Alternative credit data offers a broader view of a borrower's financial behavior by incorporating non-traditional sources such as utility payments, rental history, and digital transactions. Bank statement analysis focuses on evaluating traditional financial records like deposits, withdrawals, and cash flow to assess creditworthiness. Discover how integrating both methods can enhance lending decisions and risk assessment accuracy.

Why it is important

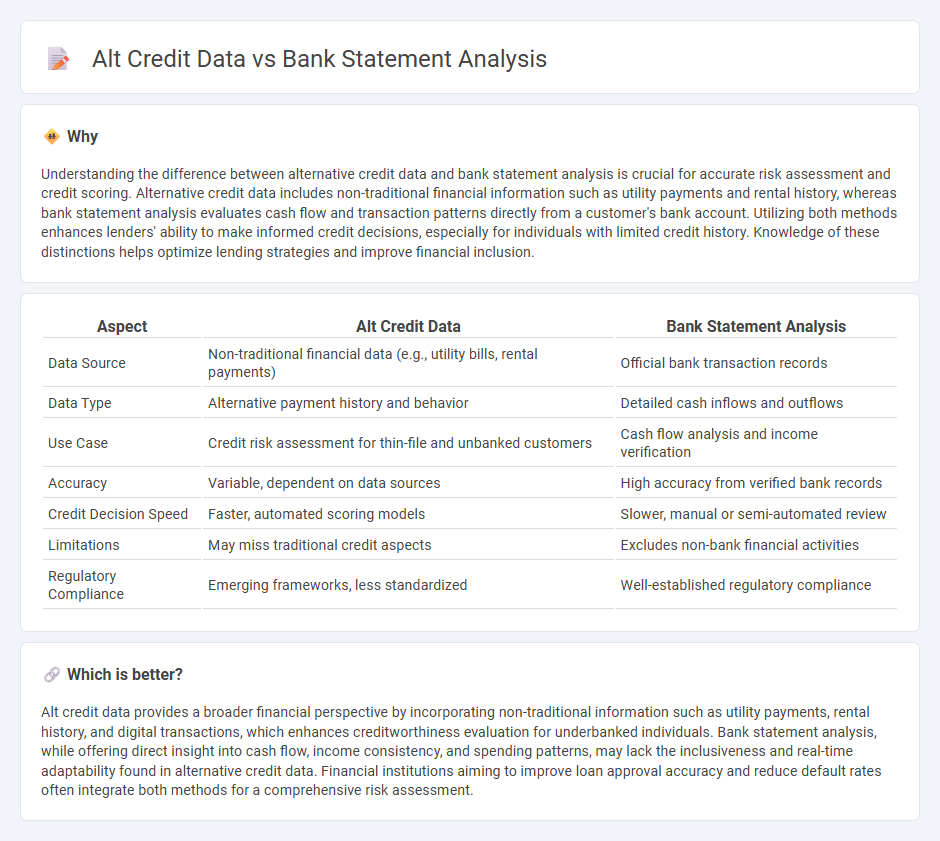

Understanding the difference between alternative credit data and bank statement analysis is crucial for accurate risk assessment and credit scoring. Alternative credit data includes non-traditional financial information such as utility payments and rental history, whereas bank statement analysis evaluates cash flow and transaction patterns directly from a customer's bank account. Utilizing both methods enhances lenders' ability to make informed credit decisions, especially for individuals with limited credit history. Knowledge of these distinctions helps optimize lending strategies and improve financial inclusion.

Comparison Table

| Aspect | Alt Credit Data | Bank Statement Analysis |

|---|---|---|

| Data Source | Non-traditional financial data (e.g., utility bills, rental payments) | Official bank transaction records |

| Data Type | Alternative payment history and behavior | Detailed cash inflows and outflows |

| Use Case | Credit risk assessment for thin-file and unbanked customers | Cash flow analysis and income verification |

| Accuracy | Variable, dependent on data sources | High accuracy from verified bank records |

| Credit Decision Speed | Faster, automated scoring models | Slower, manual or semi-automated review |

| Limitations | May miss traditional credit aspects | Excludes non-bank financial activities |

| Regulatory Compliance | Emerging frameworks, less standardized | Well-established regulatory compliance |

Which is better?

Alt credit data provides a broader financial perspective by incorporating non-traditional information such as utility payments, rental history, and digital transactions, which enhances creditworthiness evaluation for underbanked individuals. Bank statement analysis, while offering direct insight into cash flow, income consistency, and spending patterns, may lack the inclusiveness and real-time adaptability found in alternative credit data. Financial institutions aiming to improve loan approval accuracy and reduce default rates often integrate both methods for a comprehensive risk assessment.

Connection

Alt credit data enhances bank statement analysis by providing complementary financial insights beyond traditional credit scores, allowing for a more comprehensive evaluation of a borrower's creditworthiness. Integrating alternative data such as utility payments, rental history, and transaction patterns enables banks to assess risk more accurately, especially for thin-file or unbanked customers. This combined approach improves loan approval rates and reduces defaults by creating a fuller financial profile through advanced analytics and machine learning models.

Key Terms

**Bank Statement Analysis:**

Bank statement analysis leverages detailed transaction histories to assess income patterns, spending behavior, and cash flow stability, offering lenders a comprehensive view of creditworthiness beyond traditional credit scores. It extracts actionable insights from deposits, withdrawals, and recurring payments to predict future financial behavior, making it essential for underwriting loans in underbanked or self-employed populations. Discover more about how bank statement analysis enhances risk evaluation and loan decision accuracy.

Cash Flow

Bank statement analysis provides a detailed view of a borrower's cash inflows and outflows, revealing consistent income patterns and liquidity status. Alternative credit data, such as utility payments and rent history, offer supplementary insights but may lack granular cash flow details critical for assessing repayment capacity. Explore how combining both methods enhances credit risk assessment and lending decisions.

Transaction History

Bank statement analysis provides a detailed examination of an individual's transaction history, revealing spending patterns, income consistency, and financial behavior. Alternative credit data expands this view by incorporating non-traditional financial activities such as utility bill payments, rent history, and digital wallet transactions, offering a broader credit assessment. Explore how integrating these data sources enhances credit risk evaluation and financial decision-making.

Source and External Links

What Is Bank Statement Analysis And How To Do It - Bank statement analysis is the systematic review of transactions in a bank statement to understand spending habits, income sources, and overall financial health, helping detect fraud, reconcile records, and assess liquidity.

How To Do Bank Statement Analysis: A Step-By-Step Guide - Bank statement analysis reveals income and expense patterns, aids creditworthiness assessment, helps businesses track cash flow, detect fraud, and enables individuals to budget better, with AI tools improving accuracy and speed.

What is Bank Statement Analysis? - This process interprets bank statement data to gain insights into cash inflows, income verification, liabilities, and repayment capacity, essential for loan underwriting and credit risk assessment by banks and businesses.

dowidth.com

dowidth.com