Fraud orchestration integrates multiple fraud prevention tools and data sources to detect and respond to fraudulent activities in real-time, enhancing the security of banking transactions. KYC (Know Your Customer) processes focus on verifying customer identities, assessing risks, and ensuring regulatory compliance to prevent money laundering and financial crimes. Explore how combining fraud orchestration with advanced KYC strategies can safeguard your banking operations more effectively.

Why it is important

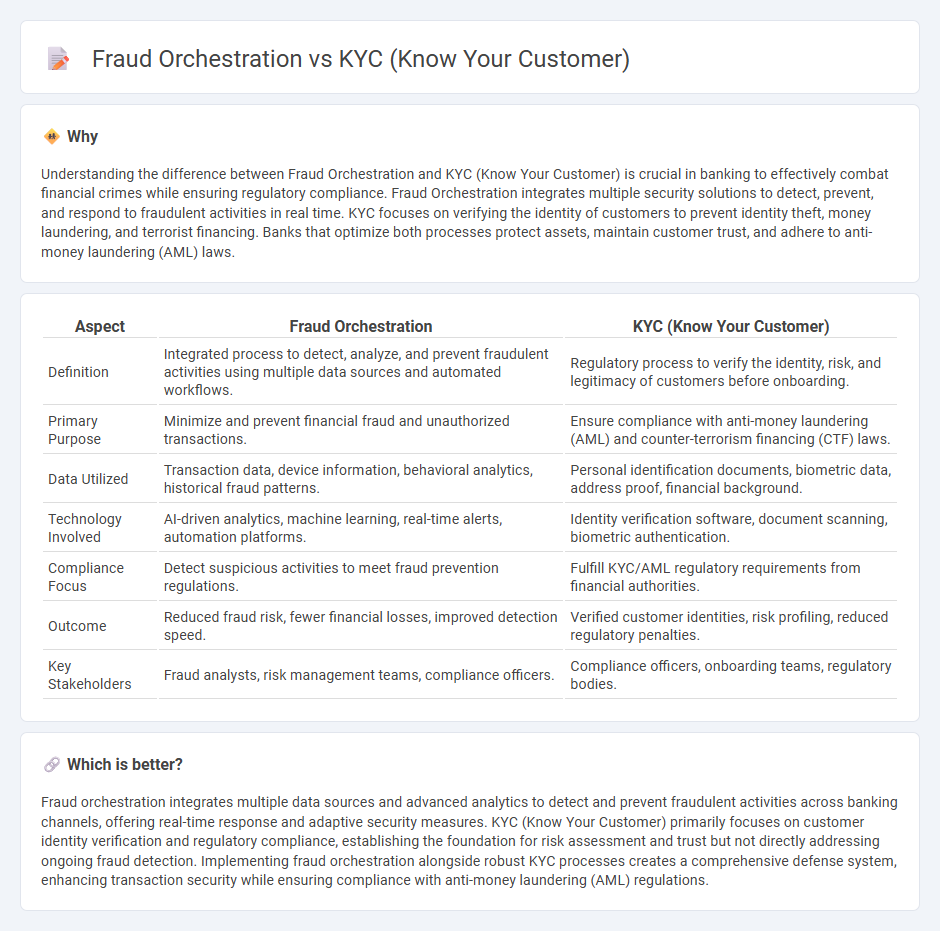

Understanding the difference between Fraud Orchestration and KYC (Know Your Customer) is crucial in banking to effectively combat financial crimes while ensuring regulatory compliance. Fraud Orchestration integrates multiple security solutions to detect, prevent, and respond to fraudulent activities in real time. KYC focuses on verifying the identity of customers to prevent identity theft, money laundering, and terrorist financing. Banks that optimize both processes protect assets, maintain customer trust, and adhere to anti-money laundering (AML) laws.

