Fraud orchestration integrates multiple fraud detection tools into a unified system to streamline response and improve accuracy, while risk management focuses on identifying, assessing, and mitigating potential financial threats through strategic policies. Fraud orchestration enhances real-time decision-making by automating alerts and coordinating actions across channels, whereas risk management involves broader governance frameworks and compliance adherence. Discover how combining fraud orchestration with risk management strengthens overall security in banking.

Why it is important

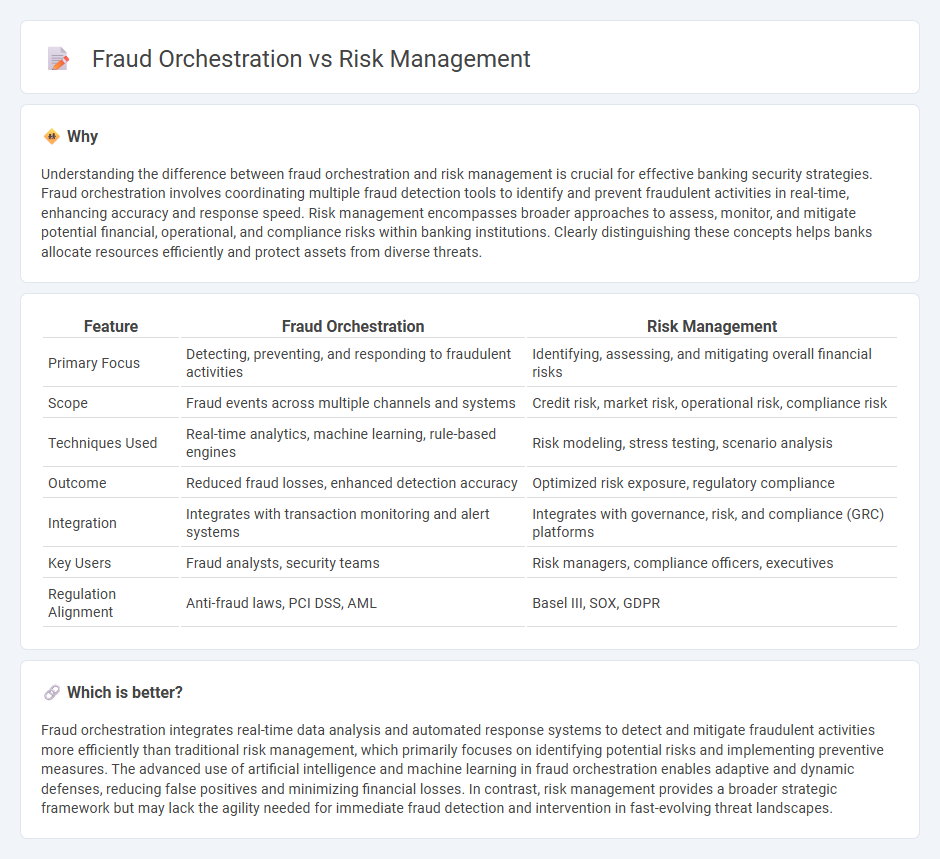

Understanding the difference between fraud orchestration and risk management is crucial for effective banking security strategies. Fraud orchestration involves coordinating multiple fraud detection tools to identify and prevent fraudulent activities in real-time, enhancing accuracy and response speed. Risk management encompasses broader approaches to assess, monitor, and mitigate potential financial, operational, and compliance risks within banking institutions. Clearly distinguishing these concepts helps banks allocate resources efficiently and protect assets from diverse threats.

Comparison Table

| Feature | Fraud Orchestration | Risk Management |

|---|---|---|

| Primary Focus | Detecting, preventing, and responding to fraudulent activities | Identifying, assessing, and mitigating overall financial risks |

| Scope | Fraud events across multiple channels and systems | Credit risk, market risk, operational risk, compliance risk |

| Techniques Used | Real-time analytics, machine learning, rule-based engines | Risk modeling, stress testing, scenario analysis |

| Outcome | Reduced fraud losses, enhanced detection accuracy | Optimized risk exposure, regulatory compliance |

| Integration | Integrates with transaction monitoring and alert systems | Integrates with governance, risk, and compliance (GRC) platforms |

| Key Users | Fraud analysts, security teams | Risk managers, compliance officers, executives |

| Regulation Alignment | Anti-fraud laws, PCI DSS, AML | Basel III, SOX, GDPR |

Which is better?

Fraud orchestration integrates real-time data analysis and automated response systems to detect and mitigate fraudulent activities more efficiently than traditional risk management, which primarily focuses on identifying potential risks and implementing preventive measures. The advanced use of artificial intelligence and machine learning in fraud orchestration enables adaptive and dynamic defenses, reducing false positives and minimizing financial losses. In contrast, risk management provides a broader strategic framework but may lack the agility needed for immediate fraud detection and intervention in fast-evolving threat landscapes.

Connection

Fraud orchestration integrates real-time data analysis and automated response systems to detect suspicious banking activities, enhancing risk management by reducing financial losses and operational vulnerabilities. Effective risk management frameworks rely on fraud orchestration to prioritize and mitigate threats based on severity and impact, ensuring regulatory compliance and protecting customer assets. Advanced machine learning algorithms used in fraud orchestration continuously adapt to emerging fraud patterns, strengthening overall risk mitigation strategies in the banking sector.

Key Terms

**Risk management:**

Risk management involves identifying, assessing, and prioritizing potential risks to minimize their impact on operations, finances, and reputation. It employs data analytics, machine learning models, and real-time monitoring to detect anomalies and prevent losses from fraud, operational failures, or compliance breaches. Explore how advanced risk management strategies can safeguard your business from evolving threats.

Credit Risk

Credit risk management involves assessing and mitigating the likelihood of borrower default through strategies such as credit scoring, risk-based pricing, and portfolio diversification. Fraud orchestration, by contrast, integrates real-time data analytics, machine learning, and automated workflows to detect and prevent fraudulent activities that directly impact credit risk. Explore comprehensive approaches to enhance your credit risk defenses with advanced fraud orchestration techniques.

Operational Risk

Risk management in operational risk centers on identifying, assessing, and mitigating potential threats that could disrupt business processes, including fraud. Fraud orchestration specifically targets the detection, prevention, and response to fraudulent activities by integrating data from multiple sources and automating workflows for efficient intervention. Explore how advanced fraud orchestration platforms enhance operational risk strategies to safeguard organizational assets and maintain regulatory compliance.

Source and External Links

Five Steps of the Risk Management Process 2025 - 360Factors - Risk management is a structured process involving five steps: identifying risks, analyzing them, evaluating or ranking them, treating the risks, and monitoring and reviewing risk continuously to minimize threats and optimize responses.

What is Risk Management? Importance, Benefits and Guide - Risk management is the process of identifying, assessing, and controlling threats to an organization's capital, operations, and financial performance, aiming not to eliminate risk but to make informed decisions on which risks to take for achieving strategic goals.

10 Types of Risk Management Strategies to Follow - AuditBoard - Effective risk management is an ongoing, cyclical process that involves continuous identification, assessment, management, and monitoring of risks, including formal documentation of identified risks and periodic reviews as required by compliance frameworks like ISO 27001 and SOC 2.

dowidth.com

dowidth.com