Account aggregation consolidates multiple bank account details into a single view, enhancing financial management by providing users with comprehensive insights across institutions. Financial data aggregation expands beyond accounts, integrating diverse financial information such as investments, loans, and credit reports to create a holistic financial profile. Explore how these technologies revolutionize personal finance and banking efficiency.

Why it is important

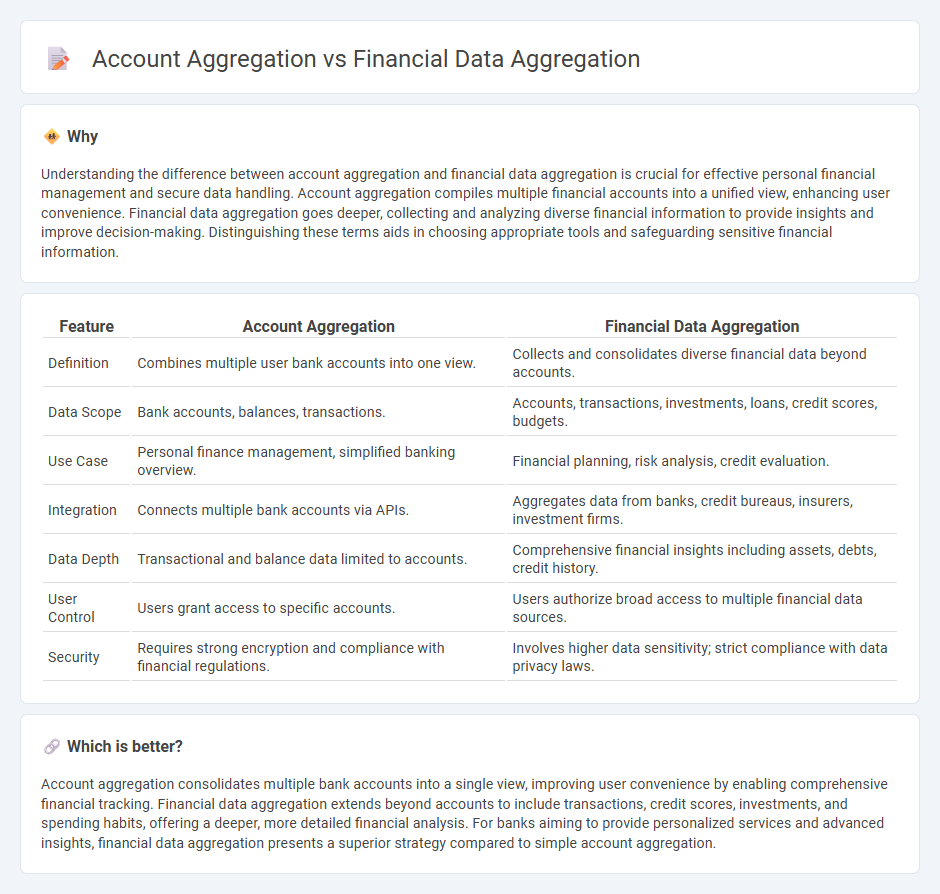

Understanding the difference between account aggregation and financial data aggregation is crucial for effective personal financial management and secure data handling. Account aggregation compiles multiple financial accounts into a unified view, enhancing user convenience. Financial data aggregation goes deeper, collecting and analyzing diverse financial information to provide insights and improve decision-making. Distinguishing these terms aids in choosing appropriate tools and safeguarding sensitive financial information.

Comparison Table

| Feature | Account Aggregation | Financial Data Aggregation |

|---|---|---|

| Definition | Combines multiple user bank accounts into one view. | Collects and consolidates diverse financial data beyond accounts. |

| Data Scope | Bank accounts, balances, transactions. | Accounts, transactions, investments, loans, credit scores, budgets. |

| Use Case | Personal finance management, simplified banking overview. | Financial planning, risk analysis, credit evaluation. |

| Integration | Connects multiple bank accounts via APIs. | Aggregates data from banks, credit bureaus, insurers, investment firms. |

| Data Depth | Transactional and balance data limited to accounts. | Comprehensive financial insights including assets, debts, credit history. |

| User Control | Users grant access to specific accounts. | Users authorize broad access to multiple financial data sources. |

| Security | Requires strong encryption and compliance with financial regulations. | Involves higher data sensitivity; strict compliance with data privacy laws. |

Which is better?

Account aggregation consolidates multiple bank accounts into a single view, improving user convenience by enabling comprehensive financial tracking. Financial data aggregation extends beyond accounts to include transactions, credit scores, investments, and spending habits, offering a deeper, more detailed financial analysis. For banks aiming to provide personalized services and advanced insights, financial data aggregation presents a superior strategy compared to simple account aggregation.

Connection

Account aggregation and financial data aggregation both involve consolidating financial information from multiple sources into a single, unified view, enhancing financial management and decision-making. Account aggregation specifically refers to gathering account-level data such as balances and transactions from various banks or financial institutions, while financial data aggregation encompasses a broader range of financial information including investments, loans, and spending patterns. This connection allows banks and fintech platforms to offer comprehensive insights, personalized services, and improved user experience by leveraging aggregated data.

Key Terms

Data Consolidation

Financial data aggregation involves collecting and consolidating data from multiple financial sources into a single platform, enhancing comprehensive data analysis and reporting. Account aggregation specifically refers to the process of linking various individual accounts, such as bank, credit card, and investment accounts, into one unified view to streamline account management. Explore the detailed differences and benefits of each approach to optimize your financial data consolidation strategy.

API Integration

Financial data aggregation consolidates transactional and account information from multiple financial institutions into a single platform, enabling comprehensive analytics and insights. Account aggregation specifically focuses on collecting account balances and details through APIs to provide users with a unified view of their financial status. Explore the latest API integration techniques to enhance security, real-time data retrieval, and seamless user experiences in financial services.

Consent Management

Financial data aggregation consolidates transaction and account data from various institutions into a unified view, while account aggregation specifically gathers account details under a single interface. Consent management plays a crucial role in both processes, ensuring users explicitly authorize data sharing in compliance with regulations like GDPR and PSD2, which enhances security and user trust. Explore how advanced consent management solutions optimize transparency and control in financial data aggregation.

Source and External Links

9 Best Financial Account Aggregators for Family Offices in 2025 - This article discusses various financial account aggregators, highlighting their key features and benefits for managing diverse financial data.

Data Aggregation - Fiserv - Fiserv provides comprehensive data aggregation solutions that help businesses access consumer financial data for better decision-making and product development.

Financial Account Aggregators: Benefits and How to Choose - This resource explains the benefits and process of financial account aggregation, helping consumers and businesses choose effective aggregation software.

dowidth.com

dowidth.com