Blockchain remittance offers secure, transparent cross-border transactions with lower fees compared to traditional banking systems, while Mobile Money provides accessible, real-time digital payments primarily within local or regional ecosystems. Both technologies revolutionize financial inclusion by enabling faster, cost-effective money transfers but differ in infrastructure and regulatory frameworks. Explore how blockchain and Mobile Money reshape global remittance landscapes to enhance your understanding.

Why it is important

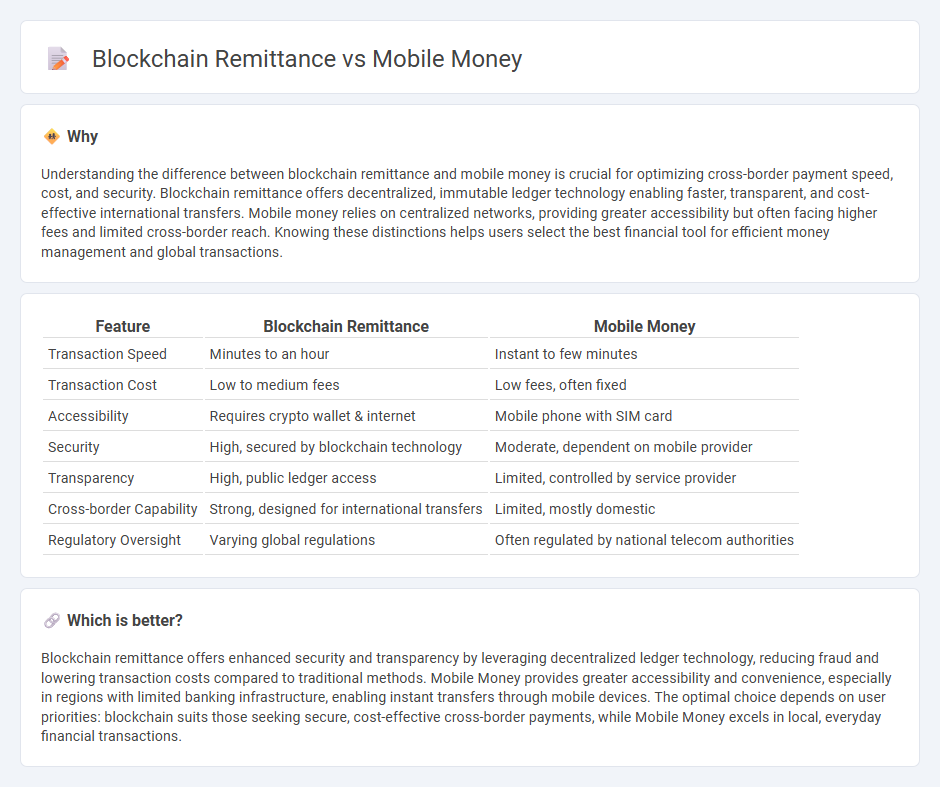

Understanding the difference between blockchain remittance and mobile money is crucial for optimizing cross-border payment speed, cost, and security. Blockchain remittance offers decentralized, immutable ledger technology enabling faster, transparent, and cost-effective international transfers. Mobile money relies on centralized networks, providing greater accessibility but often facing higher fees and limited cross-border reach. Knowing these distinctions helps users select the best financial tool for efficient money management and global transactions.

Comparison Table

| Feature | Blockchain Remittance | Mobile Money |

|---|---|---|

| Transaction Speed | Minutes to an hour | Instant to few minutes |

| Transaction Cost | Low to medium fees | Low fees, often fixed |

| Accessibility | Requires crypto wallet & internet | Mobile phone with SIM card |

| Security | High, secured by blockchain technology | Moderate, dependent on mobile provider |

| Transparency | High, public ledger access | Limited, controlled by service provider |

| Cross-border Capability | Strong, designed for international transfers | Limited, mostly domestic |

| Regulatory Oversight | Varying global regulations | Often regulated by national telecom authorities |

Which is better?

Blockchain remittance offers enhanced security and transparency by leveraging decentralized ledger technology, reducing fraud and lowering transaction costs compared to traditional methods. Mobile Money provides greater accessibility and convenience, especially in regions with limited banking infrastructure, enabling instant transfers through mobile devices. The optimal choice depends on user priorities: blockchain suits those seeking secure, cost-effective cross-border payments, while Mobile Money excels in local, everyday financial transactions.

Connection

Blockchain remittance leverages decentralized ledger technology to provide secure, fast, and low-cost cross-border money transfers, enhancing the efficiency of mobile money platforms. Mobile money systems integrate blockchain to enable real-time transaction verification, reduce fraud risks, and improve transparency for users, especially in underbanked regions. This synergy accelerates financial inclusion by offering accessible digital payment solutions without relying on traditional banking infrastructure.

Key Terms

Digital Wallet

Digital wallets in mobile money systems enable instant peer-to-peer transfers and seamless bill payments using phone numbers linked to bank accounts, offering convenience in everyday transactions. Blockchain remittance leverages decentralized ledgers for cross-border payments, providing enhanced security, transparency, and reduced transaction fees compared to traditional intermediaries. Explore in-depth how digital wallets transform remittance services and empower financial inclusion worldwide.

Decentralization

Mobile money platforms operate through centralized systems controlled by financial institutions or telecom providers, limiting user autonomy and increasing vulnerability to censorship or system failures. Blockchain remittance leverages decentralized ledger technology, enabling peer-to-peer transactions without intermediaries, enhancing transparency, security, and user control over funds. Explore the transformative potential of decentralized finance in global remittance to understand how blockchain reshapes cross-border payments.

Cross-border Transfer

Mobile money platforms simplify cross-border transfers by enabling instant, low-cost transactions using existing mobile networks, making them accessible in regions with limited banking infrastructure. Blockchain remittances enhance security and transparency through decentralized ledgers, reducing settlement times and fees while preventing fraud. Explore our detailed analysis to understand which method best suits your cross-border transfer needs.

Source and External Links

Mobile Money - Wikipedia - Mobile Money is a mobile payments system managed by mobile operators, allowing users to deposit, transfer, and withdraw money directly from their phones through a network of agents, mainly in developing countries.

Mobile Money: Issue 2 | VoxDevLit - Mobile money enables financial transactions without a traditional bank account, significantly lowering costs and barriers to entry for previously excluded populations, especially across Africa and other developing regions.

High Interest, No Account Fee Online Checking Account - T-Mobile - T-Mobile MONEY is a digital banking platform offering high-yield interest, no account or overdraft fees, early direct deposit, and in-app money management for U.S. customers.

dowidth.com

dowidth.com