Income streaming in banking involves generating consistent revenue through interest on loans and investments, while fee income derives from charges for services like account maintenance, transactions, and advisory. Banks balance these streams to ensure financial stability and growth by diversifying sources and managing risk. Explore more to understand how these income models impact banking profitability and customer relationships.

Why it is important

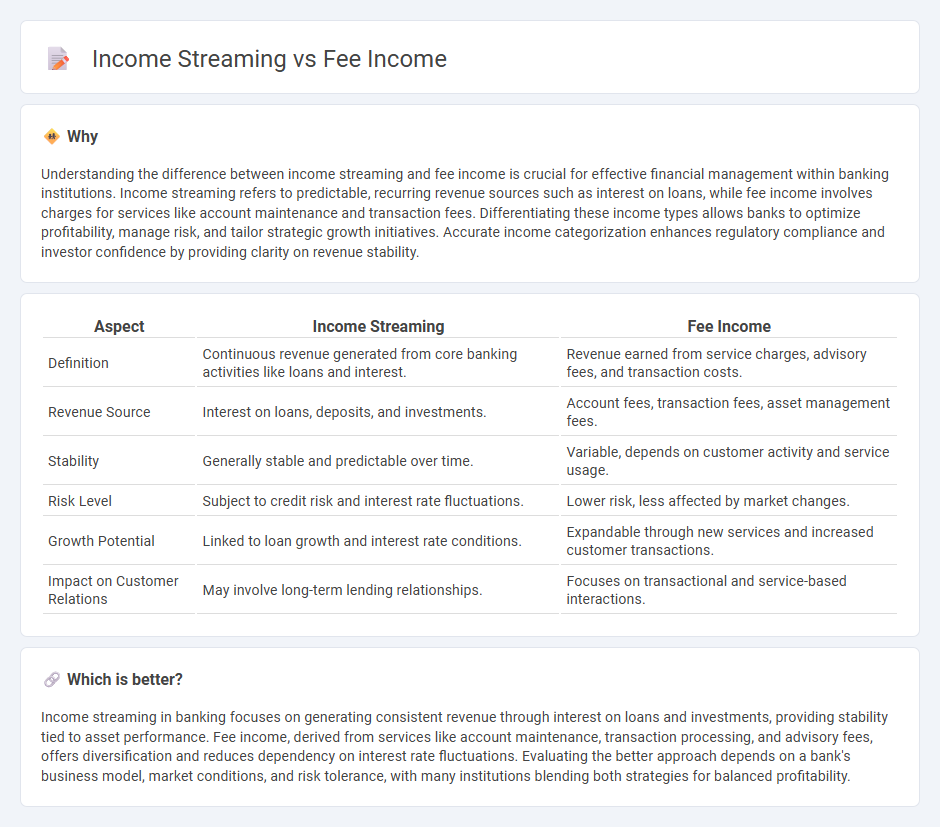

Understanding the difference between income streaming and fee income is crucial for effective financial management within banking institutions. Income streaming refers to predictable, recurring revenue sources such as interest on loans, while fee income involves charges for services like account maintenance and transaction fees. Differentiating these income types allows banks to optimize profitability, manage risk, and tailor strategic growth initiatives. Accurate income categorization enhances regulatory compliance and investor confidence by providing clarity on revenue stability.

Comparison Table

| Aspect | Income Streaming | Fee Income |

|---|---|---|

| Definition | Continuous revenue generated from core banking activities like loans and interest. | Revenue earned from service charges, advisory fees, and transaction costs. |

| Revenue Source | Interest on loans, deposits, and investments. | Account fees, transaction fees, asset management fees. |

| Stability | Generally stable and predictable over time. | Variable, depends on customer activity and service usage. |

| Risk Level | Subject to credit risk and interest rate fluctuations. | Lower risk, less affected by market changes. |

| Growth Potential | Linked to loan growth and interest rate conditions. | Expandable through new services and increased customer transactions. |

| Impact on Customer Relations | May involve long-term lending relationships. | Focuses on transactional and service-based interactions. |

Which is better?

Income streaming in banking focuses on generating consistent revenue through interest on loans and investments, providing stability tied to asset performance. Fee income, derived from services like account maintenance, transaction processing, and advisory fees, offers diversification and reduces dependency on interest rate fluctuations. Evaluating the better approach depends on a bank's business model, market conditions, and risk tolerance, with many institutions blending both strategies for balanced profitability.

Connection

Income streaming in banking relies heavily on fee income generated from services such as account maintenance, loan processing, and transaction fees. Fee income provides a steady revenue flow that banks use to diversify their income streams beyond traditional interest-based earnings. This connection enhances financial stability and profitability by balancing interest income fluctuations with consistent service charges.

Key Terms

Non-Interest Income

Non-interest income primarily includes fee income generated from services such as asset management, advisory fees, and transaction processing, which banks rely on to diversify revenue beyond interest-based lending. Fee income provides stable, predictable cash flows that enhance profitability while mitigating risks associated with fluctuating interest rates in income streaming. Explore more about how non-interest income shapes financial institutions' revenue strategies and risk profiles.

Recurring Revenue

Fee income typically arises from one-time charges or transactional fees, whereas income streaming emphasizes consistent, predictable revenue through subscription or service contracts. Recurring revenue models enhance financial stability by generating continuous cash flow, reducing dependency on sporadic sales. Explore how businesses leverage recurring revenue streams to boost long-term profitability and growth.

Transaction Fees

Transaction fees represent a critical component of fee income, generated each time a customer completes a financial transaction such as payments, transfers, or trades. Unlike other income streams that may rely on recurring charges or asset management fees, transaction fees provide a steady, usage-based revenue source aligning directly with customer activity levels. Delve deeper to understand how optimizing transaction fee structures can enhance overall income streaming strategies.

Source and External Links

Fee Income: Macroeconomic Impact & Causes | Vaia - Fee income is the revenue banks and financial institutions earn from providing services to customers, such as transaction fees, advisory fees, card fees, and bancassurance, excluding interest earned from loans.

Fee Income Definition | Law Insider - Fee income refers to revenues received from borrowers, including negative rebates and premiums, as well as transactional and service fees, and excludes trading gains.

Declining Fee Income Displays CUs' Positive Impact on Members - Non-interest fee income--such as ATM, wire, credit card, and overdraft fees--has significantly declined at credit unions nationwide, dropping to just 8% of gross annual income in 2023.

dowidth.com

dowidth.com