Comparison Table

| Aspect | Fraud Orchestration | KYC (Know Your Customer) |

|---|---|---|

| Definition | Integrated process to detect, analyze, and prevent fraudulent activities using multiple data sources and automated workflows. | Regulatory process to verify the identity, risk, and legitimacy of customers before onboarding. |

| Primary Purpose | Minimize and prevent financial fraud and unauthorized transactions. | Ensure compliance with anti-money laundering (AML) and counter-terrorism financing (CTF) laws. |

| Data Utilized | Transaction data, device information, behavioral analytics, historical fraud patterns. | Personal identification documents, biometric data, address proof, financial background. |

| Technology Involved | AI-driven analytics, machine learning, real-time alerts, automation platforms. | Identity verification software, document scanning, biometric authentication. |

| Compliance Focus | Detect suspicious activities to meet fraud prevention regulations. | Fulfill KYC/AML regulatory requirements from financial authorities. |

| Outcome | Reduced fraud risk, fewer financial losses, improved detection speed. | Verified customer identities, risk profiling, reduced regulatory penalties. |

| Key Stakeholders | Fraud analysts, risk management teams, compliance officers. | Compliance officers, onboarding teams, regulatory bodies. |

Which is better?

Fraud orchestration integrates multiple data sources and advanced analytics to detect and prevent fraudulent activities across banking channels, offering real-time response and adaptive security measures. KYC (Know Your Customer) primarily focuses on customer identity verification and regulatory compliance, establishing the foundation for risk assessment and trust but not directly addressing ongoing fraud detection. Implementing fraud orchestration alongside robust KYC processes creates a comprehensive defense system, enhancing transaction security while ensuring compliance with anti-money laundering (AML) regulations.

Connection

Fraud orchestration enhances KYC (Know Your Customer) processes by integrating real-time data analysis and advanced identity verification techniques to detect and prevent fraudulent activities within banking systems. Effective KYC protocols provide accurate customer information, which fraud orchestration platforms use to identify suspicious transactions and patterns quickly. This symbiotic relationship reduces financial crime, ensures regulatory compliance, and protects both banks and customers from potential losses.

Key Terms

Customer Due Diligence (CDD)

KYC (Know Your Customer) processes ensure comprehensive Customer Due Diligence (CDD) by verifying identities and assessing risks to prevent financial crimes. Fraud orchestration integrates real-time data analytics and machine learning to detect and respond to suspicious activities more dynamically during the CDD process. Explore how these strategies enhance compliance and security in financial services.

Identity Verification

KYC (Know Your Customer) emphasizes verifying customer identities through document validation, biometric checks, and data cross-referencing to ensure regulatory compliance and reduce onboarding risks. Fraud orchestration uses advanced analytics, machine learning, and real-time behavioral monitoring to detect and prevent fraudulent activities beyond initial identity verification. Explore how integrating both approaches enhances security and trust in financial services.

Transaction Monitoring

KYC (Know Your Customer) involves verifying customer identities to prevent financial crimes, while fraud orchestration focuses on integrating and automating fraud detection systems for comprehensive transaction monitoring. Transaction monitoring analyzes real-time and historical data to identify suspicious activities, leveraging machine learning algorithms for enhanced accuracy. Explore how combining KYC and fraud orchestration strengthens defenses against financial fraud in dynamic environments.

Source and External Links

The Importance of Know Your Customer - Entrust - KYC is a due diligence process organizations use to verify the identity of their clients, helping prevent fraud, money laundering, and other financial crimes while maintaining regulatory compliance and customer trust.

Know Your Customer (KYC): Meaning & Essential AML Requirements - KYC is a legal requirement for financial institutions to verify the identity of individuals and companies opening accounts, assess their risk for financial crime, and compare their information against regulatory watchlists.

What is KYC? Overview & short explanations - IDnow - KYC describes the process of verifying new customers' identities to prevent illegal activities like money laundering and fraud, and is mandated by various international regulations including EU directives and the USA Patriot Act.

dowidth.com

dowidth.com