Neobanks operate exclusively through digital platforms, offering streamlined, user-friendly banking experiences without physical branches, often with lower fees and advanced technology integration. Online-only banks also function without brick-and-mortar locations but may be affiliated with traditional banks, providing comprehensive banking services and FDIC insurance protections. Explore the distinctions between neobanks and online-only banks to determine the best fit for your financial needs.

Why it is important

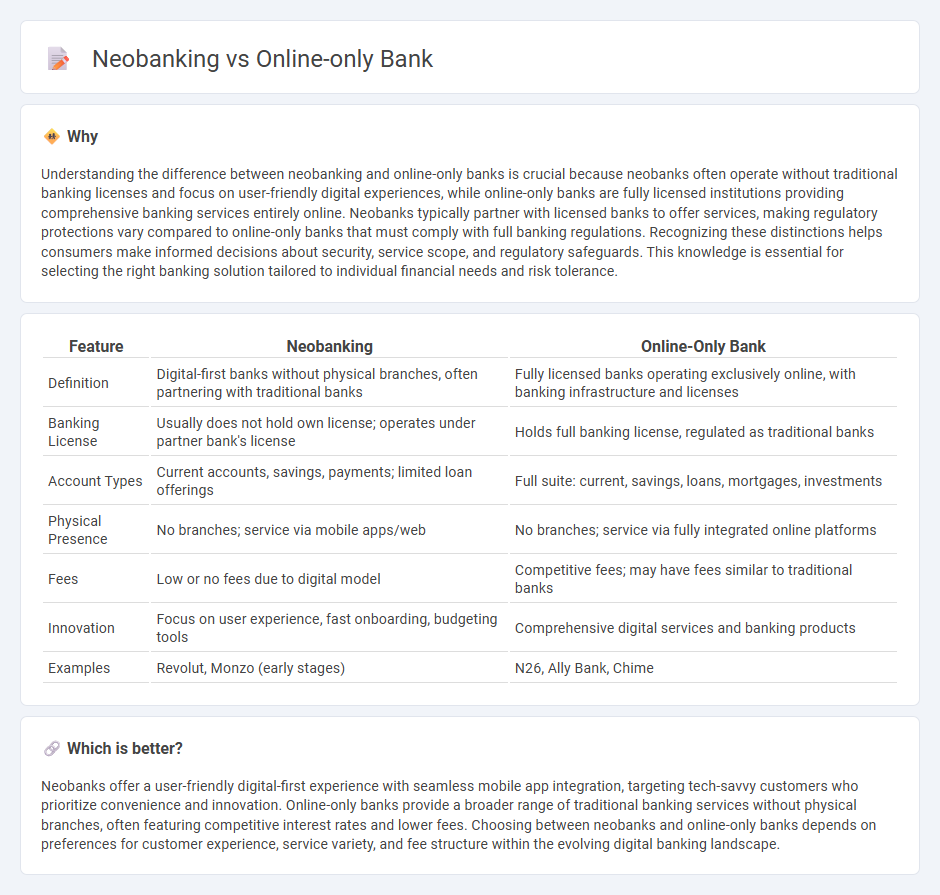

Understanding the difference between neobanking and online-only banks is crucial because neobanks often operate without traditional banking licenses and focus on user-friendly digital experiences, while online-only banks are fully licensed institutions providing comprehensive banking services entirely online. Neobanks typically partner with licensed banks to offer services, making regulatory protections vary compared to online-only banks that must comply with full banking regulations. Recognizing these distinctions helps consumers make informed decisions about security, service scope, and regulatory safeguards. This knowledge is essential for selecting the right banking solution tailored to individual financial needs and risk tolerance.

Comparison Table

| Feature | Neobanking | Online-Only Bank |

|---|---|---|

| Definition | Digital-first banks without physical branches, often partnering with traditional banks | Fully licensed banks operating exclusively online, with banking infrastructure and licenses |

| Banking License | Usually does not hold own license; operates under partner bank's license | Holds full banking license, regulated as traditional banks |

| Account Types | Current accounts, savings, payments; limited loan offerings | Full suite: current, savings, loans, mortgages, investments |

| Physical Presence | No branches; service via mobile apps/web | No branches; service via fully integrated online platforms |

| Fees | Low or no fees due to digital model | Competitive fees; may have fees similar to traditional banks |

| Innovation | Focus on user experience, fast onboarding, budgeting tools | Comprehensive digital services and banking products |

| Examples | Revolut, Monzo (early stages) | N26, Ally Bank, Chime |

Which is better?

Neobanks offer a user-friendly digital-first experience with seamless mobile app integration, targeting tech-savvy customers who prioritize convenience and innovation. Online-only banks provide a broader range of traditional banking services without physical branches, often featuring competitive interest rates and lower fees. Choosing between neobanks and online-only banks depends on preferences for customer experience, service variety, and fee structure within the evolving digital banking landscape.

Connection

Neobanking and online-only banks share a digital-first approach, eliminating physical branches to offer streamlined financial services via mobile apps and websites. Both leverage advanced technology, such as AI and cloud computing, to provide personalized banking experiences, real-time transactions, and lower operational costs. The connection lies in their focus on accessibility, convenience, and innovation, transforming traditional banking into a fully digital ecosystem.

Key Terms

Digital Banking Platform

Online-only banks operate entirely through digital banking platforms, providing customers with services such as mobile deposits, real-time transaction alerts, and robust security features without physical branches. Neobanks utilize digital banking platforms to offer streamlined user experiences often integrated with budget management tools and personalized financial insights, targeting tech-savvy consumers who prefer app-based banking. Explore the evolving landscape of digital banking platforms to understand the distinct advantages of online-only banks and neobanks.

Regulatory Licensing

Online-only banks operate with full banking licenses granted by regulatory authorities, allowing them to offer a wide range of financial services including deposits, loans, and payment processing. Neobanks typically function under partner bank licenses or e-money licenses, limiting their capabilities compared to traditional banks but enabling innovative digital-first experiences. Discover more about regulatory frameworks shaping the future of digital banking.

Core Banking Infrastructure

Online-only banks operate with fully digital core banking infrastructure, enabling real-time transaction processing, robust security, and customer-centric product offerings. Neobanks often leverage API-driven platforms integrated with third-party services, enabling agile scalability and personalized financial solutions without traditional branch networks. Explore the evolving core banking technologies underlying these fintech models to understand their impact on customer experience and operational efficiency.

Source and External Links

Discover Online Bank Accounts - Offers online banking services with no hidden fees and access to 60,000 no-fee ATMs.

Axos Bank - Provides high-yield savings and rewards checking accounts with digital banking for personal and business use.

Synchrony Bank - Offers online banking services similar to traditional banks but with lower overhead costs, often leading to no or low fees.

dowidth.com

dowidth.com