital-only banks specialize in streamlined, user-friendly banking experiences with lower fees and faster account management driven by fully online operations. Choosing between them depends on user preference for comprehensive service ecosystems versus focused, efficient financial solutions.

Connection

Super apps integrate digital-only banking services, offering seamless financial transactions within multifunctional platforms that include messaging, shopping, and payments. Digital-only banks leverage super apps' extensive user bases to enhance accessibility, streamline onboarding, and provide personalized banking experiences. This synergy accelerates financial inclusion by delivering convenient, real-time services through mobile ecosystems.

Key Terms

Neobanks

Digital-only banks, or neobanks, provide streamlined banking services exclusively through online platforms, offering user-friendly interfaces, lower fees, and faster account setup compared to traditional banks. Super apps integrate multiple services like payments, lending, shopping, and financial management within a single platform, aiming to create an all-in-one ecosystem that exceeds the scope of neobanks' core banking functions. Explore how neobanks differentiate themselves from super apps and transform the future of financial services.

Embedded Finance

Digital-only banks primarily offer standalone financial services through online platforms, emphasizing streamlined banking without physical branches. Super apps integrate embedded finance by incorporating banking, payments, insurance, and investment services within a broader ecosystem, enhancing user convenience through multifunctional digital experiences. Explore how embedded finance is transforming customer engagement and service delivery in both digital-only banks and super apps.

Ecosystem Integration

Digital-only banks prioritize streamlined financial services with robust API integrations, enabling seamless customer experiences within focused banking ecosystems. Super apps, like Grab and WeChat, offer extensive ecosystem integration by combining payments, e-commerce, transportation, and lifestyle services into a unified platform. Explore how these distinct approaches redefine user convenience and drive innovation in digital finance ecosystems.

Source and External Links

Digital Only Banks - Payset - Digital-only banks operate entirely online, offering 24/7 access, lower fees, higher interest rates, and advanced security features through smartphone or computer.

Future of Banking: The Rise of Digital-Only Checking Accounts - Digital-only checking accounts provide convenience, cost savings, enhanced security, and easy accessibility via mobile apps and online portals, with minimal to no fees and competitive interest rates.

Top 10: Digital Banks | FinTech Magazine - Leading digital-only banks like Ally, Varo, Current, Atom, Starling, Monzo, N26, and SoFi deliver mobile-centric services, innovative products, and are rapidly gaining market share by meeting the evolving needs of tech-savvy consumers.

dowidth.com

dowidth.com