Sustainable banking focuses on integrating environmental, social, and governance (ESG) criteria into financial services to promote long-term ecological balance and social equity. Shadow banking refers to non-bank financial intermediaries that provide similar services to traditional banks but operate outside conventional regulatory frameworks, often increasing systemic risk. Explore the key differences and impacts of sustainable banking versus shadow banking to understand their roles in the modern financial ecosystem.

Why it is important

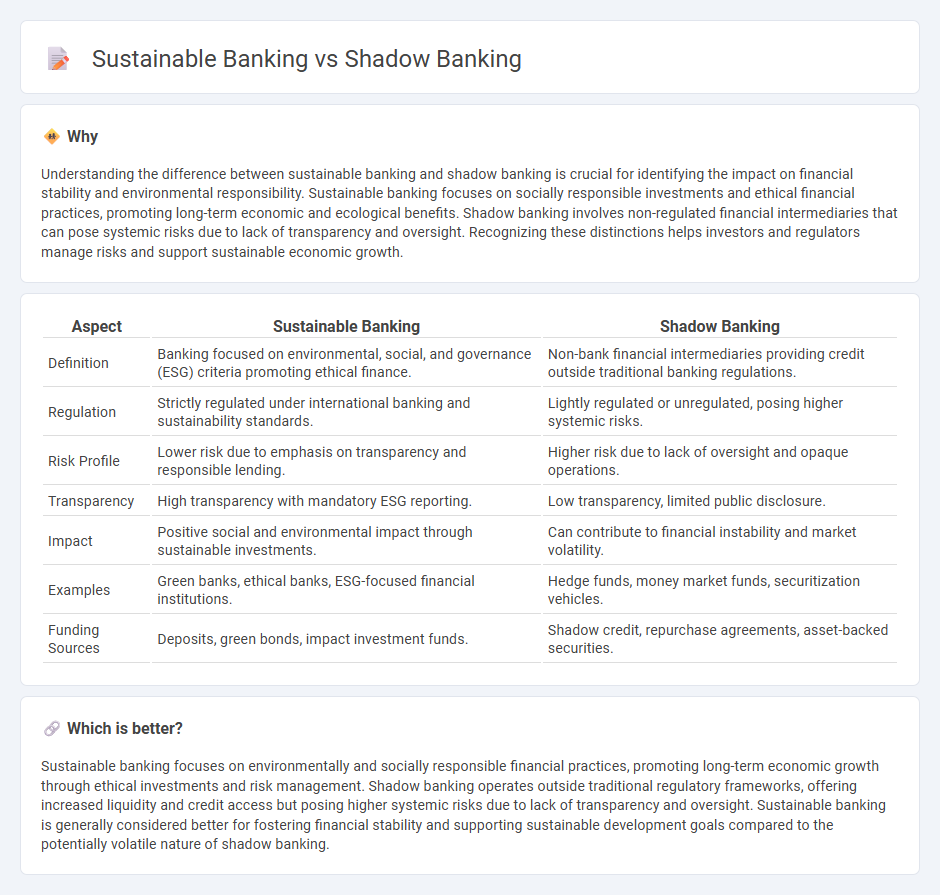

Understanding the difference between sustainable banking and shadow banking is crucial for identifying the impact on financial stability and environmental responsibility. Sustainable banking focuses on socially responsible investments and ethical financial practices, promoting long-term economic and ecological benefits. Shadow banking involves non-regulated financial intermediaries that can pose systemic risks due to lack of transparency and oversight. Recognizing these distinctions helps investors and regulators manage risks and support sustainable economic growth.

Comparison Table

| Aspect | Sustainable Banking | Shadow Banking |

|---|---|---|

| Definition | Banking focused on environmental, social, and governance (ESG) criteria promoting ethical finance. | Non-bank financial intermediaries providing credit outside traditional banking regulations. |

| Regulation | Strictly regulated under international banking and sustainability standards. | Lightly regulated or unregulated, posing higher systemic risks. |

| Risk Profile | Lower risk due to emphasis on transparency and responsible lending. | Higher risk due to lack of oversight and opaque operations. |

| Transparency | High transparency with mandatory ESG reporting. | Low transparency, limited public disclosure. |

| Impact | Positive social and environmental impact through sustainable investments. | Can contribute to financial instability and market volatility. |

| Examples | Green banks, ethical banks, ESG-focused financial institutions. | Hedge funds, money market funds, securitization vehicles. |

| Funding Sources | Deposits, green bonds, impact investment funds. | Shadow credit, repurchase agreements, asset-backed securities. |

Which is better?

Sustainable banking focuses on environmentally and socially responsible financial practices, promoting long-term economic growth through ethical investments and risk management. Shadow banking operates outside traditional regulatory frameworks, offering increased liquidity and credit access but posing higher systemic risks due to lack of transparency and oversight. Sustainable banking is generally considered better for fostering financial stability and supporting sustainable development goals compared to the potentially volatile nature of shadow banking.

Connection

Sustainable banking integrates environmental, social, and governance (ESG) criteria into financial services, promoting long-term economic resilience and ethical investments. Shadow banking, involving non-bank financial intermediaries, operates outside traditional regulatory frameworks, posing risks that sustainable banking aims to mitigate by encouraging transparency and responsible lending. The connection lies in the need for sustainable banking principles to extend oversight to shadow banking to ensure systemic stability and reduce financial risks linked to unregulated activities.

Key Terms

Regulatory Oversight

Shadow banking operates with limited regulatory oversight, often involving non-bank financial intermediaries that engage in credit intermediation outside traditional banking regulations, increasing systemic risk. In contrast, sustainable banking emphasizes strict regulatory compliance to promote environmental, social, and governance (ESG) criteria, ensuring transparency and accountability in financial activities. Explore the evolving regulatory frameworks shaping both shadow and sustainable banking sectors for a deeper understanding.

Environmental, Social, and Governance (ESG)

Shadow banking involves non-traditional financial intermediaries operating outside regular banking regulations, often prioritizing short-term profits over ESG considerations. Sustainable banking integrates Environmental, Social, and Governance (ESG) criteria into lending, investment, and development strategies, promoting long-term positive impacts on society and the environment. Explore how these contrasting approaches affect global financial stability and ethical investing.

Risk Transparency

Shadow banking operates largely outside traditional regulatory frameworks, increasing risks due to limited transparency in lending practices and asset exposure. Sustainable banking emphasizes risk transparency through clear disclosure of environmental, social, and governance (ESG) factors, fostering trust and long-term stability. Explore how enhancing transparency in these sectors impacts global financial resilience and ethical investments.

Source and External Links

Shadow Banking by Z. Pozsar - Shadow banking refers to credit, maturity, and liquidity transformation activities conducted by non-bank financial intermediaries without direct access to public liquidity or credit backstops, often using securitization and secured funding techniques.

Shadow banking system - Wikipedia - The shadow banking system consists of non-bank financial institutions that provide credit and liquidity services similar to traditional banks but do not take deposits and lack access to central bank funding or safety nets like deposit insurance.

Regulation Shadow Banking FSB - The shadow banking system is a network of financial intermediaries, including money market funds, structured finance vehicles, and hedge funds, that perform bank-like functions outside the regular banking regulatory framework and represent a significant portion of global financial system assets.

dowidth.com

dowidth.com